With a market cap of $24.8 billion, Huntington Bancshares Incorporated (HBAN) is a regional financial services company headquartered in Columbus, Ohio, operating through its Huntington National Bank subsidiary. It offers a broad suite of retail, commercial, and wealth management services across the Midwest.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Huntington Bancshares fits this criterion perfectly. With a strong digital presence and extensive branch network, Huntington delivers innovative financial products and services tailored to both individual and commercial needs.

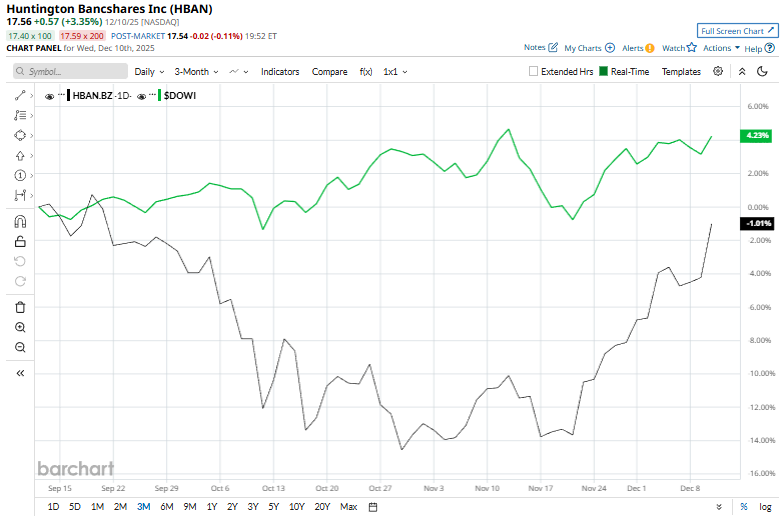

HBAN shares have fallen 2.6% from their 52-week high of $18.03. HBAN stock has decreased marginally over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% rise over the same time frame.

In the longer term, HBAN stock is up 7.9% on a YTD basis, lagging behind DOWI’s 13% gain. Moreover, shares of the regional bank holding company have soared 1.9% over the past 52 weeks, compared to DOWI’s 8.6% return over the same time frame.

The stock has been trading above its 50-day and 200-day moving averages since late November, indicating a recent uptrend.

HBAN shares rose more than 3% on Dec. 10 after the company announced a reduction in its prime rate from 7% to 6.75%, effective December 11, 2025. This follows a prior cut on October 30, when the rate was lowered from 7.25% to 7%.

In contrast, rival Regions Financial Corporation (RF) has improved 16.4% in 2025 and 8.1% over the past year, outperforming HBAN.

Despite the stock’s underperformance, analysts remain moderately optimistic on HBAN. The stock has a consensus rating of “Moderate Buy” from the 23 analysts in coverage, and the mean price target of $19.84 is a premium of 13% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jamie Dimon Has Long Been Sounding the Economic Alarm. After the Fed’s Latest Rate Cut, Can You Still Bank on JPMorgan Stock?

- Unlock Over 7% Income: Analysts Love These 2 High-Yield Dividend Stocks

- Nearly 45% of Its Float Is Being Sold Short. Should You Bet on iRobot Stock Here?

- Eric Jackson Could Make Nextdoor the Next Big Meme Stock. Should You Chase the Rally Here?