Boston, Massachusetts-based PTC Inc. (PTC) is a software company that provides advanced digital solutions. Valued at a market cap of $20.8 billion, the company’s portfolio includes Creo for 3D CAD design, Windchill for product lifecycle management, and a suite of Industrial IoT and service-management tools that help companies design, build, operate, and service products more efficiently.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and PTC fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software - application industry. The company supports digital transformation for industries such as automotive, aerospace, electronics, and industrial equipment, and is recognized as a key innovator in modern engineering and smart manufacturing technologies.

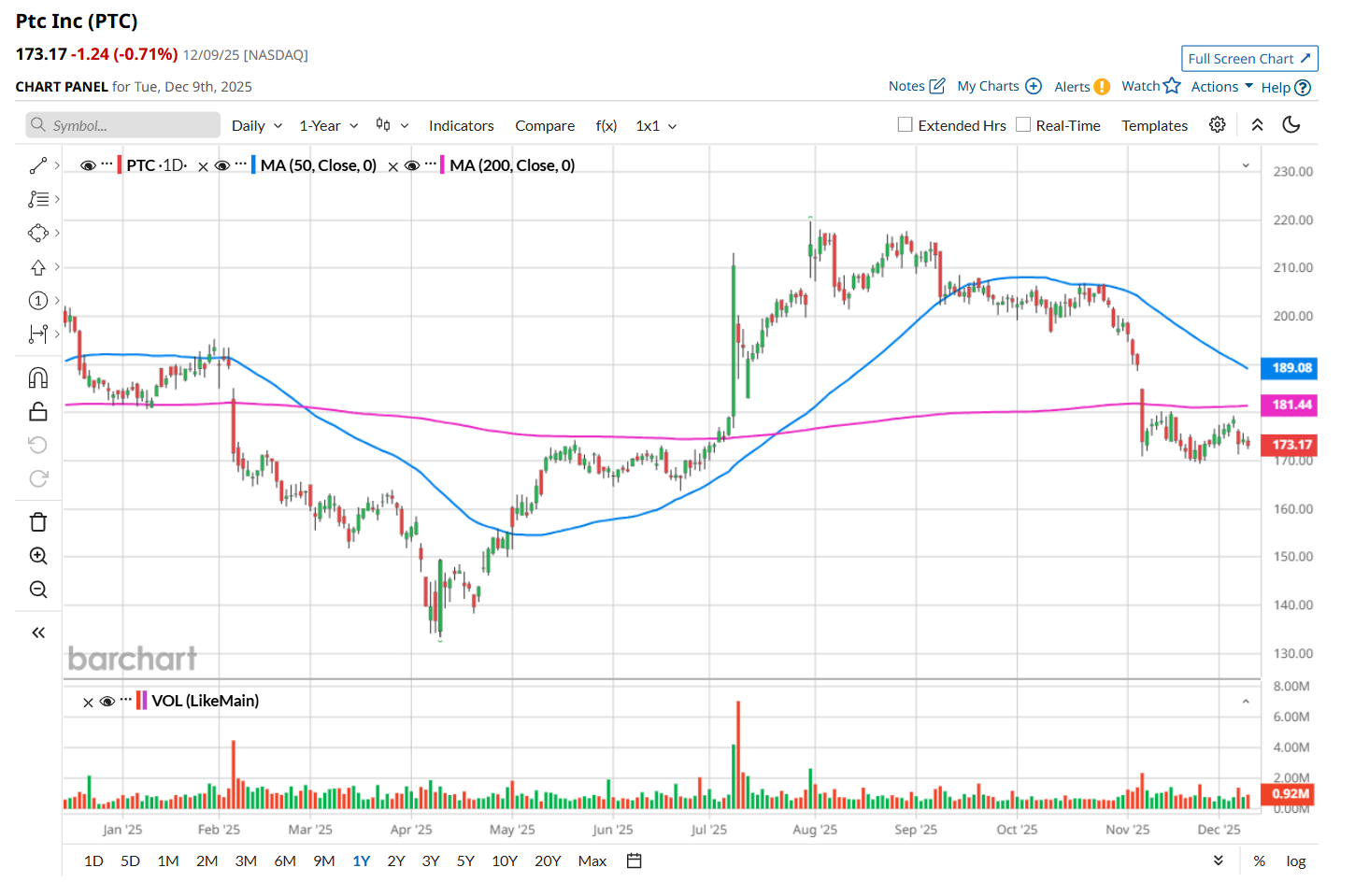

This software company has dipped 21.2% below its 52-week high of $219.69, reached on Jul. 31. Shares of PTC have declined 15.1% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 7.8% rise during the same time frame.

Moreover, on a YTD basis, shares of PTC are down 5.8%, compared to NASX’s 22.1% return. In the longer term, PTC has fallen 13.2% over the past 52 weeks, considerably lagging behind NASX’s 19.5% uptick over the same time frame.

To confirm its bearish trend, PTC has been trading below its 200-day moving average since early November and has remained below its 50-day moving average since mid-September.

On Nov. 5, PTC delivered upbeat Q4 earnings results. Due to strong growth in recurring revenue, the company’s total revenue increased 42.7% year-over-year to $893.8 million, surpassing consensus estimates by a notable margin of 20.2%. Moreover, its adjusted EPS of $3.47 advanced by a sharp 125.3% from the year-ago quarter and came in 53.5% ahead of analyst expectations. Despite these positives, its shares tumbled 8.4% in the following trading session as PTC issued weaker-than-expected guidance for the upcoming quarter. It expects Q1 2026 revenue to be between $600 and $660, significantly lower than its Q4 figure.

PTC has also underperformed its rival, Autodesk, Inc.’s (ADSK) 2.5% drop over the past 52 weeks and 1.8% rise on a YTD basis.

Despite PTC’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 18 analysts covering it, and the mean price target of $217.71 suggests a 25.7% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- VICI Properties Hits a New 52-Week Low: Is It Time for Income Investors to Place a Bet?

- Salesforce Could Rebrand to Focus on Its AI Offerings. Should You Buy the Dip in CRM Stock Here?

- Creating a 39% “Dividend” on MRVL Stock Using Options

- Stock Index Futures Muted Amid Caution Ahead of Fed Rate Decision