Valued at a market cap of $60.4 billion, Sempra (SRE) is an energy infrastructure company that owns and operates regulated electric and natural gas utilities. The San Diego, California-based company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

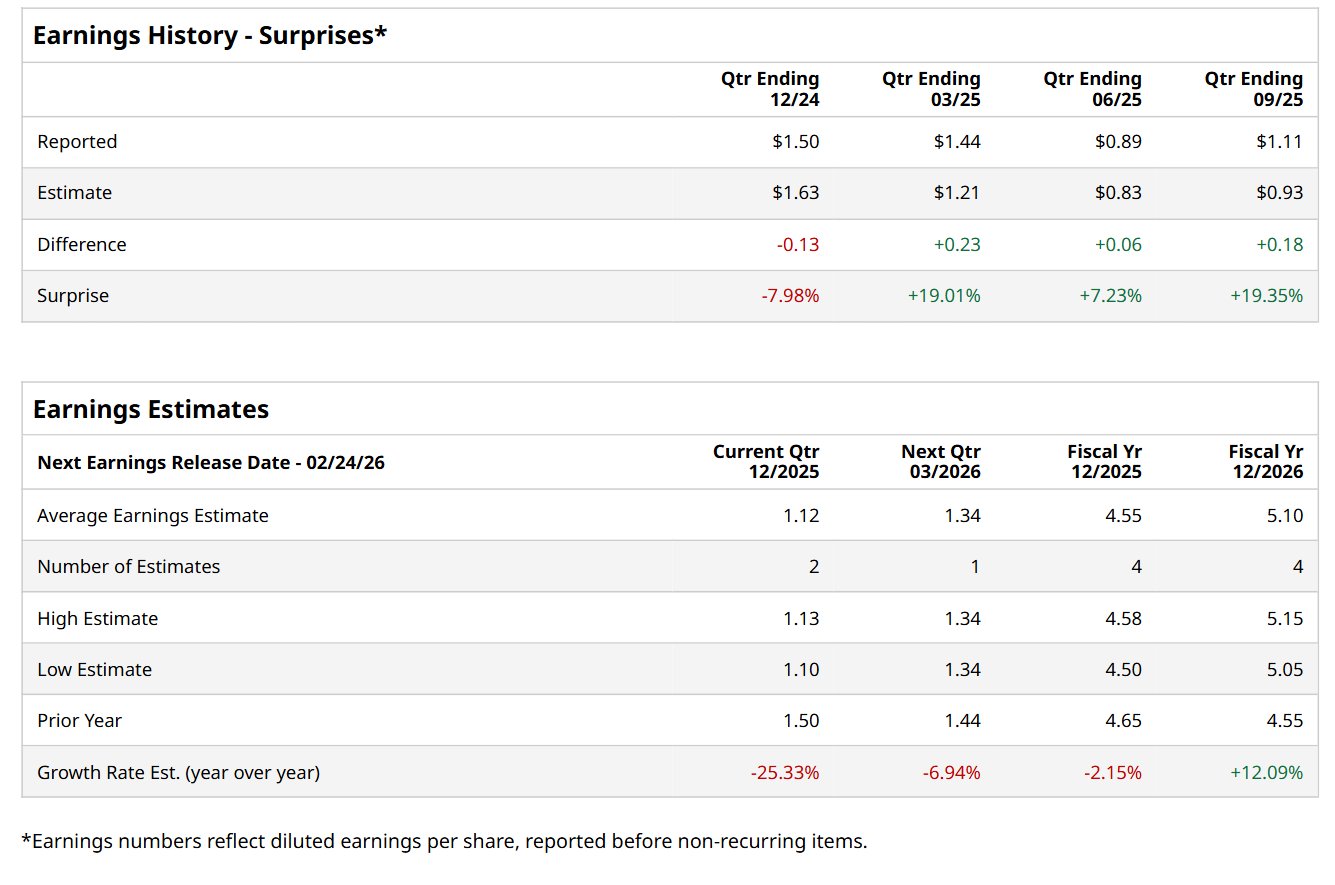

Before this event, analysts expect this utility company to report a profit of $1.12 per share, down 25.3% from $1.50 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.11 per share in the previous quarter topped the consensus estimates by 19.4%.

For the current fiscal year, ending in December, analysts expect SRE to report a profit of $4.55 per share, down 2.2% from $4.65 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 12.1% year-over-year to $5.10 in fiscal 2026.

SRE has gained 10.2% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 16.9% return over the same time frame but coming in line with the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.2% uptick over the same time period.

On Nov. 5, shares of SRE plunged marginally after reporting its Q3 results. The company’s revenue increased 13.5% year-over-year to $3.2 billion, while its adjusted EPS grew 24.7% from the year-ago quarter to $1.11 and came in 19.4% ahead of analyst estimates. Strong growth in its natural gas and electric revenues supported its performance.

Wall Street analysts are moderately optimistic about SRE’s stock, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 10 recommend "Strong Buy," one advises a "Moderate Buy,” and seven indicate "Hold.” The mean price target for SRE is $101, indicating a 9.1% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart