Tesla, Inc. (TSLA), headquartered in Austin, Texas, has been a popular name on Wall Street as a leader in electric vehicle (EV) manufacturing and clean energy solutions through its Gigafactories. The company developed advanced autonomous driving with improved Full Self-Driving software for future robotaxis and scaled battery production at Gigafactories. Tesla has a market capitalization of $1.49 trillion.

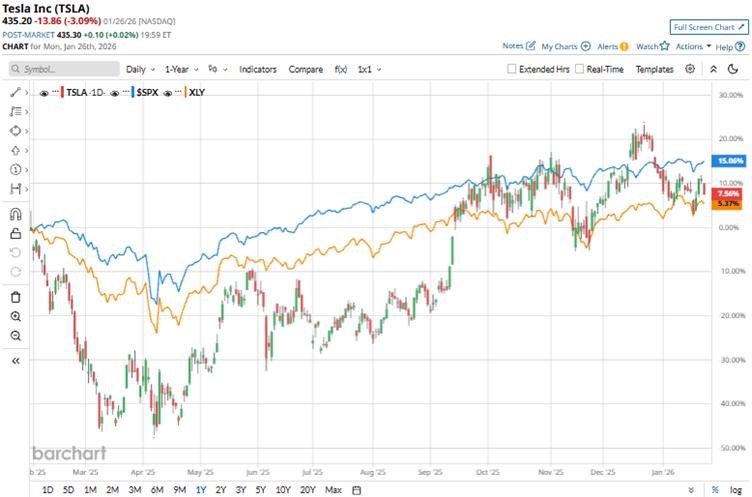

Despite competitors challenging Tesla’s dominance, the stock is still up due to tech advancements. Over the past 52 weeks, the stock has gained 7%, while it has risen 37.7% over the past six months. Tesla’s shares had reached a 52-week high of $498.83 in December 2025, but are down 12.8% from that level.

On the other hand, the S&P 500 Index ($SPX) has gained 13.9% over the past 52 weeks and 8.8% over the past six months. Therefore, while the stock has underperformed the broader market over the past year, it has outperformed over the past six months.

Turning our focus to the company’s own consumer cyclical sector, we see that the stock has outperformed, as the State Street Consumer Discretionary Select Sector SPDR ETF (XLY) is up 6.4% over the past 52 weeks and 8.8% over the past six months.

Tesla is at the center of the popularity surrounding FSD capabilities. The company recently started unsupervised robotaxi rides in Austin, Texas, without safety drivers. While this announcement falls behind the initial timeline, it is still a significant step toward its FSD ambitions. CEO Elon Musk has also teased a larger FSD driving system, which might be implemented soon. Meanwhile, Tesla’s production and deliveries are under pressure, with annual figures declining year-over-year (YOY).

For the fourth quarter of fiscal 2025 (to be reported on Jan. 28, after the market closes), Wall Street analysts expect Tesla’s EPS to decrease by 50% YOY to $0.33 on a diluted basis. For the fiscal year 2025, analysts expect its EPS to drop 45.1% YOY to $1.12 on a diluted basis. However, EPS is expected to grow 50% annually to $1.68 in fiscal 2026.

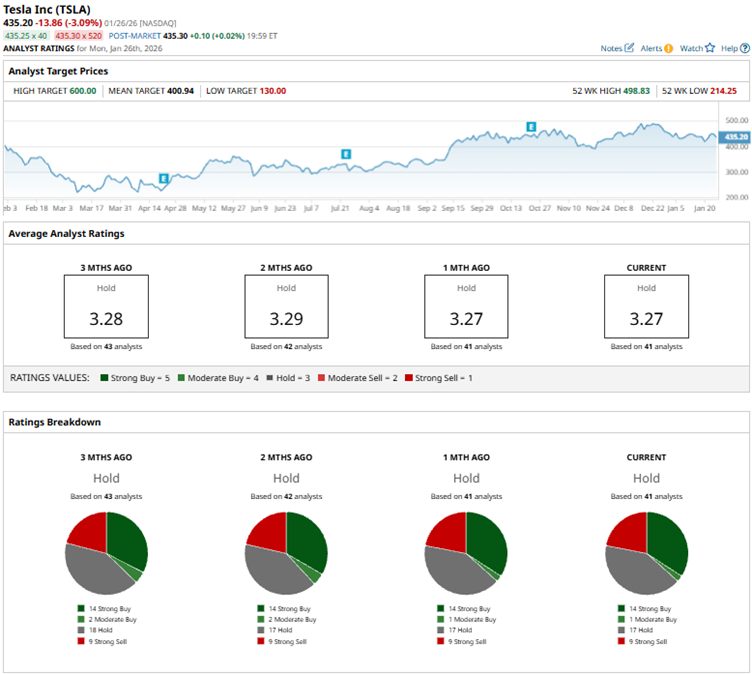

Among the 41 Wall Street analysts covering TSLA’s stock, the consensus is a “Hold.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” 17 “Holds,” and nine “Strong Sells.” The ratings configuration is slightly less bullish than it was two months ago, with one “Moderate Buy” rating now, down from two.

Recently, analysts at Barclays maintained an “Equalweight” rating on Tesla’s stock, but raised the price target from $350 to $360, after the robotaxi services were launched without safety monitors in Austin.

Tesla’s mean price target of $400.94 indicates a 7.9% downside from current market prices. However, the Street-high price target of $600 implies a potential upside of 37.9%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Drops Tariff Threats on Greenland, Should You Buy This 1 Hot Rare Earths Stock?

- As Tesla’s Austin Robotaxi Launch Draws Scrutiny, Consider Buying These 2 Robotaxi Stocks Instead

- Why 1 Analyst Just Slashed Their Price Target on Oracle Stock by More than 30%

- Seagate Stock Just Hit a New All-Time High Ahead of Earnings. Should You Chase the AI Frenzy Higher?