With a market cap of $68.3 billion, Western Digital Corporation (WDC) is a global data storage company that develops, manufactures, and sells hard disk drive (HDD)-based devices and solutions across the United States, Asia, Europe, the Middle East, and Africa. It offers a wide range of products, including internal and external drives, data center solutions, NAS systems, and accessories.

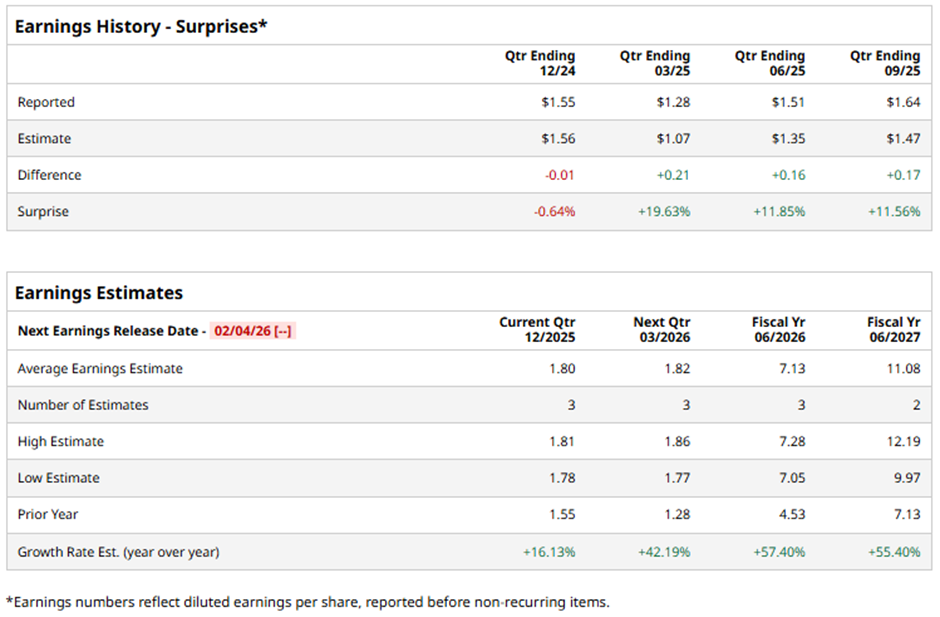

The San Jose, California-based company is slated to announce its fiscal Q2 2026 results soon. Ahead of this event, analysts forecast WDC to post an adjusted EPS of $1.80, a 16.1% growth from $1.55 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2026, analysts predict the maker of hard drives to report adjusted EPS of $7.13, a surge of 57.4% from $4.53 in fiscal 2025.

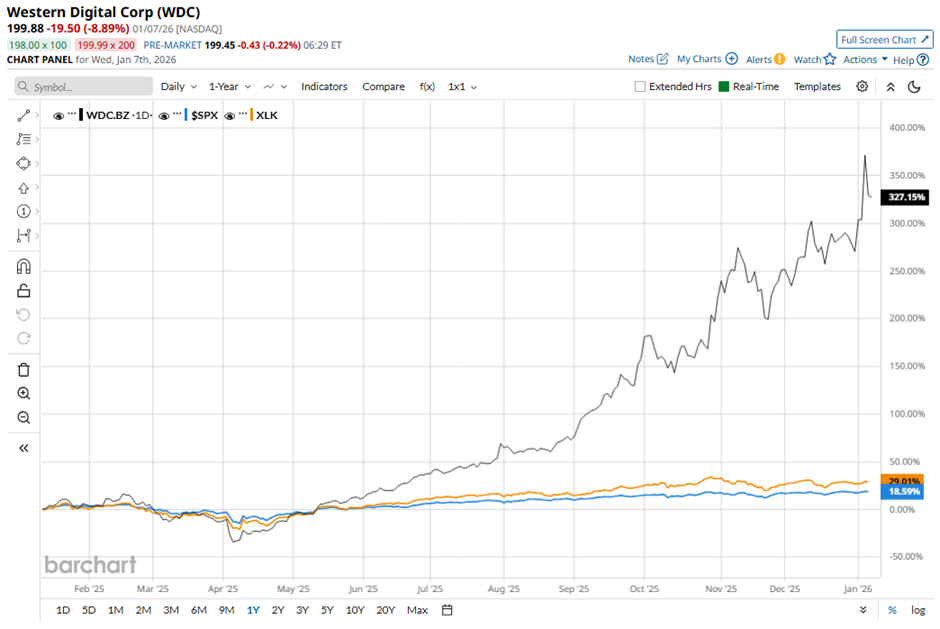

Shares of Western Digital have climbed 310.8% over the past 52 weeks, significantly outperforming the broader S&P 500 Index's ($SPX) 17.1% rise and the State Street Technology Select Sector SPDR ETF's (XLK) 25.3% return over the same period.

Shares of Western Digital soared 8.8% following its Q1 2026 results on Oct. 30. The company reported stronger-than-expected revenue of $2.82 billion and adjusted EPS of $1.78. Investor confidence was further boosted by robust cash generation, including $672 million in operating cash flow and $599 million in free cash flow, along with guidance projecting Q2 2026 revenue of $2.9 billion and adjusted EPS of $1.88. The rally was also fueled by management’s optimistic outlook on rising data center demand and improved profitability from high-capacity drives.

Analysts' consensus view on WDC stock remains bullish, with a "Strong Buy" rating overall. Out of 25 analysts covering the stock, 20 recommend a "Strong Buy," one "Moderate Buy," and four "Holds." As of writing, it is trading above the average analyst price target of $188.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Can This New ETF Be a Game-Changer in a Market Stuck Waiting for the AI Bubble to Burst?

- Nvidia CEO Jensen Huang Warns ‘Everyone’s Job Will be Affected by AI,’ But Hopes It Will ‘Enhance’ Most Jobs, Not Destroy Them

- MSTR Stock Breaks Above 20-Day Moving Average on MSCI Win. Should You Buy Shares Here?

- 2 Comeback Stocks Investors Are Watching Closely in 2026