IREN Limited (IREN), once known as Iris Energy, has spent the past few years rewriting its story. It began as a pure-play Bitcoin (BTCUSD) miner but did not stay tied to its origins. As global investment in artificial intelligence (AI) infrastructure increased, IREN shifted its focus to the data center market, developing a platform for long-term, high-demand computing growth.

The development becomes more obvious through its strategic collaborations, the most recent of which is the multi-year AI cloud arrangement with Microsoft (MSFT), which was unveiled on Nov. 3 and sent the stock up 11.5% in a single trading session.

Alongside this, IREN’s ambitious GPU expansion plan signals the company’s intention to scale much faster than many anticipated, fueling enthusiasm despite short-term bouts of volatility in its stock price performance.

The results speak for themselves. The data center segment is now driving the narrative behind IREN’s nearly 258.9% rally over the past year and underpins projections that the stock could climb nearly 195% over the next 12 months.

With AI-related infrastructure demand holding steady and capacity needs only accelerating, investors increasingly view IREN as a company building a much larger future.

About IREN Stock

Headquartered in Sydney, IREN is a leading AI Cloud Service Provider, delivering large-scale GPU clusters designed for both AI training and inference. With a market cap brushing $13.6 billion, the company operates a vertically integrated platform supported by a substantial portfolio of grid-connected land and data centers.

Alongside its AI infrastructure strategy, IREN mines Bitcoin. The company produces the digital asset by operating specialized computing systems that run the Bitcoin software on a decentralized, peer-to-peer network.

Year-to-date (YTD), IREN shares have surged 393.4%, while the past three months alone have added another 83.12%. The stock’s performance stands well ahead of the broader S&P 500 Index ($SPX), which gained 12.9% over the past year and 5.5% over the past three months.

IREN currently trades at 46.9 times forward adjusted earnings and 11.8 times sales, both of which are significantly higher than industry averages and indicate a distinct premium. The pricing reflects both the company's solid growth trajectory and the market's belief that demand for AI-driven infrastructure will continue to rise.

IREN Surpasses Q1 Earnings

On Nov. 6, IREN reported its Q1 fiscal 2026 results, which reflected rapid expansion and strengthening fundamentals. Revenue reached $240.3 million, rising 355.4% year-over-year (YOY) and exceeding Wall Street expectations. The performance marked the company’s fifth consecutive record quarter.

Operating loss climbed 62.3% from the year-ago value to $76.4 million as IREN continued scaling its platform. Depreciation increased due to ongoing infrastructure buildout, while SG&A rose sharply as the company’s materially higher share price accelerated share-based compensation and elevated payroll-related tax expenses. The increases signal the natural costs of rapid growth rather than operational strain.

The bottom line highlighted the magnitude of the shift underway. Net income came in at $384.6 million, reversing a $51.7 million loss from the year-ago period. EPS surged to $1.08, a reversal from the $0.27 loss per share in the previous year’s period, and comfortably beat analyst forecasts.

The balance sheet strengthened too, with cash and cash equivalents rising to $1 billion from $564.5 million on June 30. Looking ahead, a major driver of future visibility came from IREN’s newly announced $9.7 billion AI cloud contract with Microsoft.

The agreement is expected to generate $1.9 billion in annual recurring revenue at 85% EBITDA margins and set the company on track for $3.4 billion in run-rate revenue by the end of 2026.

Additionally, IREN is executing on a plan to scale its GPU fleet from 23,000 units to 140,000 by 2026. Once deployed, the capacity is expected to support the same $3.4 billion annualized run-rate revenue target while using only 16% of the company’s secured three gigawatts of power, leaving significant room for further expansion.

Analysts anticipate near-term earnings volatility as investment continues. They expect the fiscal year 2026 loss per share to widen 2,200% YOY to $0.63. However, projections for fiscal year 2027 point to a meaningful rebound, with earnings per share rising 154% to $0.34.

What Do Analysts Expect for IREN Stock?

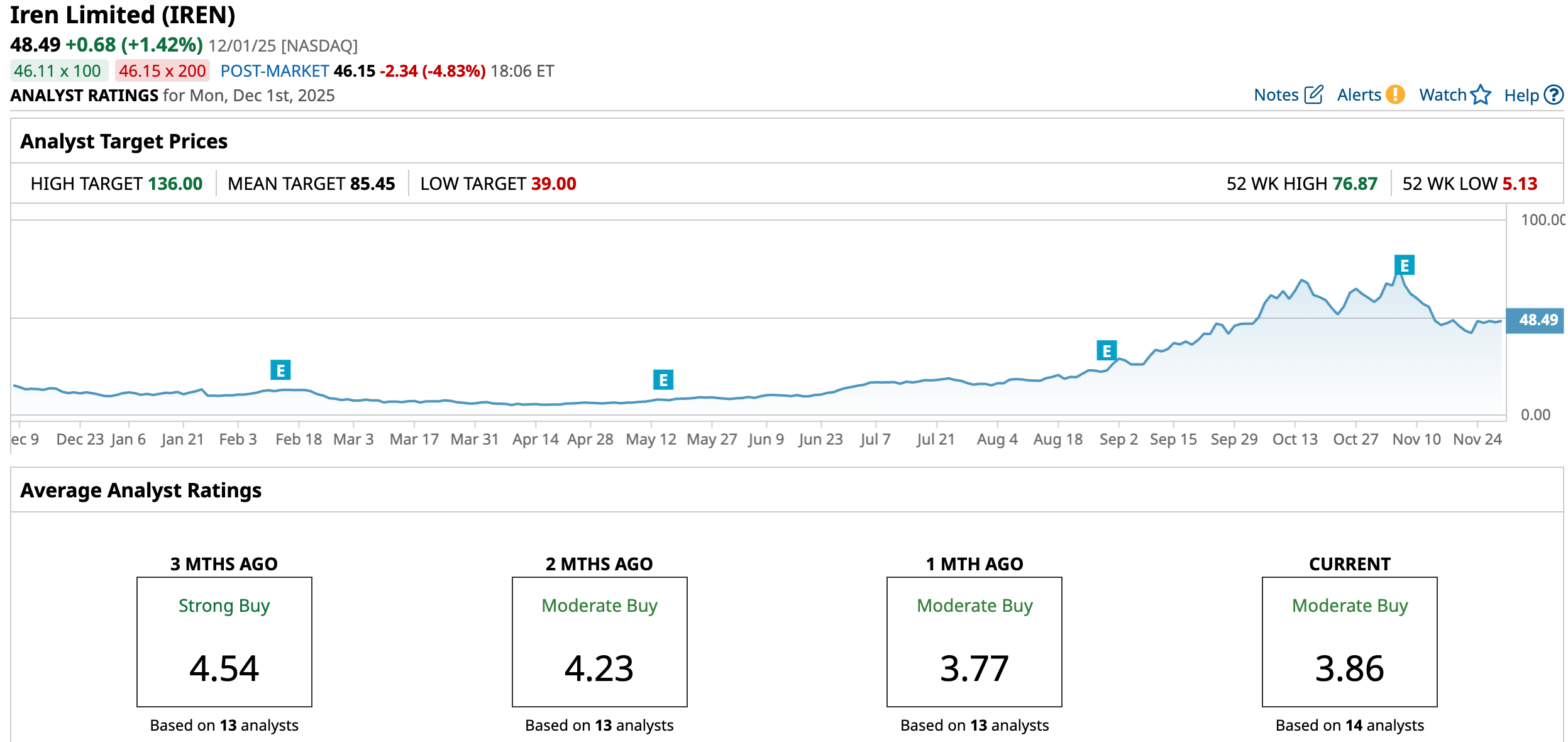

Analysts maintain a constructive stance on IREN, assigning the stock an overall “Moderate Buy” rating. Among the 14 analysts covering the company, nine recommend “Strong Buy,” while two suggest “Hold,” and three lean toward “Strong Buy.”

The average price target of $85.45 indicates 76.2% upside from current levels, while the Street-high target of $136, set by Cantor Fitzgerald’s Brett Knoblauch, implies nearly 180.5% potential appreciation, representing an opportune entry point to participate in IREN’s next phase of growth.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart