With a market cap of $298.2 billion, Cisco Systems, Inc. (CSCO) is a global technology company that designs and sells networking hardware, software, and services used to connect, secure, and manage digital infrastructure. Cisco is best known for routers and switches. It also offers cybersecurity, cloud networking, and collaboration solutions. The company serves enterprises, service providers, and governments worldwide.

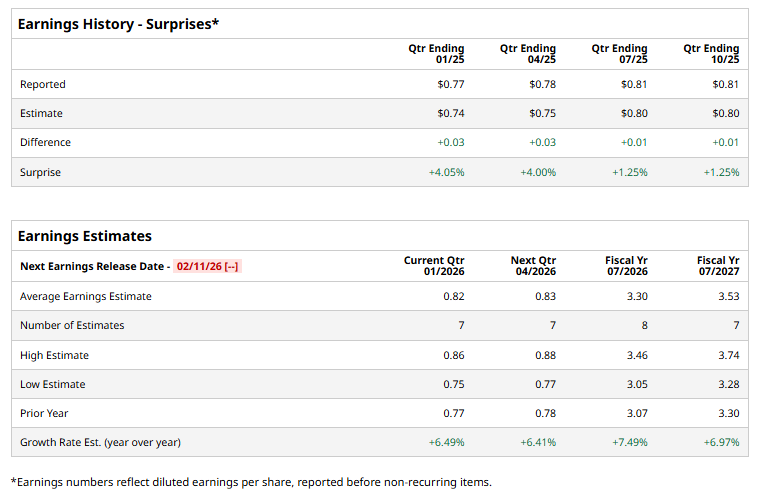

The technology giant is expected to announce its fiscal second-quarter earnings for 2026 in the near future. Ahead of the event, analysts expect CSCO to report a profit of $0.82 per share on a diluted basis, up 6.5% from $0.77 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year ending July 2026, analysts expect CSCO to report EPS of $3.30, up 7.5% from $3.07 in fiscal 2025. Its EPS is expected to rise 7% year over year to $3.53 in fiscal 2027.

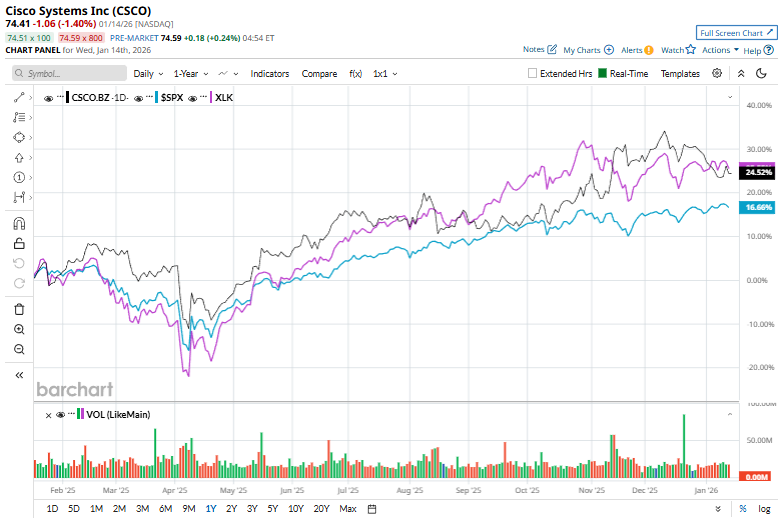

CSCO shares have surged 25.4% over the past year, outpacing the S&P 500 Index’s ($SPX) 18.6% gains but trailing the Technology Select Sector SPDR Fund’s (XLK) 27.1% gains over the same time frame.

Cisco recently reached a historic milestone, with its stock closing at a record $80.25 on Dec. 10, its first new all-time high since the dot-com era peak in 2000. After years of stagnation following the collapse of the internet bubble, Cisco’s resurgence has been driven by successful diversification beyond networking hardware into software and services through acquisitions such as Webex, AppDynamics, and Splunk. Additionally, the stock has outpaced the broader market over the past year as it continues to benefit from the AI investment cycle, highlighted by $1.3 billion in AI infrastructure orders.

Analysts’ consensus opinion on CSCO stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 13 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 10 give a “Hold.” CSCO’s average analyst price target is $85.90, indicating a potential upside of 15.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart