Headquartered in Irving, Texas, Caterpillar Inc. (CAT) is a leading global industrial firm specializing in construction and mining equipment, diesel and natural-gas engines, industrial gas turbines, and related services. Caterpillar’s scale and market presence are reflected in a market cap of around $268.1 billion. This industrial giant is expected to announce its fiscal fourth-quarter 2025 earnings soon.

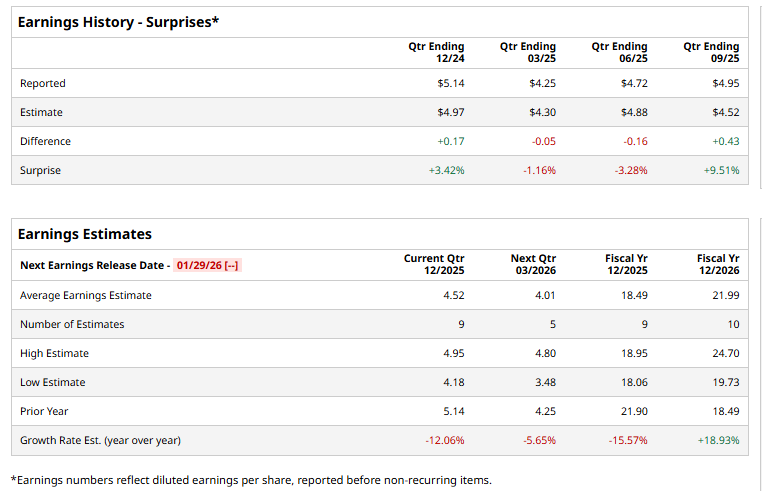

Ahead of this event, analysts expect the company to report a profit of $4.52 per share, down 12.1% from $5.14 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in two of the past four quarters, while surpassing on two other occasions.

For fiscal 2025, analysts expect CAT to report EPS of $18.49, down 15.6% from $21.90 in fiscal 2024. However, in FY2026, the company’s EPS is expected to rebound, increasing 18.9% annually to $21.99.

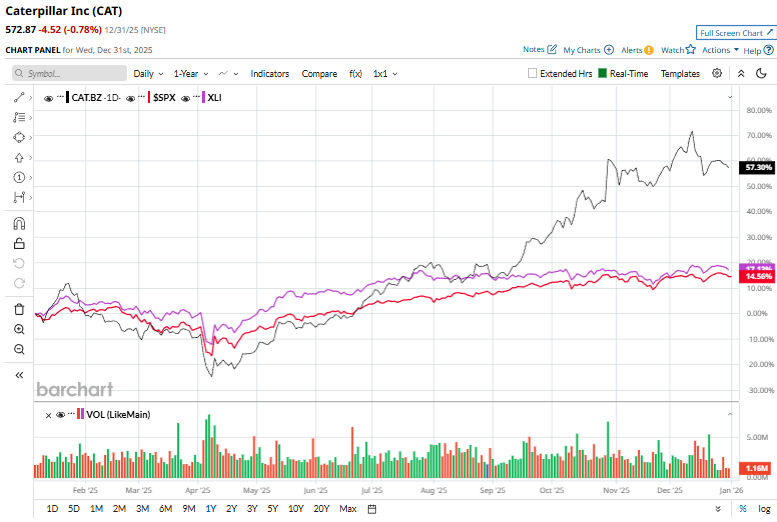

CAT stock has gained 57.8% over the past 52 weeks, significantly outperforming the Industrial Select Sector SPDR Fund’s (XLI) 17.6% surge and the S&P 500 Index’s ($SPX) 16.4% uptick during the same time frame.

Caterpillar shares jumped 3.5% on Dec. 10 after the company’s board approved the continuation of its quarterly dividend at $1.51 per share, payable on Feb. 19, 2026, to shareholders of record as of Jan. 20, 2026. The announcement reinforced Caterpillar’s long-standing shareholder return record, as the company has paid a cash dividend every year since its formation, maintained quarterly payouts since 1933, and increased its annual dividend for 32 consecutive years, earning it a place in the S&P 500 Dividend Aristocrats Index.

Wall Street analysts are moderately bullish about CAT’s stock, with a “Moderate Buy” rating overall. Among 23 analysts covering the stock, 13 recommend “Strong Buy,” nine suggest a “Hold,” and one advises a “Moderate Sell” rating. Its mean average price target of $604.24 implies an upswing potential of 5.5% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026