Valued at a market cap of $22.6 billion, Halliburton Company (HAL) provides products and services to the energy sector. The Houston, Texas-based company supports the full life cycle of oil and natural gas reservoirs, offering core services such as drilling, formation evaluation, well construction, and production optimization, all aimed at helping energy producers maximize efficiency and resource value.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and HAL fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the oil & gas equipment & services industry. With operations in more than 70 countries, the company serves national and international oil companies through a combination of advanced engineering, digital technologies, and integrated service models. Its scale, technical expertise, and strong presence in North American shale and global offshore markets position it as a major player in the industry.

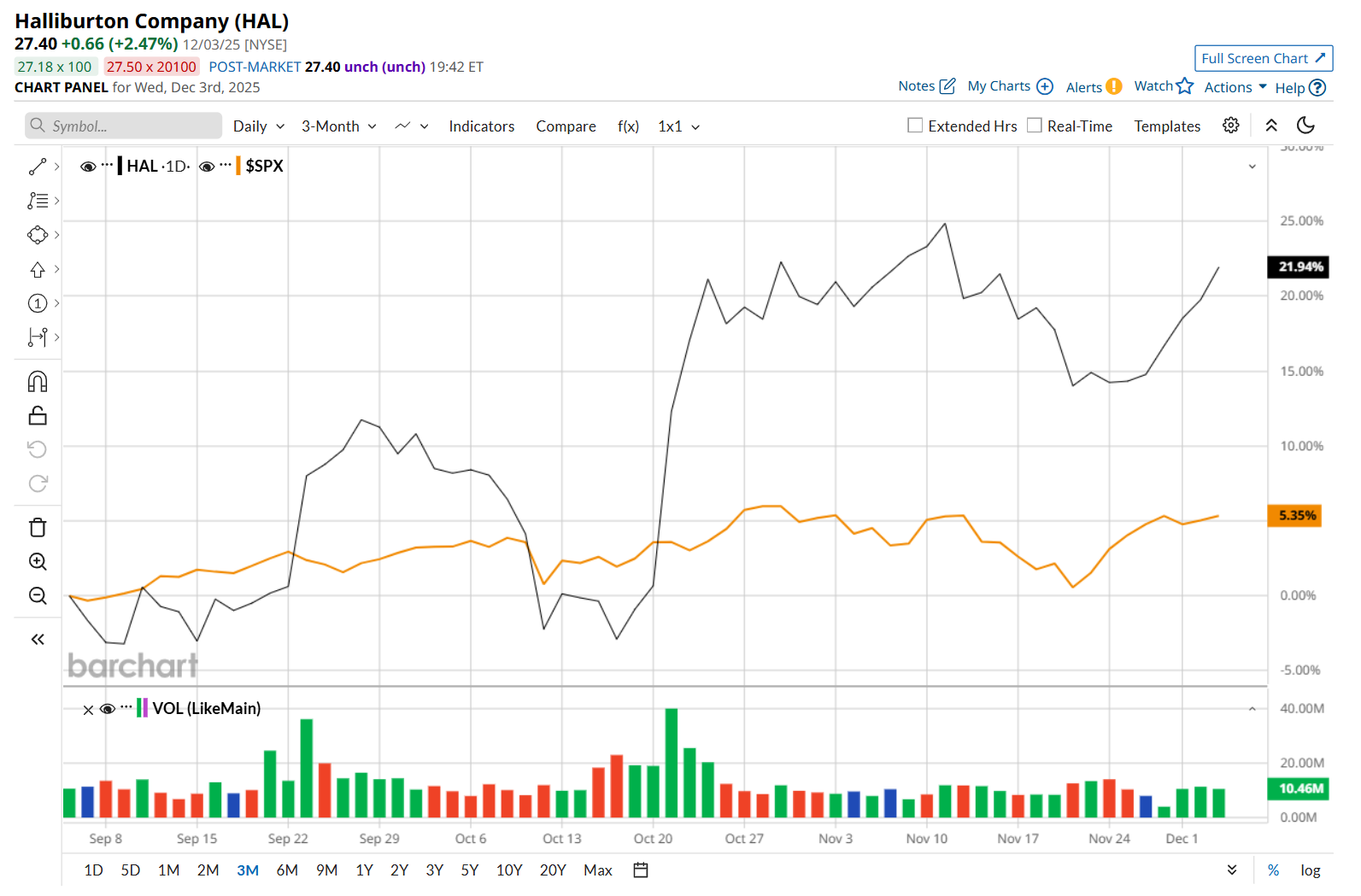

This energy company is currently trading 13.4% below its 52-week high of $31.63, reached on Dec. 4, 2024. Shares of HAL have rallied 26.9% over the past three months, considerably outperforming the S&P 500 Index’s ($SPX) 6.2% rise during the same time frame.

However, in the longer term, HAL has fallen 13.6% over the past 52 weeks, notably underperforming SPX's 13.2% uptick over the same time period. Moreover, on a YTD basis, shares of HAL are up marginally, compared to SPX’s 16.5% return.

To confirm its recent bullish trend, HAL has been trading above its 200-day moving average since late October and has remained above its 50-day moving average since late August, with slight fluctuations.

On Oct. 21, shares of Halliburton surged 11.6% after its better-than-expected Q3 earnings release. While the company’s total revenue decreased 1.7% year-over-year to $5.6 billion, it still surpassed analyst expectations by a notable margin of 3.9%. Meanwhile, its adjusted EPS also declined 20.5% from the year-ago quarter to $0.58, but handily topped consensus estimates of $0.50. Additionally, HAL highlighted meaningful progress in improving operational efficiency, with initiatives expected to generate $100 million per quarter cost savings, which might have further bolstered investor confidence.

HAL has slightly outpaced its rival, SLB N.V. (SLB), which declined 14% over the past 52 weeks and 2.1% on a YTD basis.

Looking at HAL’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 24 analysts covering it, and the mean price target of $30.13 suggests a 10% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart