Nike (NKE) shares crashed over 10% on Dec. 19 after the footwear giant reported market-beating financials for its Q2 but issued disappointing guidance for the future.

The Beaverton-headquartered firm now sees its sales declining by a low single digit percentage and gross margins coming in down about 200 basis points in the fiscal third quarter.

Investors punished NKE shares also because the company’s revenue in Greater China – one of its major global markets – tanked another 17% in the recently concluded quarter.

Together, these weaknesses made them question if CEO Elliott Hill’s turnaround plan will succeed in helping Nike reclaim its glory. Versus its August high, Nike stock is now down about 30%.

How to Play Nike Stock on Post-Earnings Plunge

The post-earnings decline even pushed NKE stock below its 50-day moving average (MA) – a technical setup that’s often interpreted as a bearish signal for the near term.

Still, Kevin McCarthy – a senior research analyst with Neuberger Berman – says “I’d be a buyer on a day like this” mostly because the management told shareholders upfront that it won’t be a linear recovery.

Nike’s second quarter release had enough “redeeming qualities” to continue believing in its long-term earnings power.

Speaking with CNBC, McCarthy refrained from putting a price target on NKE, but said the stock will likely emerge an “alpha generative investment over the next couple of years.”

Why NKE Shares Are Worth Owning for 2026

Kevin McCarthy remains positive on Nike shares also because the firm’s gross margins excluding the impact of tariffs were actually up on a year-over-year basis in Q2.

On “Squawk Box,” the analyst expressed confidence in Hill’s leadership, saying “he knows what he needs to be doing.”

According to him, NKE has cleaned its U.S. inventories where its order book is improving already, and the stock will push higher as the management replicates this progress in markets outside of its hometown as well.

A healthy 2.84% dividend yield makes up for another great reason to have Nike in your investment portfolio heading into 2026.

Nike Hasn’t Fallen Out of Favor With Wall Street

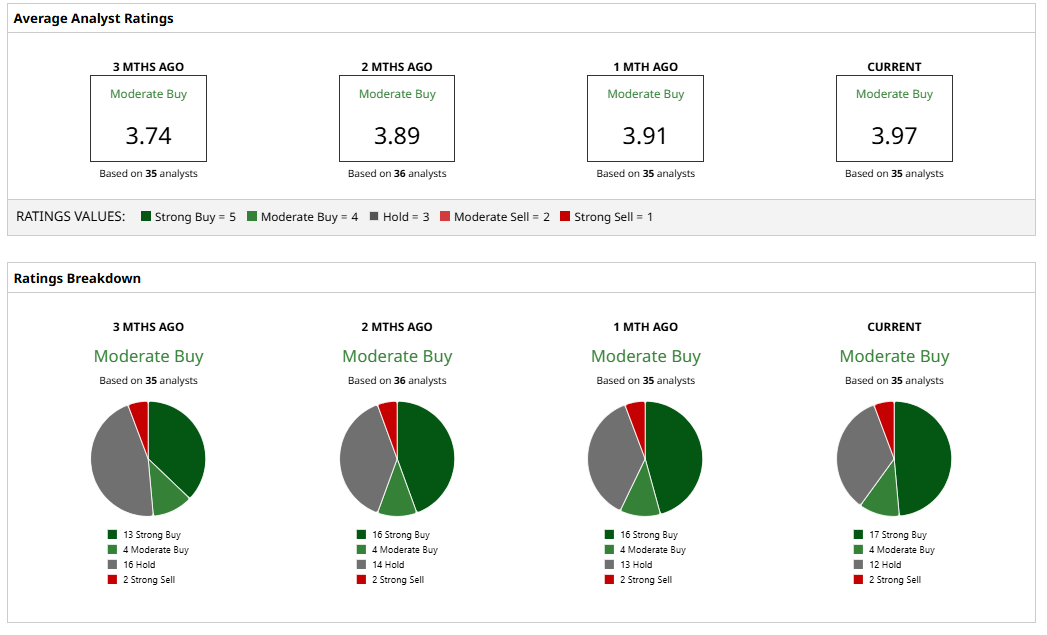

Wall Street more broadly remains constructive on Nike stock for the coming year as well.

The consensus rating on NKE shares remains at “Moderate Buy” with the mean target of about $80 indicating potential upside of roughly 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Valero (VLO) Stock Just Triggered a Rare Quant Signal the Options Market Is Missing

- Morgan Stanley Sees a Sweet Turnaround Play in This 1 Stock. Should You Buy Shares Here?

- As Nvidia Acquires SchedMD, Should You Buy, Sell, or Hold NVDA Stock?

- ‘Top Pick’ Amazon Had a Dismal Year: What’s AMZN Stock’s Forecast for 2026?