What a brutal six months it’s been for FormFactor. The stock has dropped 22.8% and now trades at $44.50, rattling many shareholders. This may have investors wondering how to approach the situation.

Is there a buying opportunity in FormFactor, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the more favorable entry price, we're swiping left on FormFactor for now. Here are three reasons why there are better opportunities than FORM and a stock we'd rather own.

Why Do We Think FormFactor Will Underperform?

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

1. Long-Term Revenue Growth Disappoints

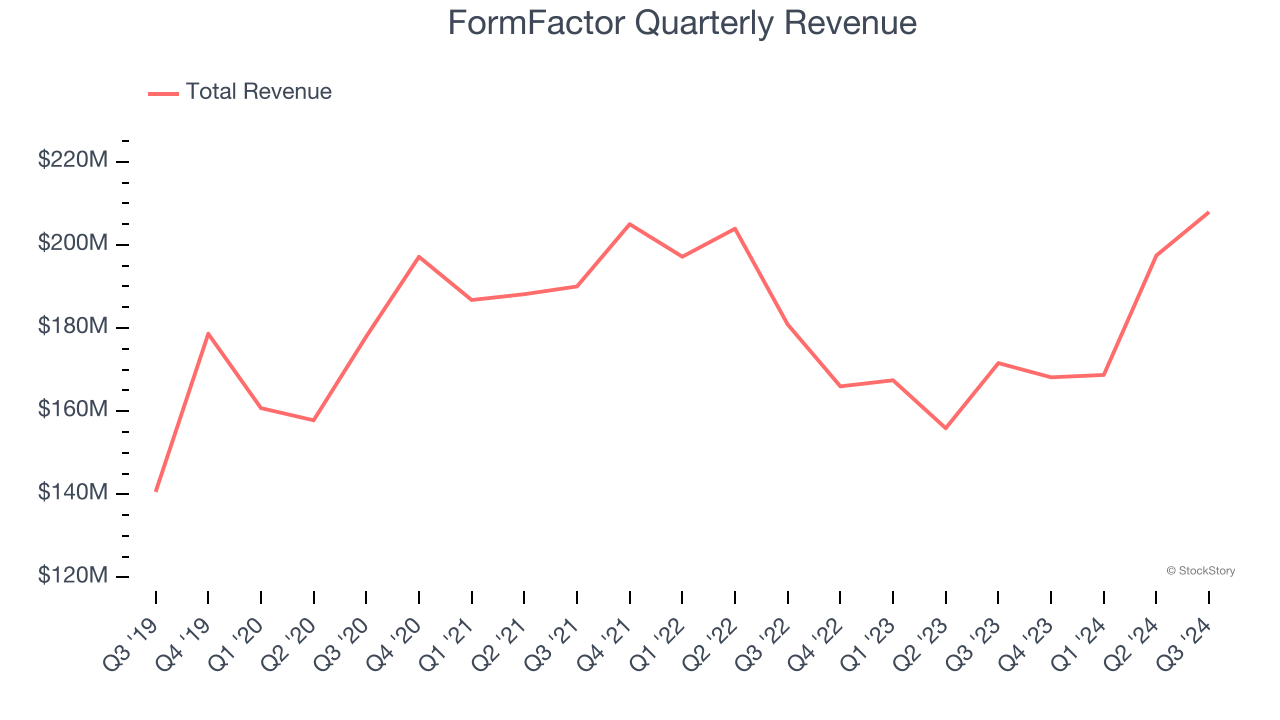

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, FormFactor’s sales grew at a mediocre 6.1% compounded annual growth rate over the last five years. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Weak Operating Margin Could Cause Trouble

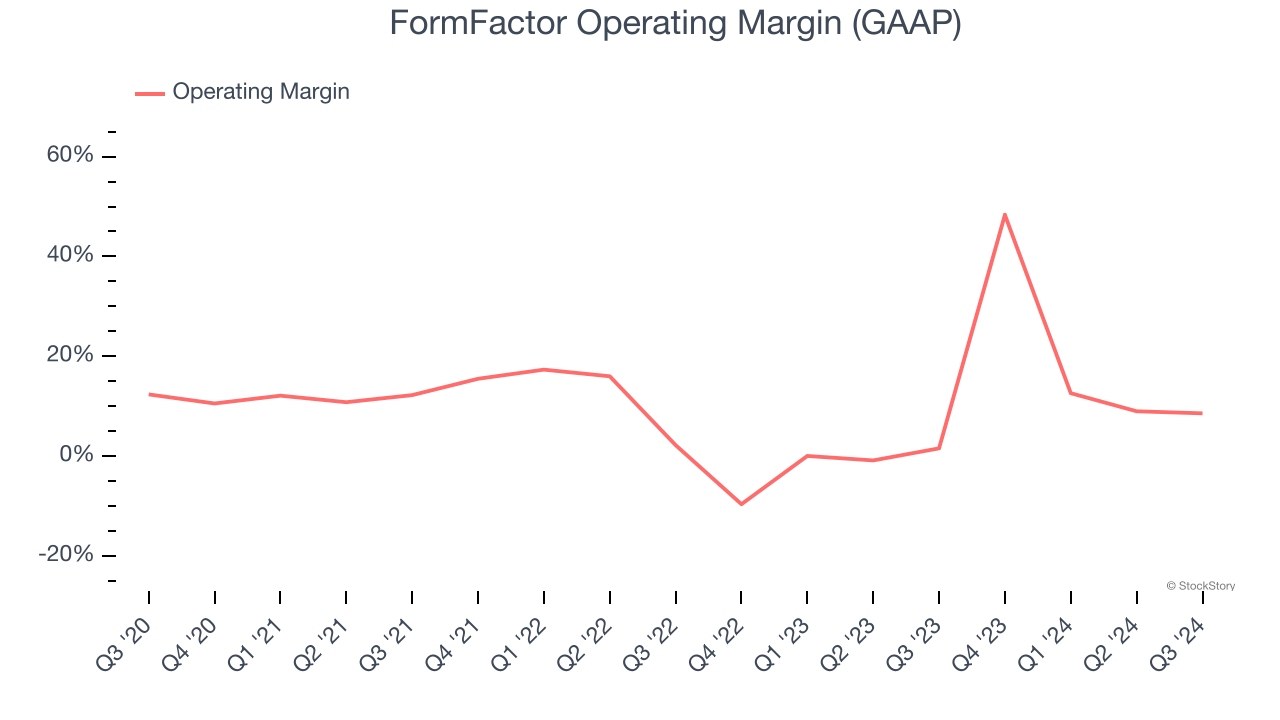

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

FormFactor was profitable over the last two years but held back by its large cost base. Its average operating margin of 8.8% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

3. Free Cash Flow Margin Dropping

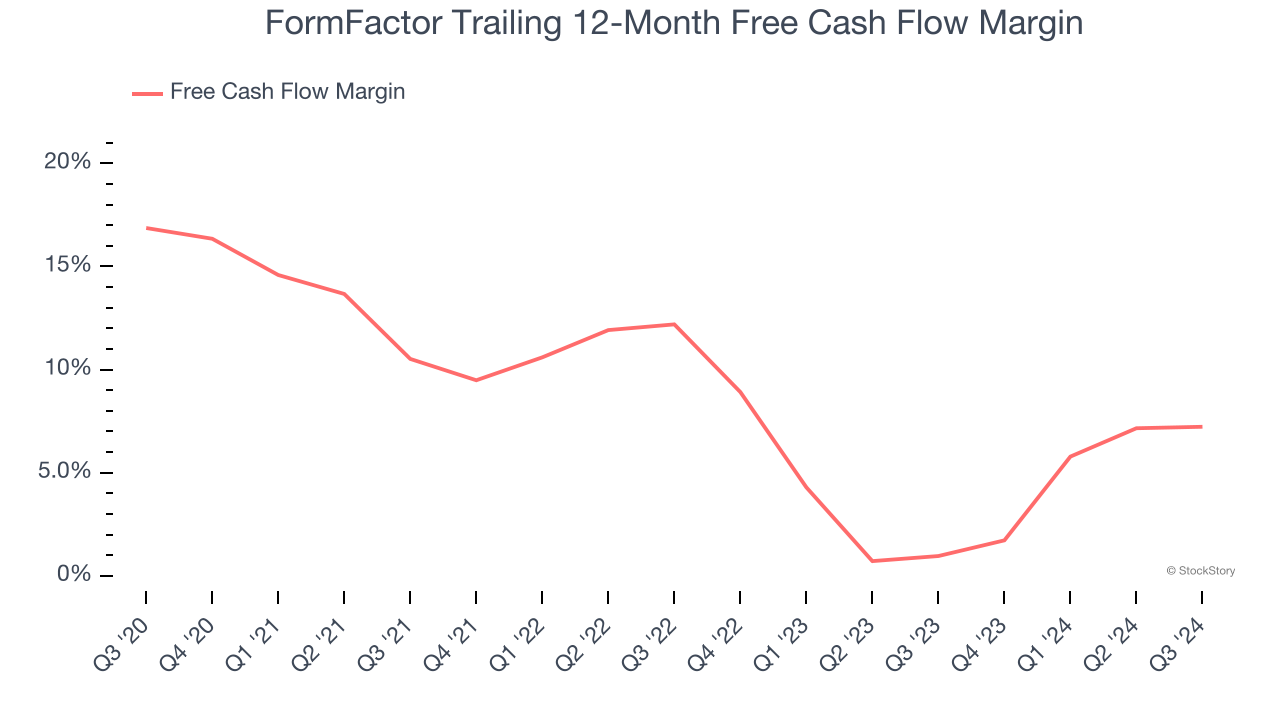

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, FormFactor’s margin dropped by 9.6 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its relatively low cash conversion. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. FormFactor’s free cash flow margin for the trailing 12 months was 7.2%.

Final Judgment

FormFactor doesn’t pass our quality test. Following the recent decline, the stock trades at 26.5× forward price-to-earnings (or $44.50 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of FormFactor

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.