Measurement equipment distributor Transcat (NASDAQ: TRNS) missed Wall Street’s revenue expectations in Q4 CY2024 as sales rose 2.4% year on year to $66.75 million. Its non-GAAP profit of $0.45 per share was 10% below analysts’ consensus estimates.

Is now the time to buy Transcat? Find out by accessing our full research report, it’s free.

Transcat (TRNS) Q4 CY2024 Highlights:

- Revenue: $66.75 million vs analyst estimates of $70.3 million (2.4% year-on-year growth, 5% miss)

- Adjusted EPS: $0.45 vs analyst expectations of $0.50 (10% miss)

- Adjusted EBITDA: $7.91 million vs analyst estimates of $9.51 million (11.9% margin, 16.8% miss)

- Operating Margin: 3.1%, down from 7.2% in the same quarter last year

- Free Cash Flow Margin: 14.6%, up from 11.1% in the same quarter last year

- Market Capitalization: $926.3 million

“In the 3rd quarter, we were pleased to close the Martin Calibration deal. Martin is a coveted calibration company that is highly synergistic and fulfills all our strategic acquisition drivers by expanding our geographic reach, increasing our capabilities and leveraging our existing infrastructure" commented Lee D. Rudow, President and CEO.

Company Overview

Serving the pharmaceutical, industrial manufacturing, energy, and chemical process industries, Transcat (NASDAQ: TRNS) provides measurement instruments and supplies.

Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

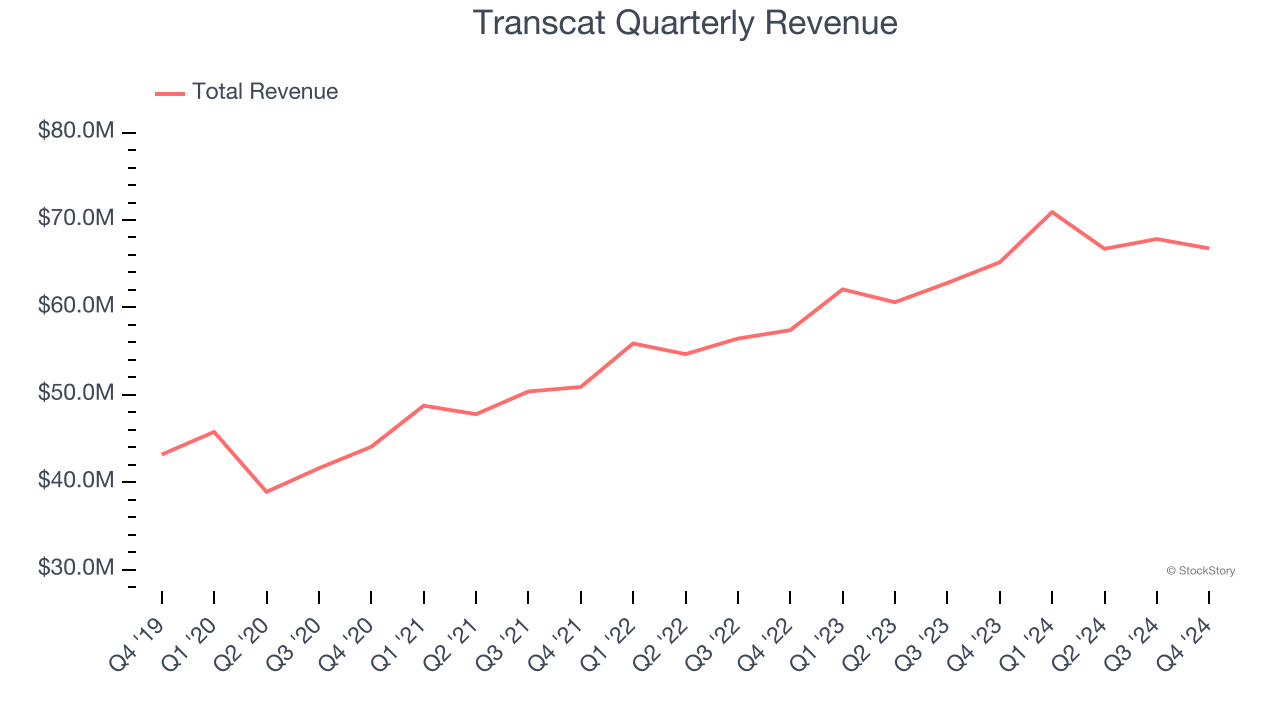

Sales Growth

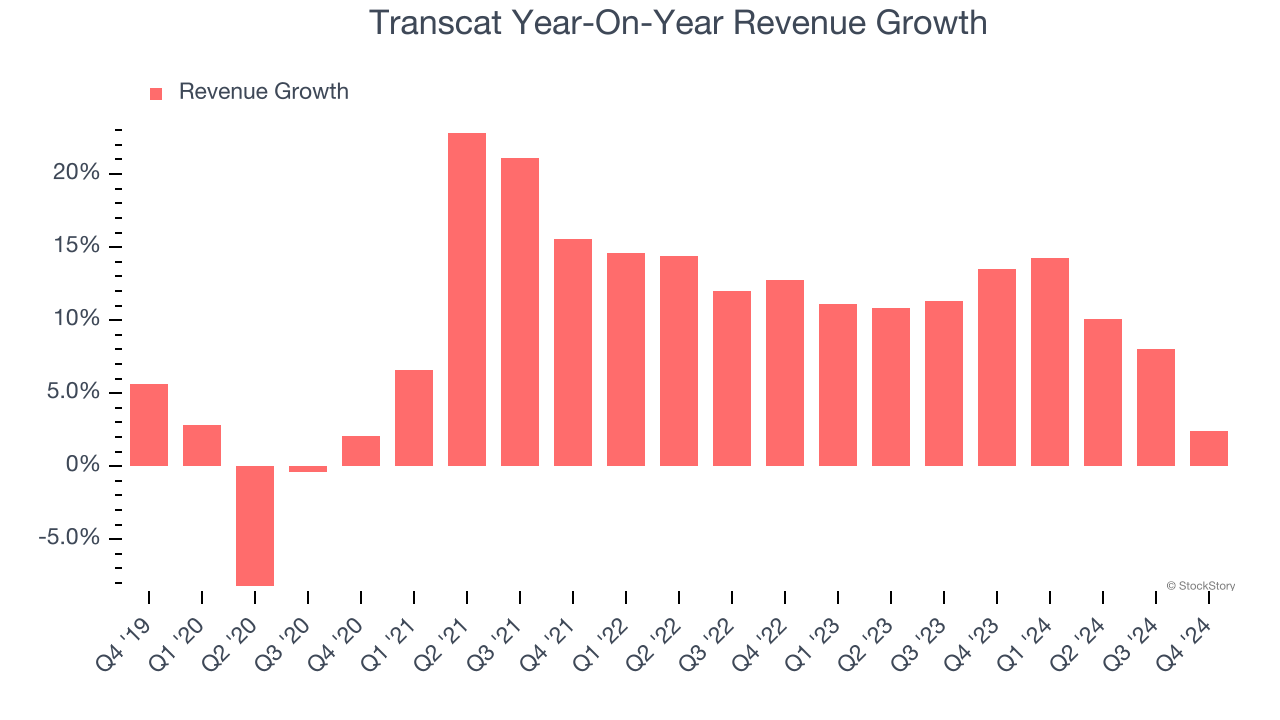

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Transcat’s sales grew at a solid 9.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Transcat’s annualized revenue growth of 10.1% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can better understand the company’s revenue dynamics by analyzing its most important segment, . Over the last two years, Transcat’s revenue () was flat. This segment has lagged the company’s overall sales.

This quarter, Transcat’s revenue grew by 2.4% year on year to $66.75 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, similar to its two-year rate. This projection is healthy and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

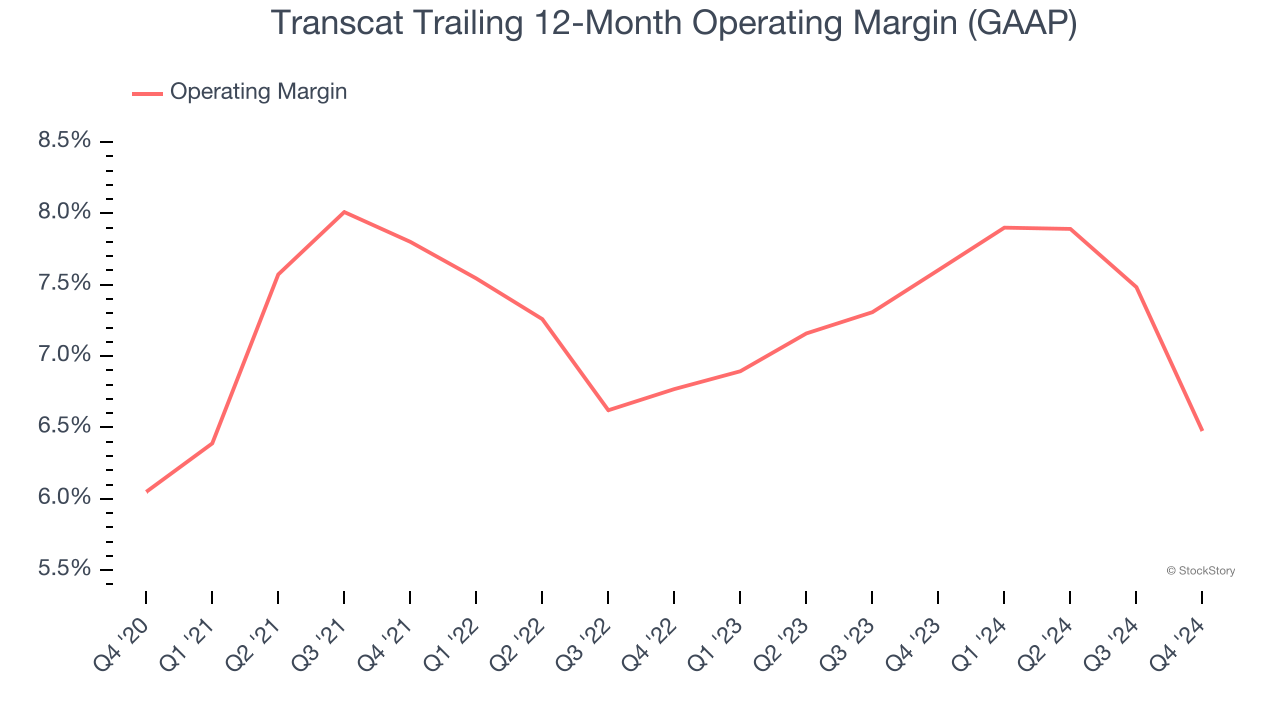

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Transcat was profitable over the last five years but held back by its large cost base. Its average operating margin of 7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Transcat’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

This quarter, Transcat generated an operating profit margin of 3.1%, down 4.1 percentage points year on year. Since Transcat’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

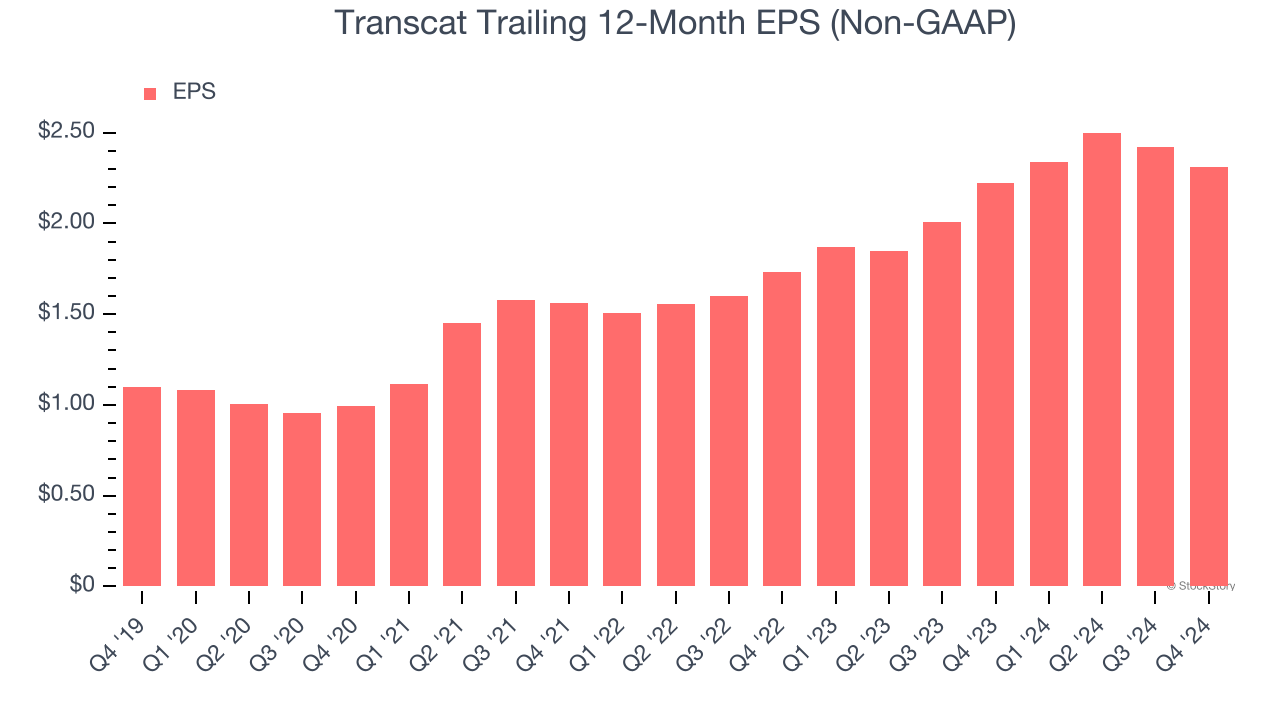

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Transcat’s EPS grew at a spectacular 16% compounded annual growth rate over the last five years, higher than its 9.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Transcat, its two-year annual EPS growth of 15.6% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Transcat reported EPS at $0.45, down from $0.56 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Transcat’s full-year EPS of $2.31 to grow 10.4%.

Key Takeaways from Transcat’s Q4 Results

We struggled to find many resounding positives in these results. Its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.4% to $96.15 immediately after reporting.

The latest quarter from Transcat’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.