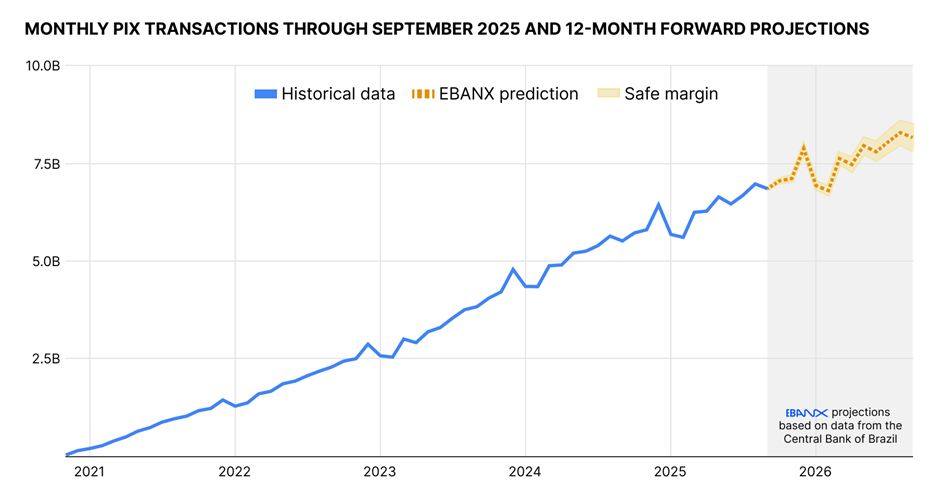

CURITIBA, Brazil, Nov. 14, 2025 (GLOBE NEWSWIRE) -- Set to mark its fifth anniversary on November 16, Brazil’s instant payment system, Pix, is on course to surpass seven billion monthly transactions for the first time, potentially reaching 7.9 billion in December. In this month, holiday shopping typically drives peak volumes—an expected 15% increase from September, the latest official data available. This growth is expected to push Pix’s total transaction volume in 2025 to USD 6.7 trillion, a 34% year-over-year increase. No other instant payment system worldwide has achieved this milestone so quickly—not even India’s real-time payment method, UPI, which inspired the Brazilian platform and took six years and eight months to approach the 8 billion mark.

The projections are part of a new analysis by EBANX, a global technology company specializing in cross-border payment services for emerging markets, based on publicly available data from the Central Bank of Brazil and the National Payments Corporation of India (NPCI).

“Pix has shown over these five years just how transformative digital payments can be for financial inclusion and economic development,” said João Del Valle, CEO and Co-founder of EBANX. “It’s easy to use, free, secure, instant, available 24/7, and—crucially—accessible to everyone. That’s why it’s become the country’s most popular payment method and has opened the door to the digital economy for millions of people.”

While 60 million Brazilians don’t own a credit card, over 170 million consumers use Pix, according to the country’s Central Bank. It represents 93% of Brazil’s adult population, according to EBANX analysis based on data from the Central Bank and IBGE. EBANX merchants offering Pix as a payment option saw an average 16% revenue increase and 25% customer-base growth within just six months. “This shows how real-time payment systems can drive measurable economic growth by making financial transactions more efficient and accessible,” he added.

Since its launch in 2020 through September 2025, Pix has processed 196.2 billion transactions, moving USD 16 trillion—over 7 times Brazil’s 2024 annual GDP of USD 2.2 trillion.

With a compound annual growth rate (CAGR) of 202% over its first five years, Pix still has plenty of room to expand, fueled by new features like Pix Automático, which enables recurring payments and directly benefits the Brazilians who don’t have credit cards.

EBANX’s global e-commerce partners are already seeing the results. Internal data shows that 74% of their new customers used Pix Automático for their first purchase. “Before Pix, these consumers were shut out of the digital economy. Now they can access products and services that used to be available only to cardholders. This is fundamentally reshaping Brazil’s consumer landscape and proving that financial inclusion isn’t just good policy, it’s good business,” Del Valle noted.

Behavioral shift

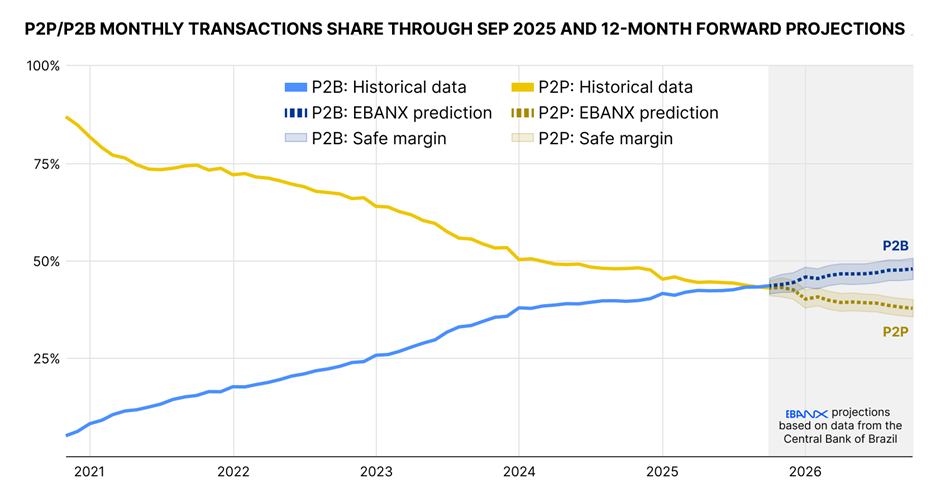

The way Brazilians use Pix has changed dramatically since the payment method launched. EBANX’s analysis of Central Bank data shows how the system has evolved from a tool for transferring money between individuals into a payment method for purchases.

When the system completed its first year in November 2021, 73% of all transactions were person-to-person (P2P). As companies recognized the opportunity this new payment method offered and began making it available to customers, person-to-business (P2B) volume grew considerably and surpassed P2P for the first time in September this year, by roughly 600,000 transactions.

That gap widened in October, reaching nearly 4 million more transactions. P2B now accounts for 44% of the total, compared to 43% for P2P. EBANX projects the gap will continue expanding, with person-to-business payments expected to reach around 48% by August 2026, before Pix’s sixth anniversary.

User profile

EBANX’s analysis also profiled the Brazilians who have been the heaviest users of the tool over the past five years. More than half (51.6%) of all transactions were made by people aged 20 to 39. By region, the Southeast leads with 42.8%, followed by the Northeast (26.6%), South (12.3%), North (9.7%), and Central-West (8.6%).

At the state level, the top 5 are São Paulo (23.8%), Rio de Janeiro (8.8%), Minas Gerais (8.3%), Bahia (7.1%), and Paraná (5%). At the bottom, Roraima and Acre recorded the fewest transactions during this period (0.4% each). In city rankings, São Paulo also tops the list at 20%, followed by Rio de Janeiro (9%), Salvador (4.7%), Manaus (4.4%), and Brasília (4.2%).

“Five years of Pix shows financial inclusion isn’t just about access—it’s about adoption. The platform’s intuitive design, availability, and zero fees have transformed how Brazilians transact and engage with the digital world, proving that inclusive financial infrastructure can drive both economic growth and social equity”, explained Del Valle.

ABOUT EBANX

EBANX is the leading payments platform connecting global businesses to the world's fastest-growing digital markets. Founded in 2012 in Brazil, EBANX was built with a mission to expand access to international digital commerce. Leveraging proprietary technology, deep market expertise, and robust infrastructure, EBANX enables global companies to offer hundreds of local payment methods across Latin America, Africa, and Asia. More than just payments, EBANX drives growth, enhances sales, and delivers seamless purchase experiences for businesses and end-users alike.

For further information, please visit:

Website: https://www.ebanx.com/en/

LinkedIn: https://www.linkedin.com/company/ebanx

Media contact:

Leo Stamillo

leo@contentco.tech

contentco.tech

Infographics accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d5b6c6a4-c944-49a9-8cb6-bc25198670fd

https://www.globenewswire.com/NewsRoom/AttachmentNg/3a36a4bb-fc20-474c-8fcd-d4a5f76e00ab