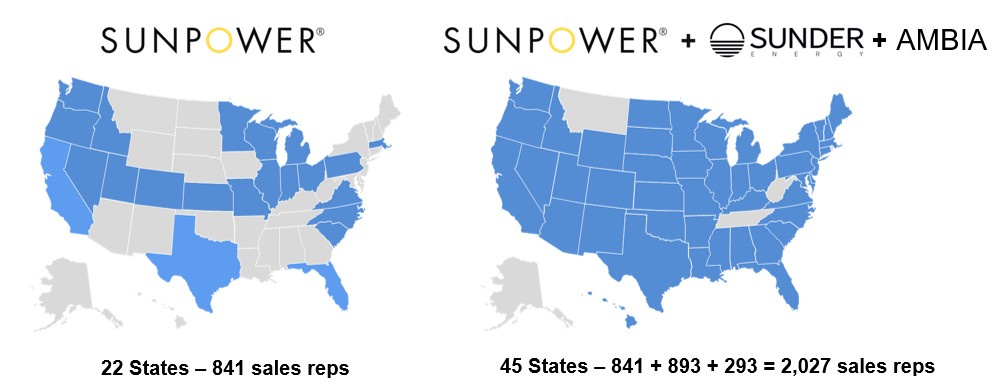

OREM, Utah, Nov. 11, 2025 (GLOBE NEWSWIRE) -- SunPower (herein “SunPower,” the “Company” or Nasdaq: “SPWR”) – a solar technology, services, and installation company – today announced that it has agreed to acquire Ambia Solar (“Ambia”), based in Lindon, Utah, just 1.7 miles from SunPower’s HQ. Ambia is the No. 19 U.S. solar company by installed megawatts as reported by Ohm Analytics. The companies have signed a non-binding LOI for $37.5 million in equity. The transaction will close this quarter (Q4’25), subject to customary closing conditions. (The verb “will” in this press release should be interpreted as “will pursue the result stated in a definitive agreement scheduled for Q4’25 and act vigorously to achieve that agreement thereafter.” It will also serve to highlight planned changes to investors and management alike.)

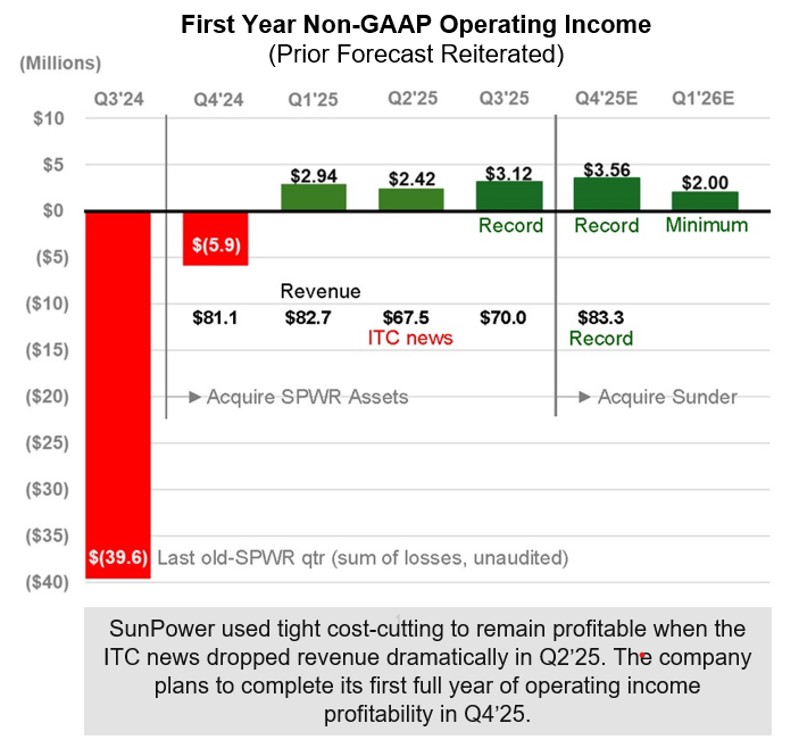

Based on three quarters of actual results and with one month left in Q4’25, Ambia’s 2025E revenue forecast is $83.6 million. The equivalent 2025E revenue forecast for SunPower is $303.4 million.

SunPower CEO, T.J. Rodgers said, “Ambia’s founding CEO, Conner Ruggio, is an ultra-marathon athlete, licensed pilot and holds an MBA from the University of Utah. He is a sales expert who believes that since the industry pays high commissions for solar sales contracts, winning sales teams should create more added value for their companies by performing the standard initial site survey, which is currently performed at SunPower by the operations team, adding a week of delay and added cost. After our deal is closed, Conner Ruggio will run our Blue Raven division, which Ambia will be merged into – appropriate, given that Ambia spun out of Blue Raven in 2022. Steve Erickson, the SunPower veteran who righted the ship as Blue Raven’s leader over the last year, will take over our new Battery Division, which focuses on battery storage and backup, the biggest opportunity in solar right now.”

