Restaurant software company (NYSE: OLO) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 24.3% year on year to $71.85 million. The company expects next quarter’s revenue to be around $72.75 million, close to analysts’ estimates. Its non-GAAP profit of $0.06 per share was also 16.1% above analysts’ consensus estimates.

Is now the time to buy Olo? Find out by accessing our full research report, it’s free.

Olo (OLO) Q3 CY2024 Highlights:

- Revenue: $71.85 million vs analyst estimates of $70.94 million (1.3% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.05 (beat by $0.01)

- Adjusted Operating Income: $8.23 million vs analyst estimates of $6.23 million (32.1% beat)

- Revenue Guidance for Q4 CY2024 is $72.75 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 54.3%, down from 59.8% in the same quarter last year

- Operating Margin: -11.9%, up from -28.2% in the same quarter last year

- Free Cash Flow Margin: 4.4%, down from 20.1% in the previous quarter

- Net Revenue Retention Rate: 120%, in line with the previous quarter

- Billings: $71.69 million at quarter end, up 26.7% year on year

- Market Capitalization: $901.3 million

“Team Olo executed well on our top priorities in the third quarter and positioned us to complete a successful 2024. We continued to win, retain, and expand with brands, we drove further innovation across our Order, Pay, and Engage product suites — including the general availability of Olo Pay’s card-present functionality on Qu point-of-sale systems — and we delivered revenue and bottom line performance that exceeded the high-end of our guidance ranges,” said Noah Glass, Olo’s Founder and CEO.

Company Overview

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE: OLO) provides restaurants and food retailers with software to manage food orders and delivery.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

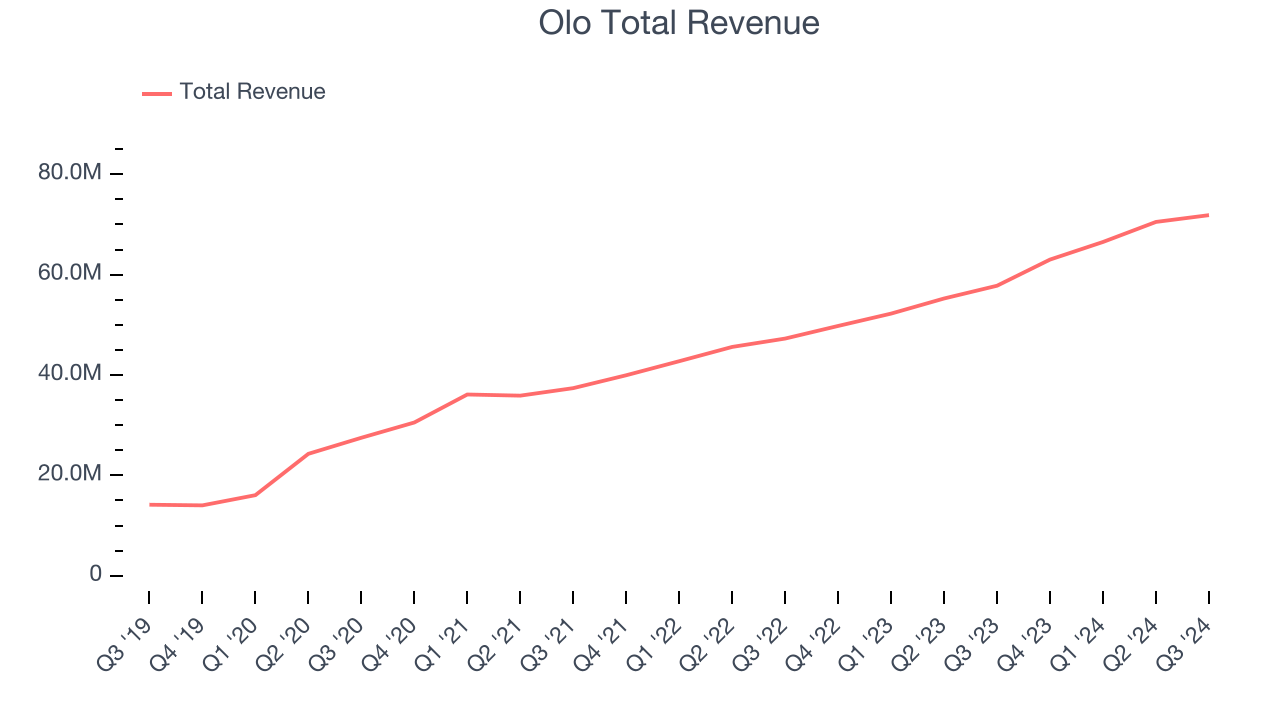

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Olo’s 24.8% annualized revenue growth over the last three years was solid. This is a useful starting point for our analysis.

This quarter, Olo reported robust year-on-year revenue growth of 24.3%, and its $71.85 million of revenue topped Wall Street estimates by 1.3%. Management is currently guiding for a 15.5% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, a deceleration versus the last three years. This projection is still healthy and indicates the market sees success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

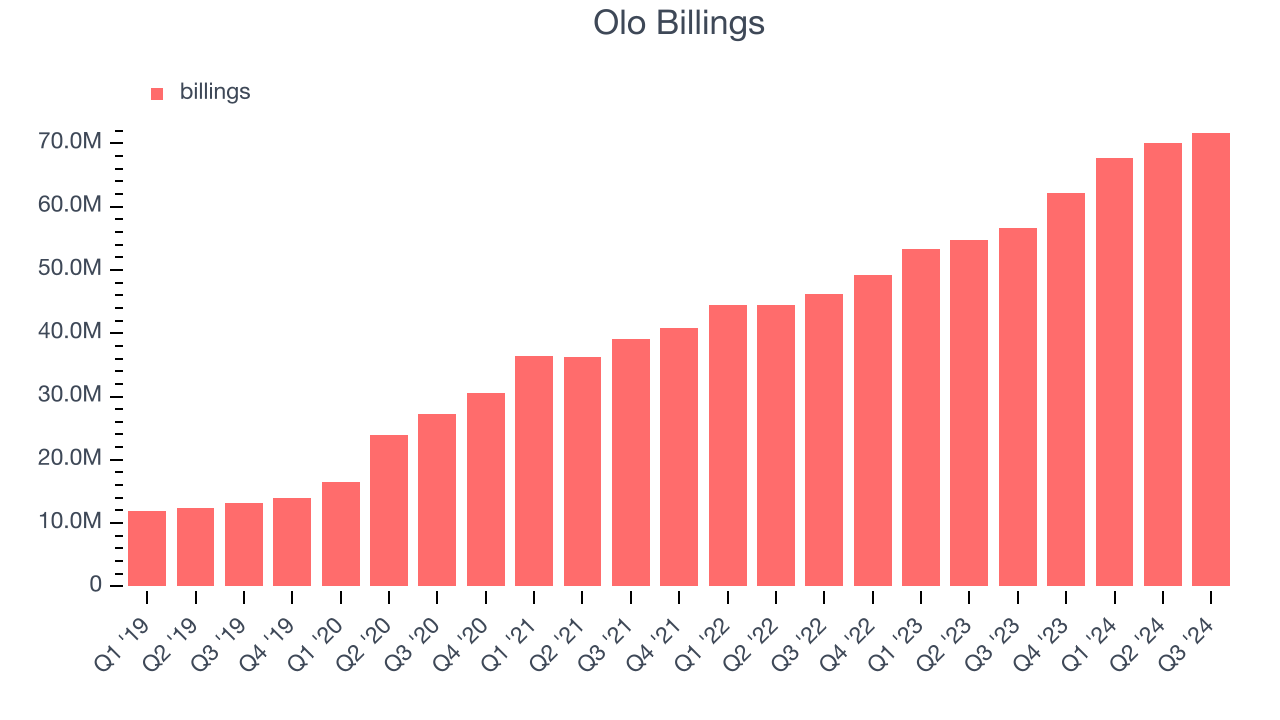

Billings

In addition to revenue, billings is a non-GAAP metric that sheds additional light on Olo’s business quality. Billings is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Over the last year, Olo’s billings growth has been fantastic, averaging 27.1% year-on-year increases and punching in at $71.69 million in the latest quarter. This performance was in line with its revenue growth, indicating robust customer demand and a strong sales pipeline. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Olo’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 120% in Q3. This means that even if Olo didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 20.3%.

Olo has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Olo’s Q3 Results

It was encouraging to see Olo narrowly top analysts’ revenue expectations this quarter. We were also glad next quarter’s revenue guidance came in higher than Wall Street’s estimates. On the other hand, its gross margin declined. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The areas below expectations seem to be driving the move, and the stock traded down 8.4% to $5.21 immediately following the results.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.