Valued at a market cap of $85.8 billion, O'Reilly Automotive, Inc. (ORLY) is a specialty retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories. The Springfield, Missouri-based company operates thousands of stores across the U.S. and Mexico, offering a wide range of replacement parts, maintenance items, and performance products.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and ORLY fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the auto parts industry. The company’s dual-market strategy, robust distribution network, and focus on customer service continue to drive consistent sales growth. In addition, it benefits from favorable industry trends such as an aging car fleet, steady miles driven, and rising adoption of same-day delivery for auto parts.

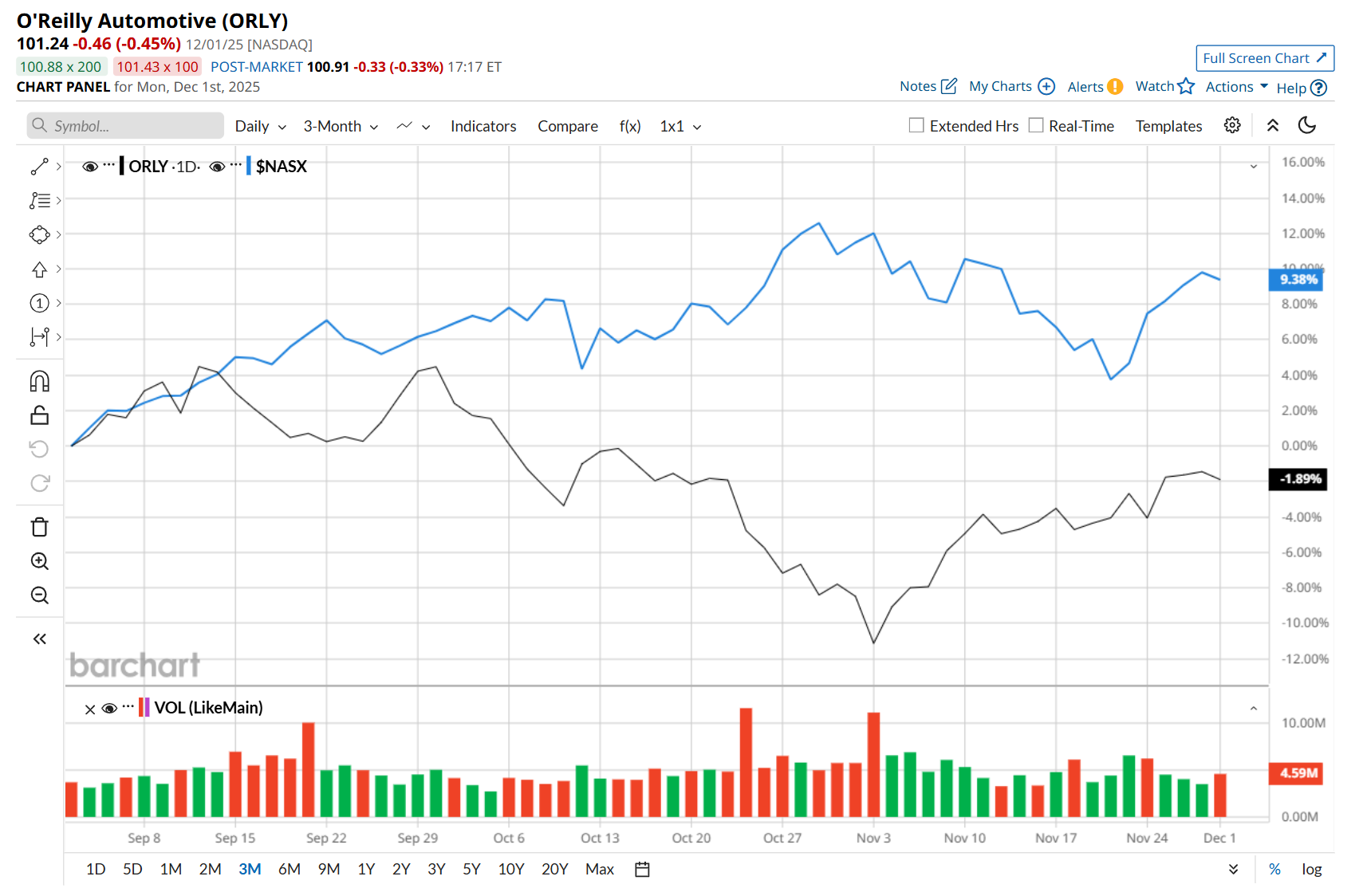

This auto parts retailer has slipped 6.9% from its 52-week high of $108.72, reached on Sep. 30. Shares of ORLY have declined 2.4% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 8.5% return during the same time frame.

Nonetheless, in the longer term, ORLY has rallied 22.2% over the past 52 weeks, outperforming NASX's 21.1% uptick over the same time period. Moreover, on a YTD basis, shares of ORLY are up 28.1%, compared to NASX’s 20.5% rise.

To confirm its bullish trend, ORLY has been trading above its 200-day moving average over the past year, with slight fluctuations, and has remained above its 50-day moving average since late November.

On Oct. 22, ORLY released better-than-expected Q3 results. The company’s revenue climbed 7.8% year over year to $4.7 billion, on the back of a 5.6% increase in comparable store sales and surpassed the consensus estimates by a slight margin. Moreover, its EPS of $0.85 increased 11.8% from the year-ago quarter, topping analyst expectations of $0.83. Additionally, ORLY raised its fiscal 2025 comparable store sales guidance to a range of 4% to 5%. However, despite these positives, its shares plunged 2.9% in the following trading session.

ORLY has underperformed its rival, AutoZone, Inc.’s (AZO) 24.5% uptick over the past 52 weeks. However, it has outpaced AZO’s 23.3% rise on a YTD basis.

Despite ORLY’s recent underperformance, analysts remain highly optimistic about its prospects. The stock has a consensus rating of "Strong Buy” from the 27 analysts covering it, and the mean price target of $112.33 suggests an 11% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart