Valued at a market cap of $230.4 billion, McDonald's Corporation (MCD) is a global fast-food company that owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally. It offers a wide range of food and beverages, including burgers, chicken items, fries, breakfast options, desserts, and drinks, while operating through conventional franchises, developmental licenses, and affiliates.

Shares of the Chicago, Illinois-based company have underperformed the broader market over the past 52 weeks. MCD stock has returned 9.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.2%. However, shares of McDonald's are up 5.5% on a YTD basis, outpacing SPX’s marginal decrease.

Focusing more closely, shares of the fast-food giant have outperformed the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) slight rise over the past 52 weeks.

Shares of McDonald’s rose 2.2% on Nov. 5, 2025, after the company reported strong Q3 2025 results, highlighted by global comparable sales growth of 3.6% and adjusted EPS of $3.22, beating expectations. Investor sentiment was further boosted by McDonald’s surpassing $4 billion in quarterly restaurant margin for the first time, with total restaurant margin dollars up 4% in constant currency and year-to-date operating margin improving to 47.2%. Additionally, management’s outlook pointing to accelerating comp sales growth in Q4, supported by Extra Value Meals, the MONOPOLY digital campaign, and positive early results from beverage tests, reinforced confidence.

For the fiscal year that ended in December 2025, analysts expect MCD’s adjusted EPS to grow 3.4% year-over-year to $12.12. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

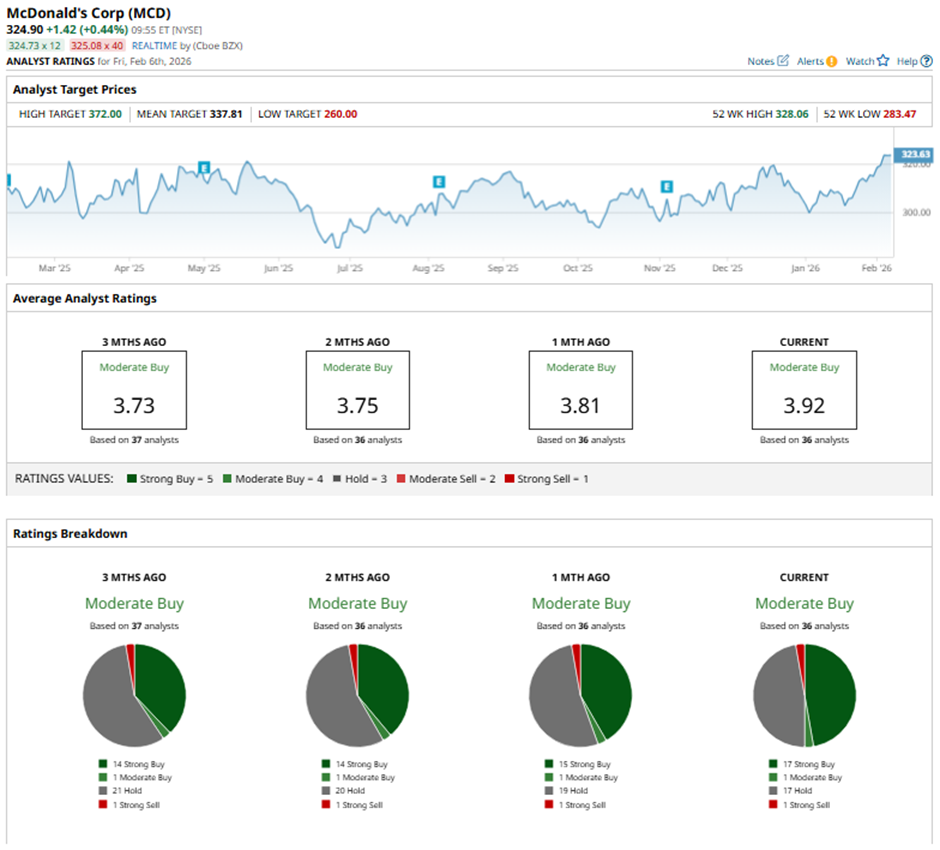

Among the 36 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” 17 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 14 “Strong Buy” ratings on the stock.

On Feb. 6, Mizuho raised McDonald’s price target to $325 while maintaining a “Neutral" rating.

The mean price target of $337.81 represents a premium of nearly 4% to MCD's current levels. The Street-high price target of $372 implies a potential upside of 14.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart