Company’s Recent Letter to Stockholders Relies on Disingenuous Total Shareholder Return Comparisons Claiming Credit for Stock Outperformance Following Launch of Legion’s Public Campaign

Board Attempts to Obfuscate Long-Tenured Directors’ Lack of Relevant Qualifications by Touting a Director That Has Resigned and Directors from Legacy On-Premise and Non-Technology Companies as “Cloud Leaders”

Board has Misrepresented Legion Partners’ Engagement with Company and Plan to Unlock Stockholder Value While Suggesting No Further Strategic Action is Necessary

We Believe the Board’s “Stay the Course” Plan Will Continue to Fail Stockholders – Legion’s Nominees Will Provide New Perspectives and Seek to Take Tangible Steps Towards Unlocking Value at OneSpan

Legion Partners Asset Management, LLC, which, together with its affiliates (collectively, “Legion Partners” or “Legion”), beneficially owns 2,790,121 shares of common stock of OneSpan Inc. (“OneSpan” or the “Company”) (Nasdaq: OSPN), representing approximately 6.9% of the outstanding stock, today issued an open letter to stockholders in response to the recently published letter by OneSpan’s Board of Directors (the “Board”) on April 26, 2021. Legion Partners has nominated four highly-qualified independent directors for election to the Company’s Board of Directors (the “Board”) at the Company’s 2021 annual meeting of stockholders: Sarika Garg, Sagar Gupta, Michael J. McConnell and Rinki Sethi.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210503005403/en/

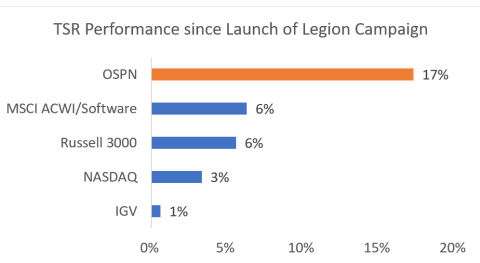

Exhibit 1. Source: Capital IQ (2/24/21-4/16/21)

A full copy of the letter can be found below and here: https://protectonespan.com/

May 3, 2021

Dear Fellow OneSpan Stockholder,

Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”, “Legion” or “we”) is a long-term stockholder beneficially owning 2,790,121 shares of common stock of OneSpan Inc. (“OneSpan” or the “Company”) (Nasdaq: OSPN), representing approximately 6.9% of the outstanding stock. We have nominated four highly-qualified independent directors for election to the Company’s Board of Directors (the “Board”) at the Company’s 2021 annual meeting of stockholders (the “Annual Meeting”). In this letter, we seek to clarify a series of misleading statements and claims found in the Board’s recent letter to OneSpan stockholders published on April 26, 2021 (the “Board’s Letter”).

OneSpan’s Stock Price Has Drastically Underperformed the NASDAQ

Do not be misled by the Company’s claims regarding OneSpan’s total shareholder returns (“TSR”). The Board’s Letter states that OneSpan stock has outperformed the NASDAQ “over the last three years.” Upon further inspection, the Board selected a seemingly random date for this calculation, April 16, 2021, which we believe has no significance other than to support this artificial narrative, especially when the Board’s Letter was published ten days later on April 26, 2021.

OneSpan’s total shareholder return performance versus the NASDAQ across multiple time periods using more pertinent dates demonstrates drastic underperformance. In fact, no portion of the Company’s TSR claim holds true when utilizing most days in 2021. We believe this was a transparent attempt to conceal the incredibly poor track records of the underqualified Board directors we are seeking to replace – and that OneSpan’s stockholders deserve better.

|

OSPN Relative TSR vs. NASDAQ |

||||||||||||

As of: |

|

1 Year |

2 Year |

3 Year |

5 Year |

10 Year |

15 Year |

||||||

12/31/2020

|

|

(23%) |

|

(35%) |

|

(38%) |

|

(134%) |

|

(231%) |

|

(375%) |

|

2/24/2021

|

|

(13%) |

|

(62%) |

|

8% |

|

(129%) |

|

(230%) |

|

(357%) |

|

4/16/2021

|

|

17% |

|

(16%) |

|

13% |

|

(119%) |

|

(287%) |

|

(311%) |

|

4/19/2021

|

|

13% |

|

(12%) |

|

(13%) |

|

(120%) |

|

(284%) |

|

(303%) |

|

4/23/2021

|

|

6% |

|

(13%) |

|

(12%) |

|

(123%) |

|

(286%) |

|

(291%) |

|

Note: Fiscal Year End (“FYE”); the Unaffected Date of 2/24/21 is one day following OSPN’s Q4 2020 Earnings Call (2/23/21 after market close) and one day prior to the launch of Legion’s public campaign (2/25/21 before market open)

Source: Capital IQ

Even if we used the Company’s randomly selected end date of April 16, 2021, the Board seems to ignore that the Company’s TSR claim appears to have benefited greatly from the launch of Legion Partners’ public campaign. We believe the recent stock price movement is representative of fellow stockholders’ excitement for change, not a sudden bout of enthusiasm for the Board’s strategy or the Company’s performance (see Exhibit 1).

It is disappointing that the Board seems to believe other investors are not sophisticated enough to assess its true TSR track record. It is precisely this type of gamesmanship and lack of accountability Legion Partners is attempting to uproot at the highest levels of the Company.

We Believe the Board’s Recent Changes Would Not Have Occurred Without Legion’s Active Engagement, But Their Self-Refresh Has Still Failed to Reverse Years of Underperformance

We have been investors in OneSpan since 2018 and over the past three years repeatedly attempted to privately engage with the Board on a long overdue refreshment process, including offering to jointly collaborate on a search for new candidates on numerous occasions. The Company has largely ignored or rejected Legion’s private outreach, while defensively adding some new directors, several of whom have prior personal connections to incumbent directors. But as the Board began adding new directors, there was little indication that any long-tenured directors would step down or even pass along their long-held leadership positions to new directors. Only after Legion’s public involvement did that change:

Legion Public Campaign Actions |

OneSpan Board Reaction |

In August 2020, Legion publishes a letter demanding Founder and Former Chairman & CEO T. Kendall “Ken” Hunt resign from the Board immediately after selling significant stock one day prior to the Company announcing a revenue miss and pulling full year guidance. |

In September 2020, Mr. Hunt announces his “retirement.” |

In the August 2020 letter, Legion calls for a strategic review of the Hardware and eSignature businesses, as well as the whole Company. |

In September 2020, the Board forms a Finance & Strategy Committee.

In December 2020, the Board hires an investment bank to run a strategic review of the eSignature business which supposedly failed to produce any “adequate” offers. |

In January 2021, Legion requests OneSpan’s director questionnaire ahead of publicly nominating candidates. |

In February 2021, Director Michael Cullinane, a 23-year veteran on the Board, discloses his “retirement” at the upcoming Annual Meeting. |

In February 2021, Legion issues a public letter which criticizes Director Michael Cullinane’s track record and background while serving as the Board’s Chair of the Audit Committee for 20 years. |

In April 2021, Director Al Nietzel is appointed the new Chair of the Audit Committee. |

The Board claims it has added “six new directors since 2019” and that “five of the new independent directors (including Naureen Hassan) are experts in cloud-based business models and SaaS.” However, Ms. Hassan resigned from the Board in March 2021, which is unfortunate as she appeared to have the best and most diverse background out of the six new additions. As for the remaining four directors with operating experience, three hail from non-technology or legacy, on-premise software companies that specialize in automotive dealership software, business process outsourcing, and physical check printing. We do not view these as cloud-first, recurring software revenue environments, which is the core of OneSpan’s strategic transformation.

Instead, the Board has collectively enabled and prioritized the ongoing concentration of power amongst its longest-tenured and arguably least qualified directors. With virtually no experience at a modern public technology company, whether as a board director1, executive, or investor, the four incumbent directors we are targeting to replace have overseen tremendous underperformance during their tenures:

Director, Age

|

Tenure

|

|

|

OSPN Relative TSR over Tenure vs. |

||||||||||||||||||||

|

|

Company Peers |

|

|

Direct

|

|

|

Cyber-

|

|

|

Russell

|

|

|

MSCI

|

|

|

IGV |

|

|

NASDAQ |

||||

John Fox, 77

|

16 |

|

|

(324%) |

|

|

(635%) |

|

|

(637%) |

|

|

12% |

|

|

(437%) |

|

|

(640%) |

|

|

(332%) |

||

Jean Holley, 62

|

14 |

|

|

(377%) |

|

|

(412%) |

|

|

(507%) |

|

|

(47%) |

|

|

(498%) |

|

|

(716%) |

|

|

(384%) |

||

Matthew Moog, 51 |

8 |

|

|

(324%) |

|

|

(359%) |

|

|

(335%) |

|

|

26% |

|

|

(240%) |

|

|

(284%) |

|

|

(145%) |

||

Marc Zenner, 58

|

2 |

|

|

(28%) |

|

|

(83%) |

|

|

(7%) |

|

|

35% |

|

|

9% |

|

|

3% |

|

|

1% |

||

Note: “Company Peers” are the Company’s self-described peer group as set forth in its Annual Report on Form 10-K for FY 2020 and include AMSWA, APPN, BL, FEYE, PFPT, PMTS, PRO, QADA, QLYS, QTWO, RPD, VRNS, SCWX; “Direct Software Peers” include CRWD, DOCU, DT, NCNO, NET, NICE, OKTA, PING, QLYS, SPLK, VRNS, ZS; “Cybersecurity Peers” include CHKP, CRWD, CYBR, FEYE, FTNT, MIME, MITK, NET, OKTA, PANW, PFPT, PING, QLYS, RDWR, RPD, SAIL, SCWX, TENB, VRNS, ZS; “IGV” references the iShares Expanded Tech-Software Sector ETF; TSR figures as of respective Board appointment date through Unaffected Date (2/24/21); tenure calculation as of June 2021

Source: Capital IQ

As we have consistently demonstrated, OneSpan stock has severely underperformed multiple broader market indices as well as the Company’s hand-selected peer group. This is in addition to its Cybersecurity Peers that thoughtfully include many cybersecurity companies selling both hardware and software solutions. Without substantive change to the Board, we fear OneSpan stockholders will continue to suffer long-term suboptimal valuation.

We Believe the Board Has Misrepresented Legion’s Plan to Unlock Stockholder Value and Instead Chosen to Advocate for the Status Quo

The Board has claimed that our campaign to replace directors is based on an “ill-conceived theory” of selling the legacy Hardware business to transform OneSpan into a pure play software company. The Board’s most recent letter implies that our approach is simply a narrow exercise in financial engineering that disregards broader strategic implications. This is a gross misrepresentation of Legion Partners’ plan to unlock stockholder value at OneSpan. In our August 18, 2020 public letter to the Board, we acknowledged that there may still be some operational and strategic synergies between Hardware and Software, and suggested alternative paths towards achieving a potential separation that would still deconsolidate Hardware financials from OneSpan and transform OneSpan into a high-growth, profitable Software company that we believe public investors would be far more excited to own.

The Board’s forceful defense of maintaining the Hardware segment underscores, in our view, their close-mindedness around conducting a strategic review of a business unit in secular decline. Given the Board’s Letter touts long-tenured directors’ “critical experience with our hardware-centric business,” it could help explain why such a resistance to conducting a strategic review of Hardware exists – a potential divestiture would further render these directors’ continued Board service useless. However, none of the four directors we are targeting for replacement have experience in cybersecurity, including hardware authentication, other than sitting on OneSpan’s Board. On the other hand, if our campaign is successful, the Board would keep two incumbent directors with extensive hardware authentication experience and gain another who also has more relevant cloud-first, recurring software revenue experience. Rather than wiping away any relevant “institutional knowledge,” we believe the success of our campaign will accelerate OneSpan’s transformation and leave the Board better positioned to oversee the Hardware segment. But by clearly tying the legacy Hardware business to the justification for their continued presence on the Board, it is unsurprising that the Board seems to have only conducted a strategic review for the eSignature business and seemingly concluded that nothing further should be done. Based on the failures of the incumbent directors we are seeking to replace, OneSpan stockholders should not be misled by the Board’s desperate attempt to spin the relevancy of their slate.

