OREM, Utah, Oct. 21, 2025 (GLOBE NEWSWIRE) -- SunPower, the “Company,” or Nasdaq: “SPWR”, a solar technology, services, and installation company, will present its Q3’25 results via webcast today Tuesday, October 21 at 1:00pm ET. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: https://investors.sunpower.com/news-events/events.

Fellow Shareholders:

The preliminary Q3’25 quarterly report of key financial parameters is shown below. The final Q3’25 quarterly report will be the SEC 10Q report expected to be filed on November 12, 2025.

| SunPower Q3’25 Revenue & Operating Income Statement1 | |||||||||||

| GAAP2 | NON-GAAP3 | ||||||||||

| ($1000s, except gross margin) | Q3 2025 | Q2 2025 | Q3 2025 | Q2 2025 | |||||||

| Revenue | 70,005 | 67,524 | 70,005 | 67,524 | |||||||

| Gross Profit | 32,040 | 28,761 | 33,636 | 29,387 | |||||||

| Gross Margin | 46% | 43% | 48% | 44% | |||||||

| Operating Expense (Opex) | 34,384 | 31,479 | 30,513 | 26,969 | |||||||

| Opex (less commission) | 26,850 | 22,424 | 22,979 | 17,288 | |||||||

| Stock Comp. and Intangibles | 5,467 | 5,136 | 0 | 0 | |||||||

| Operating Income (loss) | (2,344) | (2,718) | 3,123 | 2,418 | |||||||

| Cash Balance4 | 4,109 | 11,125 | 4,109 | 11,125 | |||||||

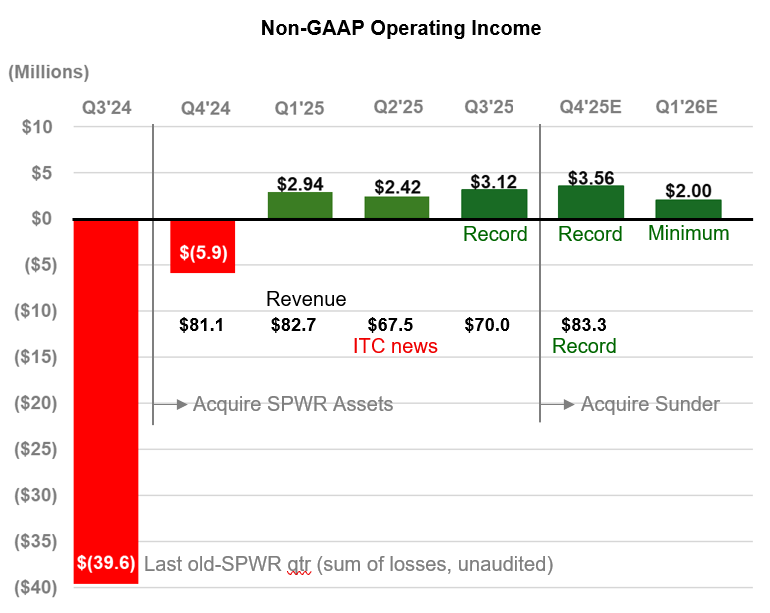

- Our revenue increased to $70.0 million from $67.5 million in Q2’25, which was impacted by the ITC announcement in that quarter

- Our operating income was a post-acquisition record $3.12 million (4.5% of revenue), up from $2.42 million in Q2’25

- Our ending cash balance was $4.11 million. We are in the process of raising money now

______________________

1 Non-GAAP Operating income is based on the non-GAAP results used to run the company and posted on the IR section of our website under “News” [us.sunpower.com].

2 Our 2025 GAAP financial statements for Q2 are in the SEC 10Q filing posted on our website.

3 Our non-GAAP financials differ from the GAAP report in only three ways: 1) no non-cash amortization of intangibles, 2) no employee stock compensation charges and 3) no one-time restructuring losses.

4 Cash balances exclude restricted cash.

- We have now posted three consecutive profitable quarters, after four years of losses

- Our Q3’25 operating income is a post-acquisition record of $3.12 million, representing 4.5% of revenue

- Our Q4’25 operating income estimate is $3.56 million on $83.3 million in revenue, both would be records

- Our 2025 revenue is estimated to be $303 million, with $12.0 million in operating income coming in four consecutive profitable quarters

- Our Q1’26 operating income is estimated to be no less than $2.0 million, and we currently expect to be profitable during 2026

SunPower CEO, T.J. Rodgers commented, “In the Q2’25 Shareholder Report, I used an analogy to the legendary 1967 Ice Bowl in Green Bay (minus 18oF) to describe our 18% Q2’25 revenue freeze to $67.5 million. We have now bounced back in Q3’25 to $70.0 million in revenue with record $3.12 million operating income. In Q4’25, we expect further revenue growth to $83.3 million with $3.56 million in operating income, both would be records.”

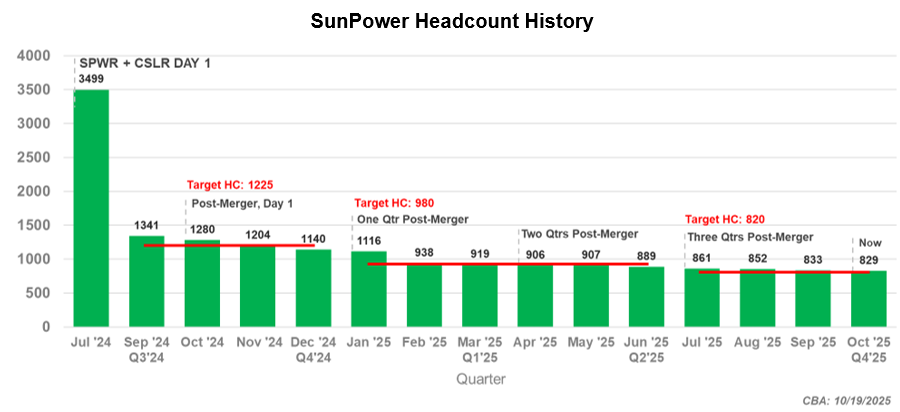

- Our headcount reached the financial target at 829, down from an initial 3,499, even after adding 21 new employees from Sunder

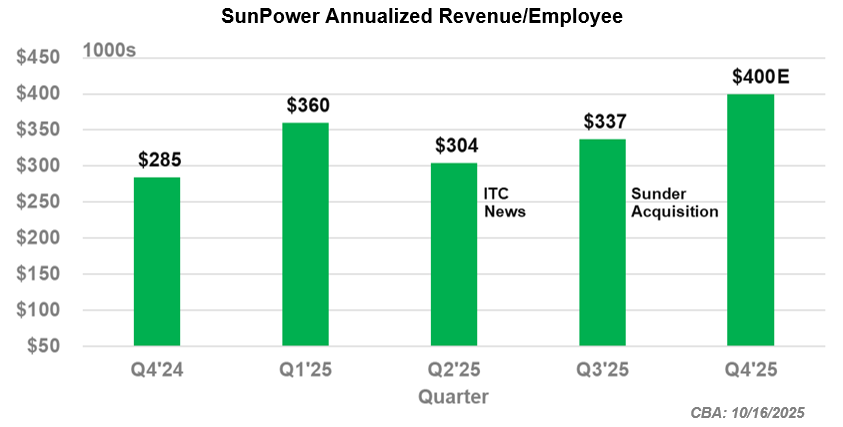

- Forecasted revenue/employee will increase to a new record of $400 thousand per year in Q4’25, thanks to hard work in operations and the recent Sunder acquisition

Rodgers said, “Our external costs come from buying solar panels and paying license fees. Then SunPower employees create high performance, internet-connected storage & solar systems for our customers, which we then support for 10-25 years. Consequently, our only effective cost-control method is to control employee expenses. The first step, reducing headcount to the right number of employees, is done. From now on, growing revenue will be our earnings driver, hence our current focus on acquisitions.

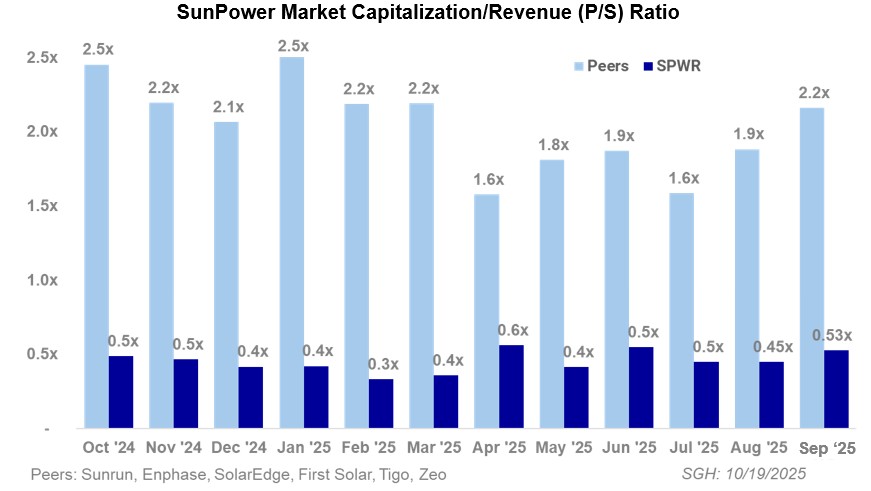

Rodgers continued, “In addition to competitive salaries, we currently pay every employee a fixed bonus of $2,000 to $4,000 per year, based on Company quarterly performance. We also offer Silicon-Valley style stock options to every employee. The options are becoming more interesting to employees – many of whom have never had options – as they watch the value of their publicly traded options rise and can calculate what will happen if and when SunPower’s market capitalization (share count times stock price) rises to a value of just one times annualized sales (today $280 million):

($70.0 million x 4) x (P/S = 1.0) ÷ 83.11 million shares = $3.37

Rodgers continued, “Right now our stock is valued at only 0.53 times sales, compared to peer ratios at about 2.0 times sales. Thus, P/S multiple expansion offers a compelling investment opportunity, with concomitant risk, for stock price appreciation. The first reason for our low P/S valuation is our low cash balance of $4.1 million, down from the typical $10-$11 million we have carried since the SunPower asset purchase. We are in the process of raising money now to address this.

Rodgers continued, “In addition – and probably more importantly – our share price suffers from the negative disinformation from retail market data companies that today use bots instead of analysts to post information on us. Their bots dig up information on “old” SunPower, a defunct company, and usually post it with no disclaimers, not even a simple “this data is over one year old.” After my talk at a recent Canaccord conference, I watched in frustration as an investor in the room searched for five full minutes through old-SunPower bankruptcy postings before he got any real data on the only SunPower that exists today.

Rodgers concluded, “We are making progress on this front. At our request, CNET, whose core values include a ‘Commit to Accuracy,’ cleaned their website of obsolete old-SunPower investor information. And, they did it in just two weeks. I would like to thank CNET for its journalistic integrity.”

Sunder Acquisition Upsides

SunPower closed the strategic acquisition of Sunder Energy to create the No. 5 residential solar company in the U.S.* This transformative acquisition expands SunPower’s reach from 22 to 45 states, increases its dealer salesforce from 881 to 1,744 as of last week and is anticipated to increase our bookings in Q4’25 by slightly over 2x. (Remember, a 2x increase in bookings equates to a 1.3x increase in revenue until the new orders are also installed by SunPower in 2026.)

Rodgers commented, “Sunder is the third dealer salesforce I have inherited during my career. Based on that experience, I expected high turnover due to the acquisition. The dealers serving any company like SunPower are legally independent. At any time, they can offer their services to another customer without notice – and often do so when they are unhappy with their parent company. In this acquisition, to minimize turnover and improve our dealer salesforce management, we deferred to Sunder to maintain its own practices – in particular its state-of-the art salesforce recruiting and training – with very encouraging results so far. We have actually had 232 inquiries about joining SunPower’s new Sunder division and signed up 195 of them.

Rodgers concluded, “The Sunder sales management team also impressed our internal SunPower 881-member dealer salesforce to the point that we decided to complete our merger into a single 1744-member salesforce led by Eric Nielsen, former Sunder President now our EVP of Sales. SunPower’s current VP of sales, Evan Dwyer, told us in the executive staff yesterday, ‘Now, we have the people, systems and management to achieve the growth we need.”

*Measured in installed megawatts as reported by Ohm Analytics.

About SunPower

SunPower Inc. (Nasdaq: SPWR) is a leading residential solar services provider in North America. The Company’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.sunpower.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “in the process,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q3’25, Q4’25, 2025 and 2026 revenue and operating profit projections, our expectations regarding our Q3’25, Q4’25 and fiscal 2025 and 2026 financial performance; our forecasted revenue per employee; the anticipated timing for the filing of the Q3 Form 10-Q; our expectations regarding the timing of and our ability to raise additional capital; increases in value of employee options; expectations relating to the integration of Sunder Energy, including with respect to the retention and expansion of the dealer salesforce; and expectations and plans relating to further cost control efforts. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with Sunder, our ability to achieve the anticipated benefits of the Sunder acquisition, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our financial statements for Q3’25 and the filing of the related Form 10-Q, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary Unaudited Financial Results

The selected unaudited financial results for the Q3’25 are preliminary and subject to our quarter-end accounting procedures. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q3’25 and may not represent the actual financial results for such quarter. In addition, the information in this press release is not a comprehensive statement of our financial results for Q3’25, should not be viewed as a substitute for financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), SunPower provides additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures in this press release, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measures do not include the impact of items that management does not consider indicative of SunPower’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of SunPower’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

| Company Contacts: | |

| Jeanne Nguyen | Sioban Hickie |

| CFO | VP Investor Relations |

| jeanne.nguyen@sunpower.com | IR@sunpower.com |

| (801) 477-5847 |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||||||||||||

| (In Thousands) | |||||||||||||||||||||

| SUNPOWER INC. - AS REPORTED Unaudited | SPWR - Unaudited | ||||||||||||||||||||

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | |||||||||||||||

| GAAP operating Income(loss) from continuing operations | Note | (7,544 | ) | (9,494 | ) | (29,970 | ) | (21,501 | ) | 1,042 | (2,718 | ) | (2,344 | ) | |||||||

| Depreciation and amortization | A | 357 | 329 | 305 | 1,745 | 1,582 | 1,419 | 1,293 | |||||||||||||

| Stock based compensation | B | 1,341 | 1,229 | 1,516 | (1,019 | ) | 314 | 3,717 | 4,174 | ||||||||||||

| Restructuring charges | C | 406 | 2,603 | 21,072 | 14,835 | - | - | - | |||||||||||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 15,561 | 1,896 | 5,136 | 5,467 | ||||||||||||||

| Non-GAAP net Income (loss) | (5,440 | ) | (5,333 | ) | (7,077 | ) | (5,940 | ) | 2,938 | 2,418 | 3,123 | ||||||||||

| Notes: | |||||||||||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||||||

| (C) | Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severence), legal, professional services (i.e. historical carveout audits) and due diligence. | ||||||||||||||||||||

Source: SunPower

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e54add86-f00e-4752-bebf-cd845273683a

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb6e670b-4a88-45b0-b917-b6cb70380e39

https://www.globenewswire.com/NewsRoom/AttachmentNg/09f96038-f1ea-46ee-a667-e508e903a1de

https://www.globenewswire.com/NewsRoom/AttachmentNg/9329c682-6dd0-4ced-8672-d08f746cb3ba