I’m just an investor and a writer. But Rob Reiner was one of my very favorites.

I remember him as far back as “Meathead,” the son-in-law to Archie Bunker on the 1970s hit TV comedy All In The Family. And of course he was the son of Carl Reiner, the iconic partner to Mel Brooks. Ironically, my late father, who taught me to chart at age 16 with pencil and graph paper, was also named Carl.

I’m a big believer in trying to control only what we can. So on a day where I’m left puzzled as to why we keep losing people to untimely deaths, I wanted to channel some of my frustration into what I can control. That’s helping investors better understand how to be their own investing boss.

As a tribute to the late Rob Reiner and his late wife Michele Singer Reiner, a noted photographer in her own right, here are a few investment lessons and observations about today’s investment climate, inspired by some of the most iconic lines from Rob Reiner’s great legacy of movies.

‘This Goes to 11’ (This Is Spinal Tap)

On a 0 to 10 scale, the current excitement over the artificial intelligence (AI) trade might just be approaching 11. Oh, we know it has the potential to change our daily lives the way the internet did. Not to mention everything from the automobile, fast food, and video games before it.

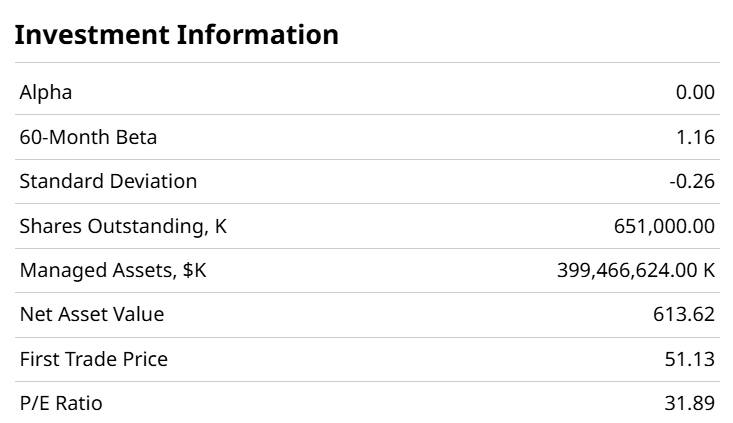

But Wall Street has a nasty habit of getting ahead of itself. And with the Nasdaq-100 Index ($IUXX) selling at well over 30x earnings and sporting a 3-year return of more than 120%, I think it’s fair to say that things are stretched.

‘I’ll Have What She’s Having’ (When Harry Met Sally)

That enthusiasm is contagious. It has prompted a glut of new ETF products, many of which are nearly identical to existing funds. And it has the effect of rewarding companies by association, in this case with AI leaders.

The giants of tech will survive some missteps, but 2025 has been characterized by something we last saw during the dot-com bubble: where a partnership announcement or even a name change can add billions of dollars to a stock’s market capitalization. Be careful what you envy.

‘You Can’t Handle the Truth’ (A Few Good Men)

We live in an age where “the truth” is always up for debate. Even when it shouldn’t be. This has bled into the only industry I’ve ever been in, financial services and market analysis.

Here, expertise is often confused with popularity. It is not confined to this business by any means. And it works out OK for the followers, until it doesn’t. Then, as Warren Buffett famously said, “when the tide goes out, you can see who was swimming naked.”

‘It’s Supposed to Be Hard. If It Wasn’t Hard, Everyone Would Do It. The Hard … Is What Makes It Great.’ (A League of Their Own)

I am on a personal mission to bring simpler approaches to self-directed investors. But simpler doesn’t happen in a snap.

Simpler today is a combination of two things. First, the fact that markets are now so highly correlated, with a risk on/risk off vibe constant, it is easy to get caught up overthinking how to run your portfolio.

The other aspect of simpler products is just how much information is fed to us every day. Investing used to be about striving to find an edge. A lot of that has been eroded by the fact that everyone has the same information, very little is kept hidden, it’s all out there.

We’ve never had more information at our fingertips. But perhaps we’ve never used less of it. Simpler investing starts with not trying to be the all-knowing one. It is instead about figuring out what speaks to you most. Regardless of what anyone else thinks.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart