Chicago, Illinois-based Cboe Global Markets, Inc. (CBOE) is a financial exchange holding company with a market cap of $26.1 billion. It is best known for operating one of the world’s largest and most active derivatives and securities exchanges.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CBOE fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the financial data & stock exchanges industry. The company has expanded globally and now owns and operates a broad network of trading venues across equities, options, futures, foreign exchange (FX), exchange-traded products (ETPs), and digital asset markets.

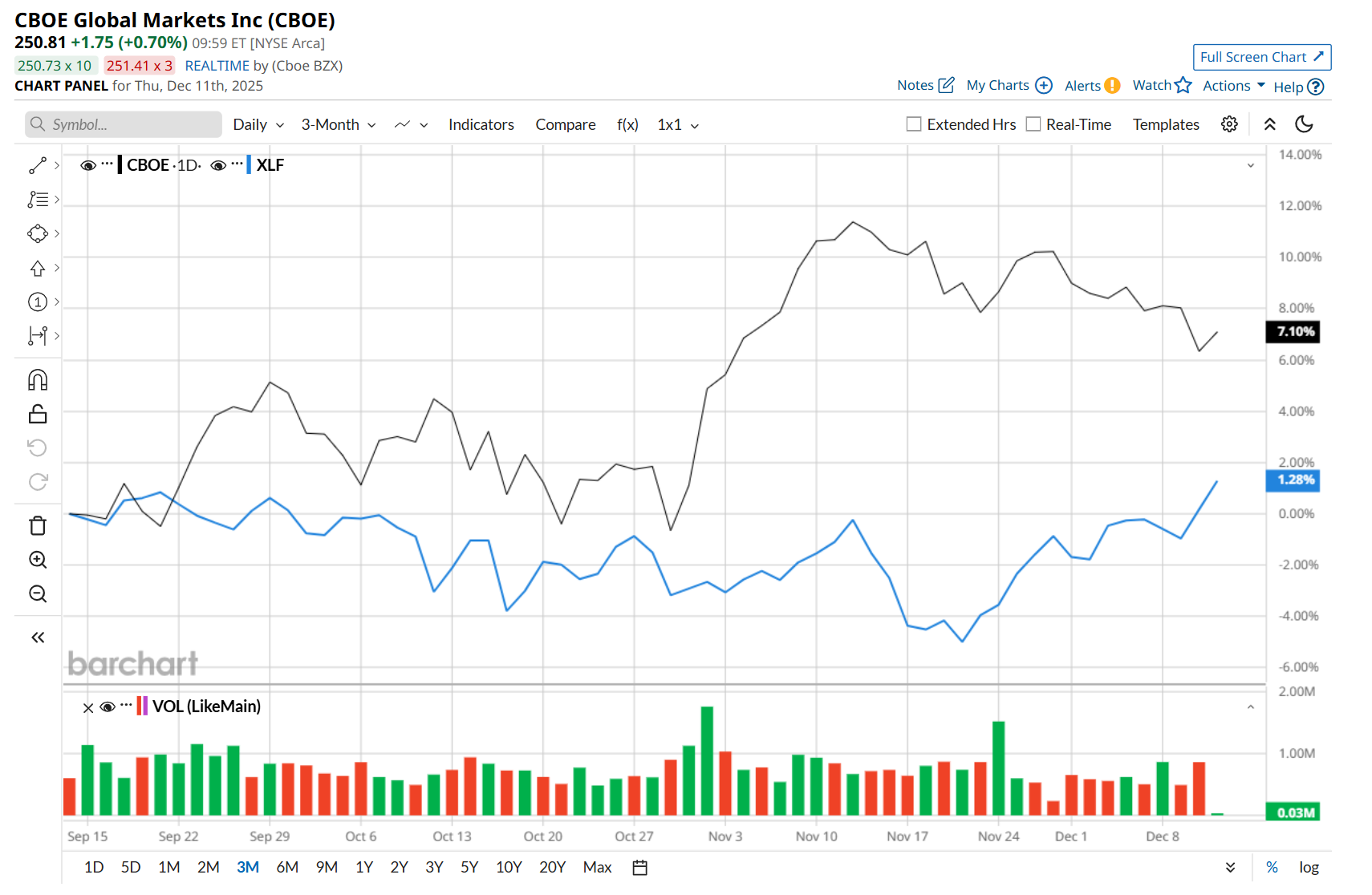

This financial company is currently trading 4.8% below its 52-week high of $262.98, reached on Nov. 12. Shares of CBOE have gained 5.7% over the past three months, outperforming the State Street Financial Select Sector SPDR ETF’s (XLF) marginal rise during the same time frame.

In the longer term, CBOE has soared 23.3% over the past 52 weeks, outpacing XLF’s 9.3% uptick over the same time frame. Moreover, on a YTD basis, shares of CBOE are up 27.8%, compared to XLF’s 12.6% return.

To confirm its bullish trend, CBOE has been trading above its 200-day moving average over the past year, with minor fluctuations, and has remained above its 50-day moving average since late October.

Shares of CBOE surged 3.7% after its impressive Q3 earnings release on Oct. 31. The company’s total revenue improved 8.1% year-over-year to a record $1.1 billion, driven by strong growth in revenues from its derivative market. Additionally, its adjusted EPS also reached a record high of $2.67, up 20.3% from the year-ago quarter and 5.5% above Wall Street estimates.

CBOE has also considerably outpaced its rival, Intercontinental Exchange, Inc. (ICE), which gained 2% over the past 52 weeks and 8.2% on a YTD basis.

Despite CBOE’s recent outperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 17 analysts covering it, and the mean price target of $256.86 suggests a 2.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How Fast Does an AI Chip Depreciate, and Why Does It Matter for Nvidia Stock?

- Avocado and AI: How Would a New Model from Meta Platforms Influence the Bull and Bear Cases for META Stock?

- 2 Defined-Risk Options Strategies to Trade Quarterly Earnings Without Gambling

- As Democrats Sound the Alarm on Palantir, How Should You Play PLTR Stock?