Valued at a market cap of $14.8 billion, Paramount Skydance Corporation (PSKY) is a global media and entertainment company based in New York. It operates across film, television, streaming, and content production.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and PSKY fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the entertainment industry. The company’s strengths and specialty lie in its powerful combination of iconic intellectual property and modern, franchise-focused content creation.

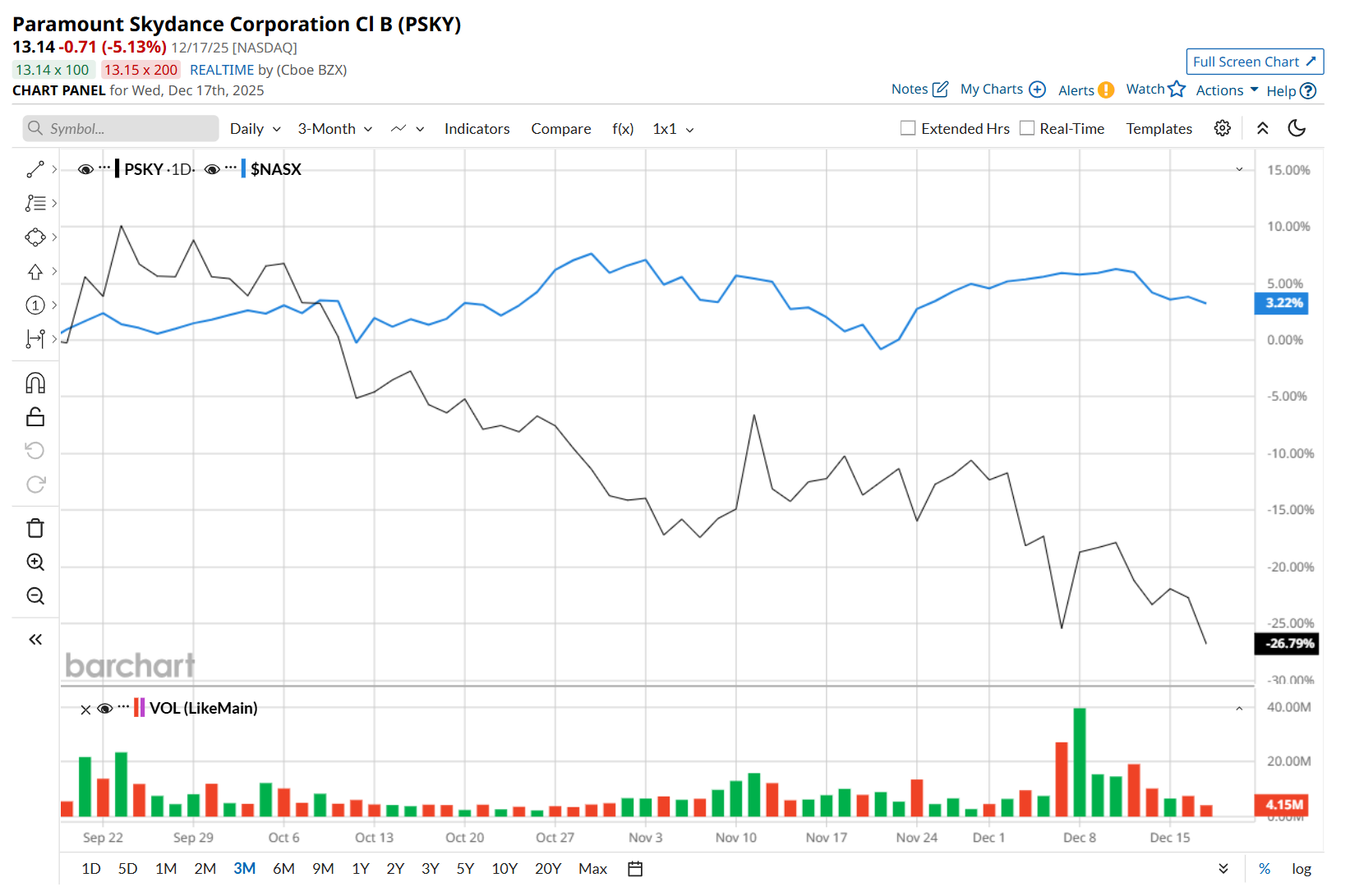

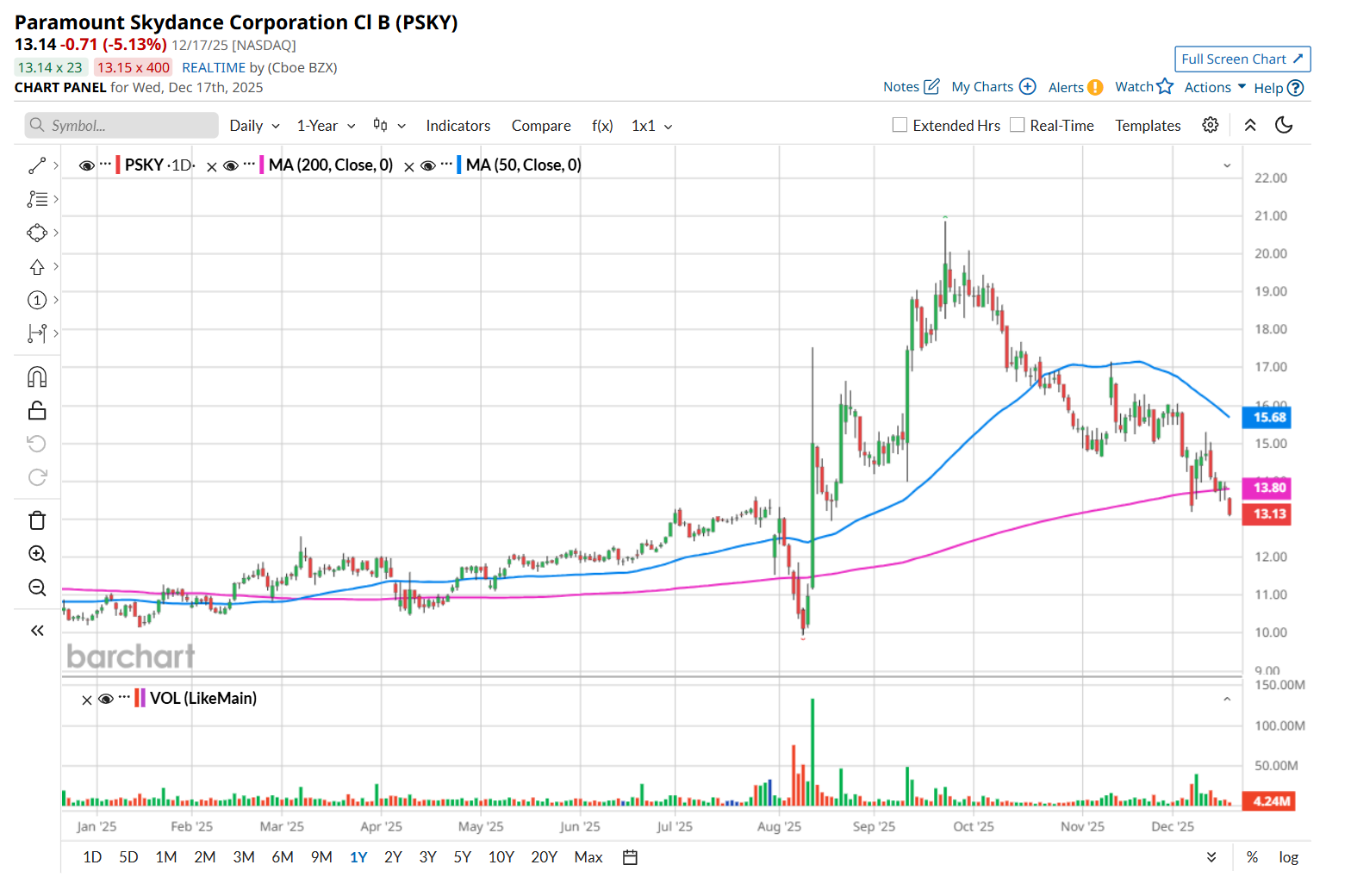

This entertainment company has slipped 36.7% from its 52-week high of $20.86, reached on Sep. 23. Shares of PSKY have declined 25.9% over the past three months, considerably underperforming the Nasdaq Composite’s ($NASX) 3.5% rise during the same time frame.

However, in the longer term, PSKY has rallied 22.9% over the past 52 weeks, outperforming NASX’s 14.6% uptick over the same time frame. Moreover, on a YTD basis, shares of PSKY are up 27%, compared to NASX’s 19.4% return.

To confirm its bearish trend, PSKY has been trading below its 200-day moving average since mid-December and has remained below its 50-day moving average since late October.

On Dec. 16, shares of PSKY fell 1% after several analysts issued “Sell” ratings citing concerns over the company’s valuation following its hostile bid for Warner Bros. Discovery, Inc. (WBD). Wall Street remains skeptical about the richness of the offer and the potential strain on PSKY’s balance sheet, which is already weighed down by elevated debt levels.

PSKY has outpaced its rival, The Walt Disney Company (DIS), which declined 1.2% over the past 52 weeks and gained marginally on a YTD basis.

Given PSKY’s recent underperformance, analysts remain moderately bearish about its prospects. The stock has a consensus rating of "Moderate Sell” from the 20 analysts covering it, and the mean price target of $14.33 suggests an 8.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns That During Bubbles, Stock Prices and Earnings Will ‘Diverge,’ But They Can’t ‘Continuously Overperform Their Businesses’

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?