Franklin Resources, Inc. (BEN), with a market capitalization of $13.4 billion, is a global investment management and financial services holding company that operates principally through its flagship brand Franklin Templeton. Headquartered in San Mateo, California, the firm manages a wide array of investment products and solutions, including equities, fixed income, balanced and multi-asset funds, ETFs, and alternative strategies, for a diverse client base of individual, institutional, and high-net-worth investors worldwide.

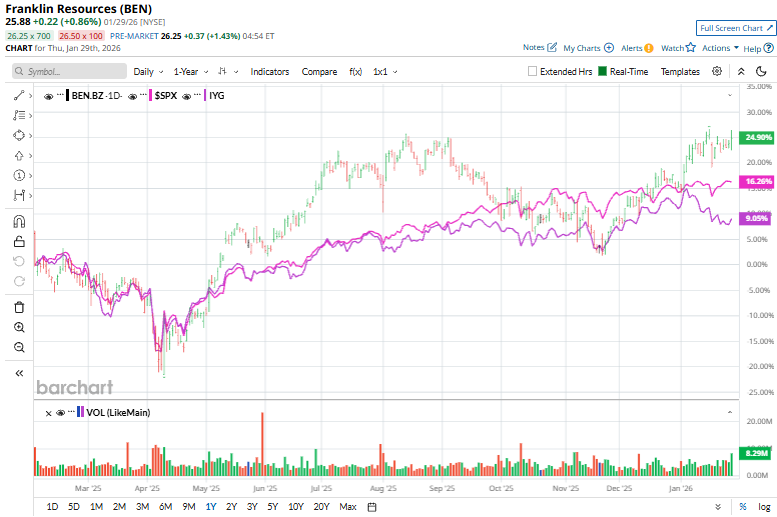

Shares of the leading asset management company have outperformed the broader market considerably over the past year. BEN has increased 29.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. Over the past six months, however, Franklin Resources stock climbed 5.3%, lagging behind $SPX’s 9.4% rally.

Narrowing the focus, BEN has surpassed the iShares U.S. Financial Services ETF’s (IYG) 8.8% gain over the past year and 3.4% return over the past six months.

Franklin Resources shares gained 1.2% on Jan. 22 following the launch of the Templeton Emerging Markets Debt ETF (TEMD), an actively managed fund aimed at delivering income and capital appreciation from emerging market debt while dynamically managing currency risk. The new ETF strengthens Franklin Templeton’s active fixed-income lineup by offering a flexible strategy that bridges U.S. dollar– and local currency–denominated debt, providing broader market access and the potential for attractive yields compared with traditional indexed or single-currency approaches.

For the current fiscal year, ending in September, Street expects BEN’s EPS to improve 10.8% year over year to $2.46. Franklin Resources’ earnings surprise history is stellar. It beat or matched the consensus estimate in each of the last four quarters.

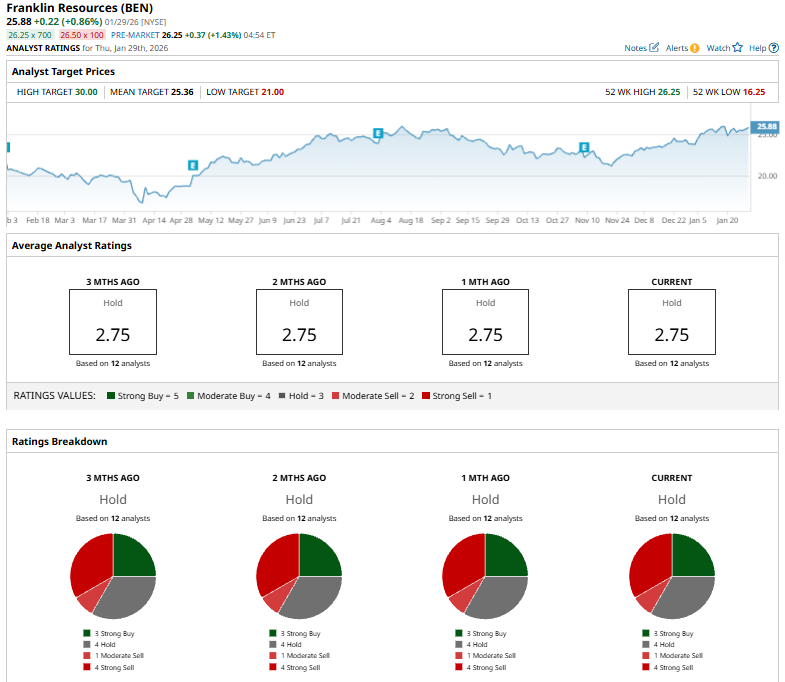

The consensus rating among the 12 analysts covering BEN stock is a “Hold.” This is derived from three “Moderate Buys,” four “Holds”, one “Moderate Sell,” and four “Strong Sells.”

This configuration has been consistent over the past months.

On Jan. 16, Barclays analyst Benjamin Budish raised his price target on Franklin Resources to $25 from $22, a 13.64% increase, while maintaining an “Underweight” rating.

The stock currently trades above the mean price target of $25.36 and the Street-high target of $30 represents an upside potential of 15.9%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart