The financial sector, particularly bank stocks, has been on a tear lightly, clawing back losses from the year and edging into positive territory. So far during the quarter, the financial sector has proven to be an outperforming sector.

Bank stocks surged last week following a significant rally fueled by lower-than-anticipated inflation figures in the U.S. The stock market experienced notable gains due to flat consumer prices in October compared to the previous month, alongside core prices (excluding energy and food) rising by 4% year-over-year (YoY), slightly underperforming the anticipated 4.1% gain.

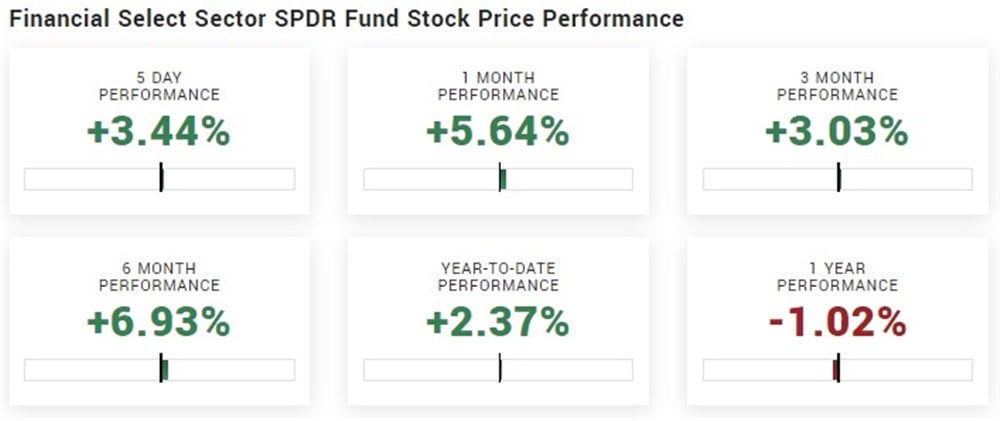

So far, during the final quarter, the Financial Select Sector SPDR ETF (NYSE: XLF) is up 3.15%, beating the overall market, SPDR S&P 500 ETF Trust (NYSE: SPY), which is up only 2.61%. Notably, the XLF is up almost 6% on the month and over 3% last week.

Having bounced sharply over the last month, rising from the low end of its 52-week range around $31 to the high end at Friday's close of $35.01, many eyes will now be on the XLF ETF for possible upside continuation.

Now is as good a time as any to analyze three individual financial stocks offering attractive dividends that have recently displayed impressive relative strength in the sector and market.

Morgan Stanley

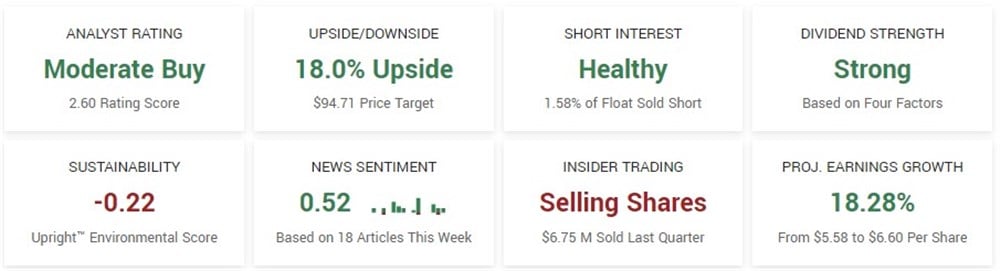

Morgan Stanley (NYSE: MS) ranks as the sixth largest financial institution in the United States and holds the 39th position among the world's largest banks, listed at 61st on the Forbes Fortune 500. As a financial holding company, Morgan Stanley offers a comprehensive array of financial services to a global clientele.

In its latest quarterly earnings announcement on October 18, the company reported $1.38 EPS, surpassing analysts' predictions by $0.07. The quarter yielded $13.27 billion in earnings, slightly exceeding analyst estimates of $13.22 billion, showcasing a 2.2% year-over-year revenue increase.

Morgan Stanley remains poised for promising growth with 18.28% in projected earnings growth, a 4.24% dividend yield, a "moderate buy" consensus analyst rating and a $94.71 price target, suggesting an approximate 18% upside.

BlackRock Inc.

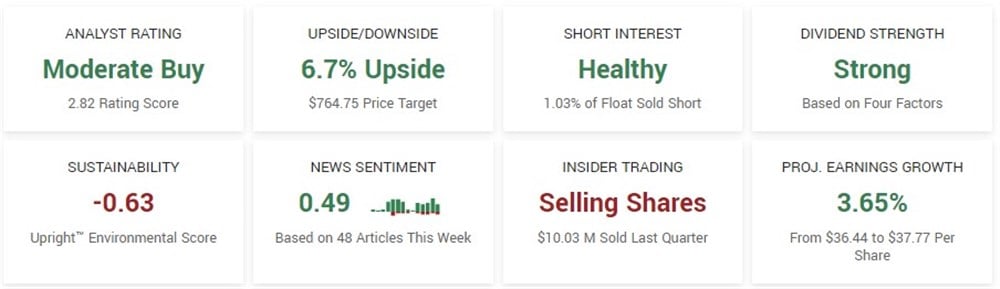

BlackRock Inc. (NYSE: BLK), a prominent American multinational investment company headquartered in New York City, is the world's largest asset manager, supervising over $8 trillion in assets since its establishment in 1988. The company has established a substantial presence globally across 30 countries and catering to clients in 100 nations.

In its most recent earnings disclosure on October 13, BlackRock reported an impressive $10.91 EPS for the quarter, exceeding analysts' consensus estimates by $2.57. The quarter generated $4.52 billion in revenue, in line with the consensus estimate, marking a 4.9% increase compared to last year.

Boasting a 2.79% dividend yield, a projected earnings growth of 3.65%, and a "moderate buy" rating from analysts, BlackRock holds a price target projecting a nearly 7% upside for its shares.

Bank of America

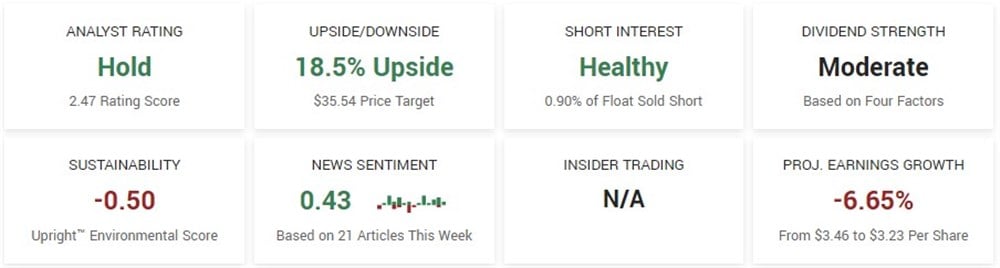

Bank of America (NYSE: BAC) is a global provider of banking and financial services, catering to individuals, small businesses, institutions, corporations and governments worldwide. The bank operates through three segments: consumer banking, global wealth and investment management and global banking.

In its latest earnings report on October 17, the financial services provider outperformed analyst expectations, reporting 90-cent quarterly earnings per share, exceeding estimates by seven cents. The quarter saw earnings of $25.20 billion, slightly higher than analyst projections of $25.13 billion, marking a 2.8% increase in revenue compared to the same period last year.

The company has a 3.2% dividend yield, an appealing P/E ratio of 8.4 that draws value investors' attention, a "hold" rating by analysts and a price target of $35.54, projecting a nearly 19% upside. However, Bank of America currently has an earnings growth of negative 6.65%, potentially raising concerns for growth investors.