With a market cap of $44.4 billion, Exelon Corporation (EXC) is a utility services holding company. It operates in the energy sector, focusing on the distribution and transmission of electricity and natural gas. The company engages in the purchase and regulated retail sale of electricity and natural gas, serving a wide range of customers.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Exelon fits right into that category. Its clientele includes residential, commercial, industrial, governmental, public authority, and transportation sectors.

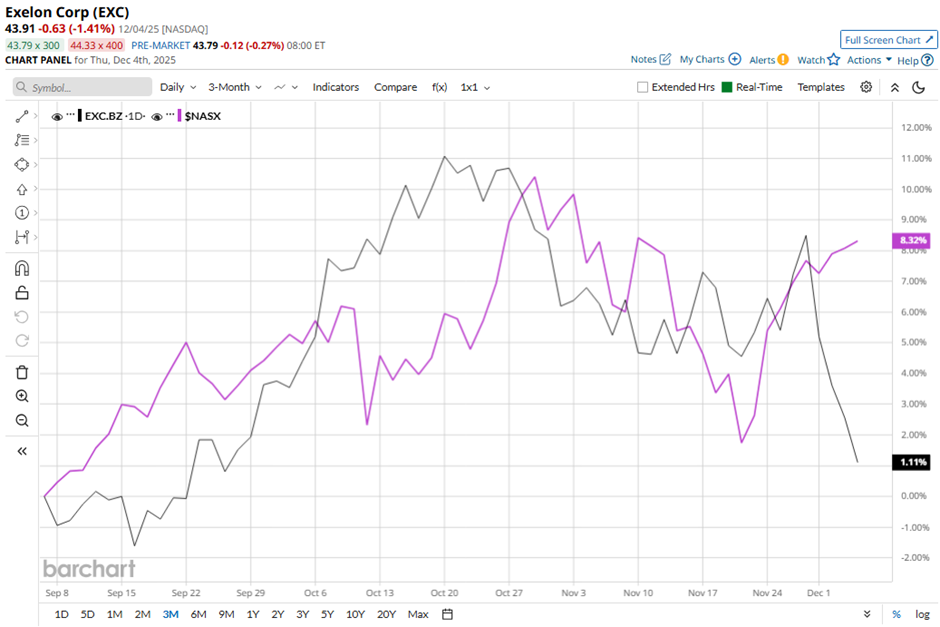

Despite this, shares of the Chicago, Illinois-based company have declined 9.5% from its 52-week high of $48.51. EXC stock has risen 1.3% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 8.3% return over the same time frame.

Exelon stock is up 16.7% on a YTD basis, lagging behind NASX’s 21.7% surge. Moreover, shares of the company have increased 16% over the past 52 weeks, compared to NASX’s 19.1% gain over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since early January.

Shares of Exelon rose marginally on Nov. 4 after the company’s report of strong Q3 2025 results, with GAAP and adjusted operating earnings increasing to $0.86 per share from $0.70 and $0.71 per share, respectively, in Q3 2024. Investors were encouraged by Exelon reaffirming its full-year 2025 adjusted EPS guidance of $2.64 - $2.74 and the long-term operating EPS growth target of 5% - 7% through 2028.

In contrast, rival The Southern Company (SO) has lagged behind EXC stock. SO stock has gained 6.1% on a YTD basis and 1.7% over the past 52 weeks.

Despite the stock’s underperformance relative to the Nasdaq, analysts remain moderately optimistic on Exelon. The stock has a consensus rating of “Moderate Buy” from 19 analysts in coverage, and the mean price target of $50 is a premium of 13.9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart