With a market cap of $65 billion, FedEx Corporation (FDX) is a global provider of transportation, e-commerce, and business services operating through its Federal Express and FedEx Freight segments. The company offers a wide range of shipping, logistics, printing, and digital solutions to support businesses and consumers worldwide.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and FedEx fits this criterion. FedEx has grown into a leading player in express delivery and supply chain management.

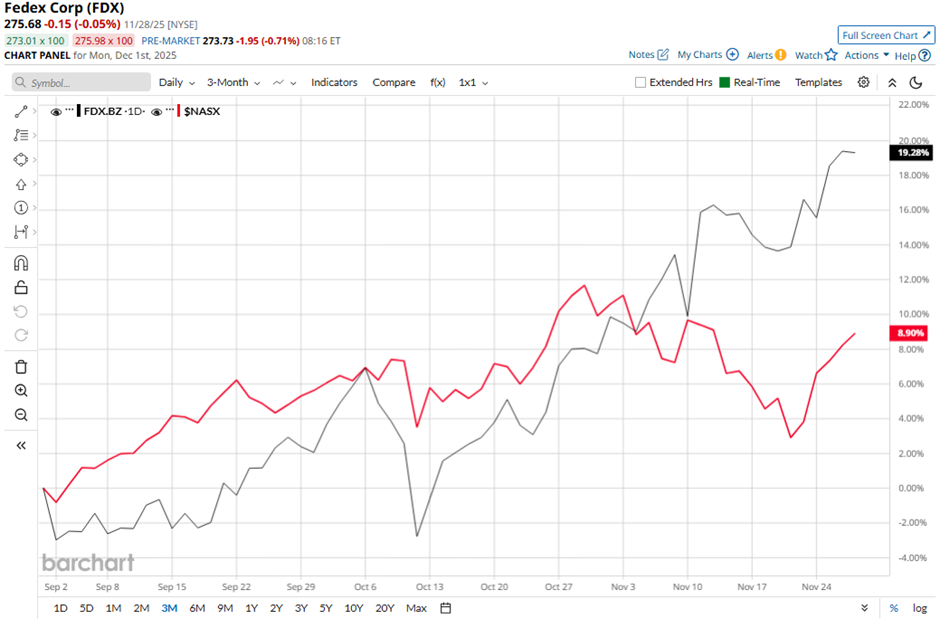

Shares of the Memphis, Tennessee-based company have declined 9.4% from its 52-week high of $302.02. FDX stock has soared 18.5% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 7.7% gain over the same time frame.

In the longer term, FDX stock is down 2.7% on a YTD basis, lagging behind NASX’s 21% gain. Moreover, shares of the company have decreased 9.6% over the past 52 weeks, compared to NASX’s 22.6% return over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day moving average since June.

Shares of FDX rose 2.3% following its Q1 2026 results on Sep. 18 because the company posted solid year-over-year earnings growth, with adjusted operating income increasing to $1.30 billion and adjusted EPS rising to $3.83, driven by strong U.S. domestic package revenue and structural cost reductions. Investors were also encouraged by FedEx’s fiscal 2026 outlook, including 4% - 6% revenue growth and $17.20 - $19 adjusted EPS after excluding optimization, spin-off, and fiscal-year-change costs.

Additionally, confidence improved due to FedEx completing $500 million in share repurchases during the quarter and advancing toward the planned June 2026 spin-off of FedEx Freight.

In contrast, rival United Parcel Service, Inc. (UPS) has lagged behind FDX stock. Shares of United Parcel Service have dipped 24.3% on a YTD basis and 29.6% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic on FedEx. The stock has a consensus rating of “Moderate Buy” from 30 analysts in coverage, and as of writing, it is trading above the mean price target of $268.52.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The AI Race Is a Marathon, Not a Sprint. Here Is How AMD Stock Could Still Finish First.

- This Under-$10 Stock Just Reported a 700% Surge in Robotaxi Revenue. Should You Buy Shares Here?

- As Google Locks Down a Multimillion-Dollar NATO Deal, Should You Buy, Sell, or Hold GOOGL Stock?

- Should You Grab This ‘Strong Buy’ Growth Stock With 56% Upside?