With a market cap of $337.3 billion, Chevron Corporation (CVX) is one of the world’s largest and most prominent integrated energy companies, with operations spanning the entire oil and gas value chain. Headquartered in Texas, Chevron is engaged in exploration, production, refining, marketing, and petrochemicals, with a strong presence across North America, Asia, and other key global markets.

Shares of this oil giant have underperformed the broader market over the past year. CVX has gained 7.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. Over the past six months, both the stock and the S&P 500 Index have climbed 9.2%.

Narrowing the focus, CVX has surpassed the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). The exchange-traded fund has declined 1.9% over the past year and gained 5.8% over the past six months.

On Jan. 14, Chevron shares rose more than 2% as energy stocks advanced, supported by WTI crude oil reaching a 2.5-month high.

For FY2025, which ended in December, analysts expect CVX’s EPS to decline 287.8% to $7.26 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

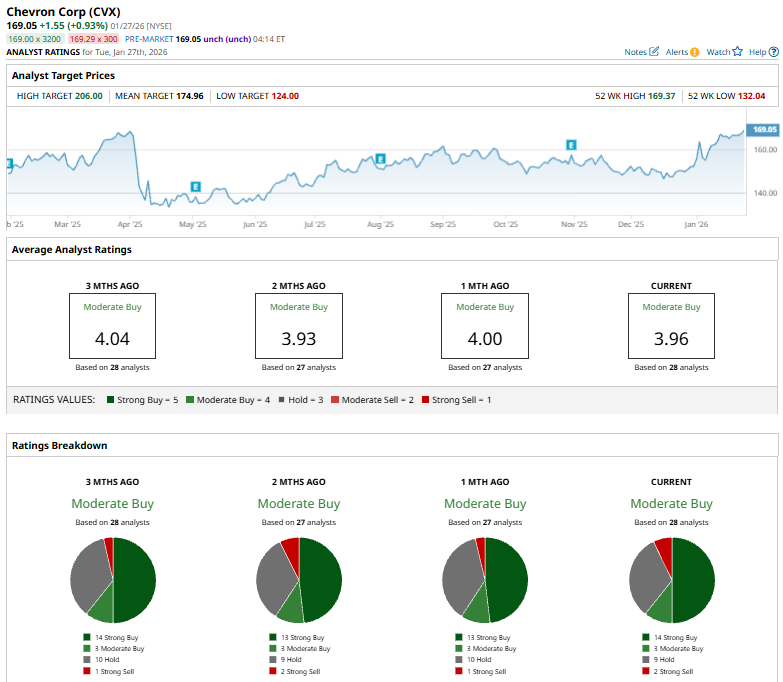

Among the 28 analysts covering CVX stock, the consensus is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, three “Moderate Buys,” nine “Holds,” and two “Strong Sells.”

This configuration is more bullish than a month ago, with 13 analysts suggesting a “Strong Buy.”

On Jan. 23, 2026, Morgan Stanley analyst Devin McDermott reaffirmed an “Overweight” rating on Chevron, while trimming the price target to $174 from $180, reflecting a modest adjustment in outlook while maintaining confidence in the company’s long-term prospects.

The mean price target of $174.96 represents a 3.5% premium to CVX’s current price levels. The Street-high price target of $206 suggests an ambitious upside potential of 21.9%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nasdaq Futures Rally as ASML Provides a Boost, Fed Decision and Big Tech Earnings Awaited

- 1 Dividend Stock to Buy Now as Trump Turns Up the Tariff Heat Again

- Nvidia Just Gave You a $2 Billion Reason to Buy CoreWeave Stock

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buys Shares. Is It Too Late to Chase GME Stock Here?