Ambia CEO, Conner Ruggio, said, “We have a great opportunity to create significant value in the SPWR stock all Ambia employees will receive at the close by allowing us to bring to SunPower significant new revenue and substantial cost reductions through a formal synergy program which already has a first draft.”

SunPower CEO, T.J. Rodgers said, “We look forward to Ambia’s $83.6 million of added revenue – which will start in Q1’26, just as the ITC for individual homeowners expires – but I stress, as I did with our prior acquisition of Sunder, that the management team and its veteran solar employees are in themselves a big win for SunPower. For example, Ambia’s COO, Spencer Jensen, literally built the SunPower-Blue Raven operation that I chose on merit to be SunPower’s only operations area of the three possible candidates after the SPWR asset purchase. Spencer will be the Blue Raven COO, running all of our combined operations, with the goal of delivering to SunPower the operational improvements achieved at Ambia: a 41.6-day order-to-install median cycle time and NPS score of 71 awarded by customers.”

Spencer Jensen, who has a BS in Chemical Engineering from BYU and an MBA from the University of North Carolina, said, “I look forward to combining the two operations teams and moving them to the next level of operational performance. I also look forward to combining our two midwestern sales forces to bring each state to critical mass without increasing field overhead.”

Rodgers continued, “The SEIA has forecasted that the U.S. residential solar industry will install a massive 11 gigawatts (about $28 billion) – 6.0 gigawatts in 2025 and 5.2 gigawatts in 2026. Right now, due to the 2026 forecasted 13% ITC reduction, the industry is consolidating, giving publicly traded companies like SPWR an opportunity to join with leading private companies like Ambia – not to cash the founders out – but to let them invest in kind in a bigger and more durable company that they will also help run.”

Rodgers concluded, “The tangible benefits of the acquisition after closure will show up fully in Q1’26 financial statements, just when the new industry will be challenged with the ITC loss for homeowners, but not for Third Party Ownership, aka TPO-funded transactions. Fortunately, Ambia’s backlog will be 72% TPO at the close. This proposed acquisition reinforces SunPower’s existing financial forecasts to achieve record revenue and operating income in Q4’25, and to remain profitable in the double-jeopardy Q1’26 quarter.”

About SunPower

SunPower (Nasdaq: SPWR) is a leading residential solar services provider in North America. The Company’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.us.sunpower.com.

About Ambia Solar

Ambia Solar was ranked in the (private company) Inc. Magazine 5000 as the 140th fastest growing company in the U.S. over the past three years, and 3rd fastest growing company in the energy sector. For more information visit www.ambiasolar.com.

Non-GAAP Financial Measures

In addition to providing financial information based on generally accepted accounting principles in the United States of America (“GAAP”), this press release includes additional financial metrics that are not prepared in accordance with GAAP (“non-GAAP”). Management believes the non-GAAP financial measures, in addition to GAAP financial measures, are useful measures of operating performance for SunPower (as well as the combined business with Ambia) because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of SunPower’s operating performance, including as a result of the acquisition of Ambia, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of SunPower’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included elsewhere in this press release. We encourage investors to carefully consider our projected operating results under GAAP, as well as our non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about SunPower, the letter of intent entered into between Ambia and SunPower, the potential acquisition of Ambia (which remains subject to the negotiation and execution of the definitive acquisition agreement, SunPower’s further due diligence, approval of the acquisition by Ambia and its equity holders, and satisfaction of customary closing conditions), the expected financial and other benefits of the potential acquisition of Ambia and SunPower’s and Ambia’s industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events, SunPower’s future financial or operating performance, and the potential acquisition of Ambia. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “expected to,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” “could,” “forecast,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, that SunPower and Ambia have signed a non-binding letter of intent and are negotiating Ambia’s potential acquisition by SunPower (which remains subject to the negotiation and execution of the definition acquisition agreement, SunPower’s further due diligence, approval of the acquisition by Ambia and its equity holders, and satisfaction of customary closing conditions), current expectations that SunPower and Ambia will complete the negotiation of a definitive agreement for SunPower’s acquisition of Ambia, that, if the parties execute a definitive acquisition agreement, the anticipated acquisition would close during Q4 2025, the 2025 revenue forecast for SunPower, that the anticipated benefits to SunPower of the Ambia acquisition will show up in the Company’s Q1’26 financial statements, that the acquisition will lead to record revenue and record operating income for SunPower in Q4’25, as well as in Q1’26, the 2025 revenue forecast for Ambia, the SunPower revenue anticipated to be achieved as a result of the potential Ambia acquisition, statements relating to who will head SunPower’s Blue Raven division and New Battery division following the closing, that the Ambia acquisition will create significant value in SunPower’s stock, that the acquisition will create both significant new revenue and substantial cost synergies to make SunPower bigger and more profitable starting in the first quarter after the transaction is closed, that the combination of the SunPower and Ambia operations teams will move them to the next level of operational performance that Ambia has achieved, that industry consolidation gives SunPower an opportunity to join with leading private companies to create a bigger and more durable company, that SunPower will capture all of the sales revenue from Ambia, that SunPower will expand its business from 22 to 45 states, the anticipated amount of revenue that the Ambia acquisition will add to SunPower’s revenue, the impacts of the ITC subsidy, that Ambia can continue as usual regardless of changes in the ITC subsidy, that the acquisition is a win-win deal, other anticipated benefits of the Ambia acquisition, expectations that the U.S. solar industry will install nine gigawatts (about $27 billion) in 2025 and 2026 combined, expectations and trends relating to the consolidation of the solar industry, and potential benefits of that consolidation for SunPower to create bigger and more durable companies, expectations regarding Q3’25 and Q4’25 operating profit, and the expectation that post-acquisition revenue and profit records will be achieved in Q4’25.

Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, risks associated with the negotiation of the definitive acquisition agreement, SunPower’s further due diligence, approval of the acquisition by Ambia and its equity holders, the timing of the closing of the Ambia acquisition (assuming the definitive acquisition agreement is executed), including the risks that a condition to closing would not be satisfied or that the proposed acquisition will not occur, the outcome of legal proceedings that could be instituted against the parties to the Ambia acquisition, unanticipated difficulties or expenditures relating to the proposed transaction, the response of business partners and competitors to the announcement of the Ambia acquisition, and/or potential difficulties in employee retention as a result of the announcement and pendency of the proposed transaction, SunPower’s ability to retain Ambia’s key employees and service providers following the closing of the acquisition, risks associated with the integration of the Ambia business with SunPower, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results, impact the anticipated benefits of the Ambia acquisition, or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC, and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-Binding Letter of Intent

While SunPower currently expects that Ambia and SunPower will reach a definitive agreement to purchase Ambia, the non-binding letter of intent provides that either Ambia or SunPower are each free to abandon negotiations with respect to the proposed acquisition at any time and for any reason or for no reason, and the decision to so abandon negotiations and not proceed with the acquisition shall not be subject to legal challenge, except for breaches by Ambia of the exclusivity terms set forth in the letter of intent.

Preliminary Unaudited Financial Results

The potential financial impacts and anticipated financial results to SunPower resulting from the Ambia acquisition set forth in this press release are unaudited and preliminary and are subject to further accounting procedures and, if applicable, external audit by our independent registered accounting firm. As a result, the financial results presented in this press release are preliminary, subject to SunPower’s further due diligence, and may change in connection with completion of the potential acquisition of Ambia and in connection with the financial statements required to be prepared for SunPower and Ambia.

Such financial statements may not represent the actual financial results for any quarter or full year discussed in this press release. In addition, the information in this press release is not a comprehensive statement of our financial results for Q3’25, Q4’25, FY’25 or any period in 2026, should not be viewed as a substitute for financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

| Company Contacts: | |

| Jeanne Nguyen | Sioban Hickie |

| CFO | VP Investor Relations |

| jeanne.nguyen@sunpower.com | IR@sunpower.com |

| (801) 477-5847 |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||||||||||||||

| (In Thousands) | |||||||||||||||||||||||

| SUNPOWER INC. - AS REPORTED Unaudited | SPWR - Unaudited | ||||||||||||||||||||||

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | |||||||||||||||||

| GAAP operating Income(loss) from continuing operations | (7,544 | ) | (9,494 | ) | (29,970 | ) | (21,501 | ) | 1,042 | (2,718 | ) | (2,344 | ) | ||||||||||

| Note | |||||||||||||||||||||||

| Depreciation and amortization | A | 357 | 329 | 305 | 1,745 | 1,582 | 1,419 | 1,293 | |||||||||||||||

| Stock based compensation | B | 1,341 | 1,229 | 1,516 | (1,019 | ) | 314 | 3,717 | 4,174 | ||||||||||||||

| Restructuring charges | C | 406 | 2,603 | 21,072 | 14,835 | - | - | - | |||||||||||||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 15,561 | 1,896 | 5,136 | 5,467 | ||||||||||||||||

| Non-GAAP net Income (loss) | (5,440 | ) | (5,333 | ) | (7,077 | ) | (5,940 | ) | 2,938 | 2,418 | 3,123 | ||||||||||||

| Notes: | |||||||||||||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||||||||

| (C) | Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severance), legal, professional services (i.e. historical carveout audits) and due diligence. | ||||||||||||||||||||||

Source: SunPower

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/5e3f5bd8-37f6-41c1-ae06-551e613ce468

https://www.globenewswire.com/NewsRoom/AttachmentNg/404a5ee0-f6c5-478f-a961-77f8d67669f9