San Francisco, California-based Autodesk, Inc. (ADSK) provides 3D design, engineering, and entertainment technology solutions. With a market cap of $64.7 billion, Autodesk’s operations span the Americas, Europe, the Middle East and Africa, and the Indo-Pacific.

Companies worth $10 billion or more are generally described as "large-cap stocks." Autodesk fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the software application industry. It serves various industries, including architecture, construction, product design, entertainment, and more.

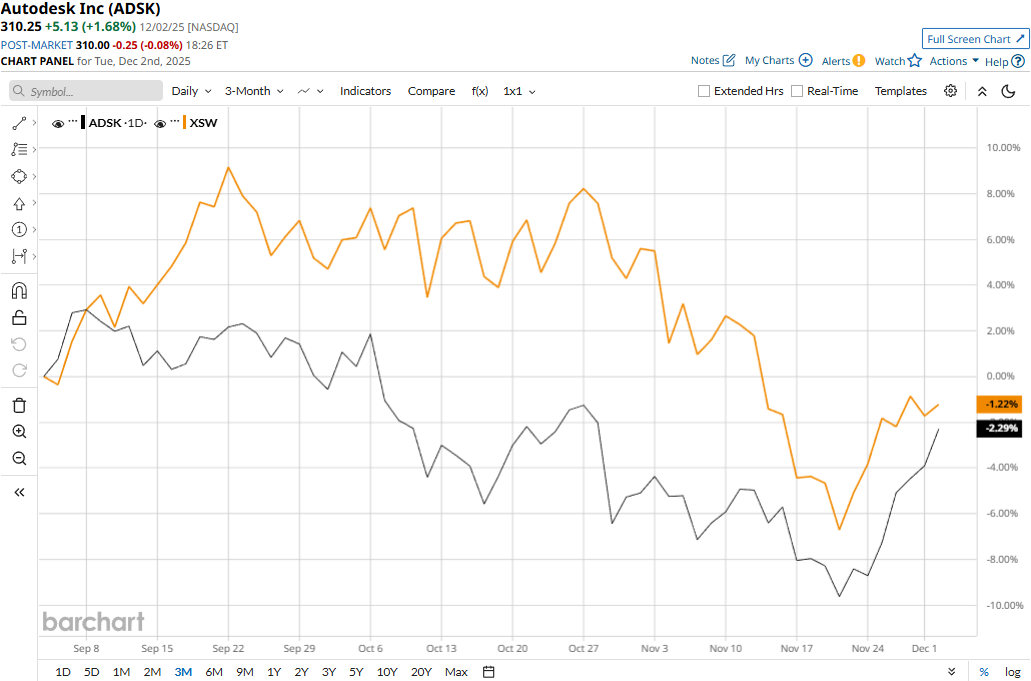

ADSK touched its three-year high of $329.09 on Sept. 8 and is currently trading 5.7% below that peak. Meanwhile, its stock prices have declined 2.8% over the past three months, slightly underperforming the SPDR S&P Software & Services ETF’s (XSW) 1.6% dip during the same time frame.

Over the longer term, Autodesk has notably outperformed other software stocks. ADSK stock prices have gained nearly 5% on a YTD basis and registered 4.6% returns over the past 52 weeks, compared to XSW’s 1.7% dip in 2025 and 4.8% decline over the past year.

Autodesk has traded mostly above its 200-day moving average since early May but dropped below its 50-day moving average in October, underscoring its overall bullish trend and recent downturn.

Autodesk’s stock prices gained 2.4% in the trading session following the release of its impressive Q3 results on Nov. 25. The company observed a notable surge in billings and revenues. Its topline for the quarter soared 18% year-over-year to $1.9 billion, beating the Street’s expectations by 2.7%. Meanwhile, its adjusted EPS soared 23% year-over-year to $2.67, exceeding the consensus estimates by 7.2%.

Meanwhile, Autodesk has lagged behind its peer ANSYS, Inc.’s (ANSS) 11% surge in 2025 and 13.3% gains over the past 52 weeks.

Among the 26 analysts covering the stock, the consensus rating is a “Strong Buy.” Its mean price target of $370.72 suggests a 19.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.