Instead, the Board believes that “investors and sell-side analysts can fairly value OneSpan using a sum-of-the-parts approach or other methodologies…” given that “hardware sales…must be valued differently than software sales.” We agree that Hardware should be valued separately from Software, which is why we have asked the Company for three years to provide more detailed financial disclosures between Hardware and Software, including Software gross and operating margins. As we believe the Board lacks relevant experience overseeing modern software public companies, it is unsurprising that they have failed to understand the importance of showcasing profitability in addition to revenue, especially when Software carries ~30-40 points higher gross margins than Hardware per our estimates. We believe the high-growth and high-margin profile of OneSpan’s Software business remains underappreciated given the Company’s confusing disclosures, thus contributing to OSPN’s discounted valuation. Furthermore, only two out of the Company’s five sell-side analysts utilize a sum-of-the-parts approach and have price targets ranging from $38 to $39 per share.

In our view, the Board has not presented any meaningful ideas or plans for closing the significant gap between OneSpan’s current stock price and OneSpan’s intrinsic value, leading us to conclude that the Board appears either unwilling or unable to figure out a viable plan for unlocking value. We have little confidence that the Board’s “status quo” plan will result in full and fair value for OneSpan stockholders. Following the publication of the Board’s Letter, others appear to agree:

“[We] believe the company could use a fresh perspective such as that offered by Legion Partners' proposed candidates.”

- Colliers Research (4/26/2021)

If elected, Legion’s nominees will bring fresh perspectives to the Board and seek to evaluate all strategies to close the significant gap between OSPN’s current stock price and its intrinsic value, including a potential divestiture of Hardware (considering various transaction structures) or a sale of the entire Company. These processes would complement efforts to fix OneSpan’s standing in the public markets, including by improving its financial disclosures on Software profitability.

Legion’s Nominees Bring Tremendous Technology Industry and Public Company Board Experience

The Board’s latest attempt to alarm stockholders about our campaign centers around director continuity and maintaining the Board’s “institutional knowledge.” If Legion’s nominees are elected, the longest serving director will have a tenure of four years. And, while the Company believes the replacement of “four important contributors” would do harm to stockholders, their track records detailed above likely proves the opposite.

We have carefully curated a slate of highly-qualified and diverse candidates with strong backgrounds in technology, including both software and hardware. In addition, Legion Partners’ nominee Michael McConnell arguably has more public technology company board experience than the entire OneSpan Board combined, which includes current and former board service at other cloud SaaS public companies. We believe the election of Mr. McConnell, as well as Legion Partners’ other three nominees: Sarika Garg, Sagar Gupta and Rinki Sethi, would bring tremendous industry and governance experience that would be far more additive than the hypothetical loss of “institutional knowledge” that incumbent directors have gained while largely overseeing the disrupted, legacy Hardware segment that is now in secular decline. In our view, stockholders have suffered enough under current Board leadership and should not be penalized for the Board’s failure to objectively self-assess and refresh its directors with high-quality talent pertinent to the Company’s go-forward strategy.

While the Board’s Letter likely sought to shore up support for incumbent directors, we believe its numerous misleading statements and arguments against taking strategic action have only further damaged the Board’s credibility. If stockholders cannot trust the Board on a simple topic such as honestly communicating the Company’s own stock price performance – what can they trust?

The time has come for stockholders to #ProtectOneSpan from this Board’s longstanding underperformance by electing strong technology leaders to the Board. For more information about Legion Partners’ nominees, please visit https://protectonespan.com/.

Sincerely,

Chris Kiper and Ted White

Legion Partners Asset Management, LLC

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

1 Other than OneSpan

View source version on businesswire.com: https://www.businesswire.com/news/home/20210503005403/en/

Contacts

Media Contact:

Sloane & Company

Joe Germani / Dan Zacchei

jgermani@sloanepr.com / dzacchei@sloanepr.com

Investor Contact:

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills

(212) 257-1311

info@saratogaproxy.com