Walmart Inc. (WMT) is an Arkansas-based multinational retail corporation and one of the largest companies in the world by revenue and scale. Founded in 1962, Walmart operates a global network of over 10,750 retail locations across 19 countries in formats that include supercenters, discount stores, neighborhood markets, and warehouse clubs under the Sam’s Club banner, as well as a substantial e-commerce presence. With a market cap of $954 billion, it serves approximately 270 million customers and members weekly and employs about 2.1 million people worldwide.

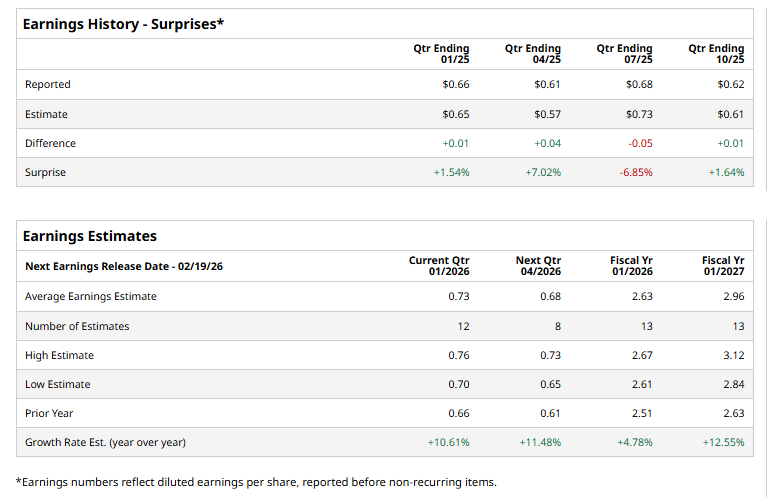

The discount retail giant is expected to announce its fourth-quarter results shortly. Ahead of the event, analysts expect Walmart to report a profit of $0.73 per share, up 10.6% from $0.66 per share reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates three times over the past four quarters, it missed the Street's bottom-line estimates once.

For FY2026, Walmart’s EPS is expected to come in at $2.63, up 4.8% from $2.51 reported in fiscal 2025. In fiscal 2026, its earnings are expected to surge 12.6% year over year to $2.96 per share.

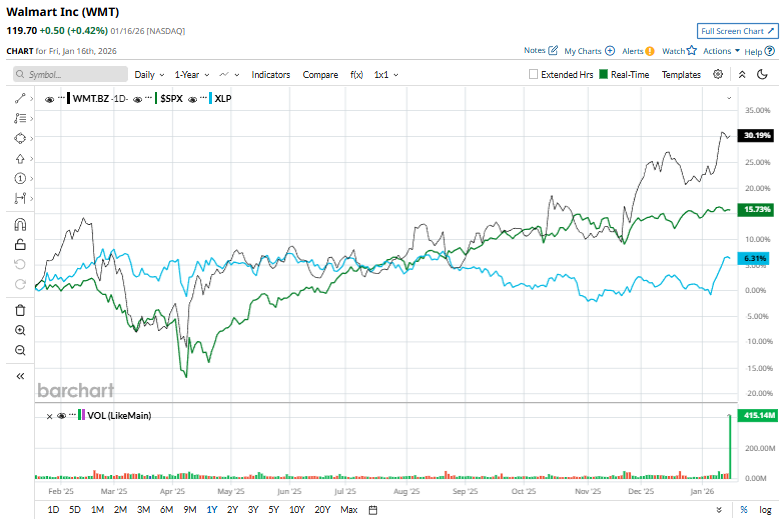

WMT shares have soared 31.1% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.9% rise during the same time frame.

Walmart’s stock rose 1.3% on Jan. 9 after Nasdaq announced that Walmart will be added to the Nasdaq-100 and related indices effective Jan. 20, 2026, replacing AstraZeneca across multiple Nasdaq benchmarks, a move seen as a validation of Walmart’s market relevance and trading liquidity.

Analysts remain extremely bullish on the stock’s long-term prospects. WMT has a consensus “Strong Buy” rating overall. Of the 37 analysts covering the stock, opinions include 29 “Strong Buys,” six “Moderate Buys,” and two “Holds.” Its mean price target of $124.75 suggests a 4.2% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart