Although United Community Banks (currently trading at $31.35 per share) has gained 13.2% over the last six months, it has trailed the S&P 500’s 18.8% return during that period. This might have investors contemplating their next move.

Is there a buying opportunity in United Community Banks, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is United Community Banks Not Exciting?

We're cautious about United Community Banks. Here are three reasons why UCB doesn't excite us and a stock we'd rather own.

1. Lackluster Revenue Growth

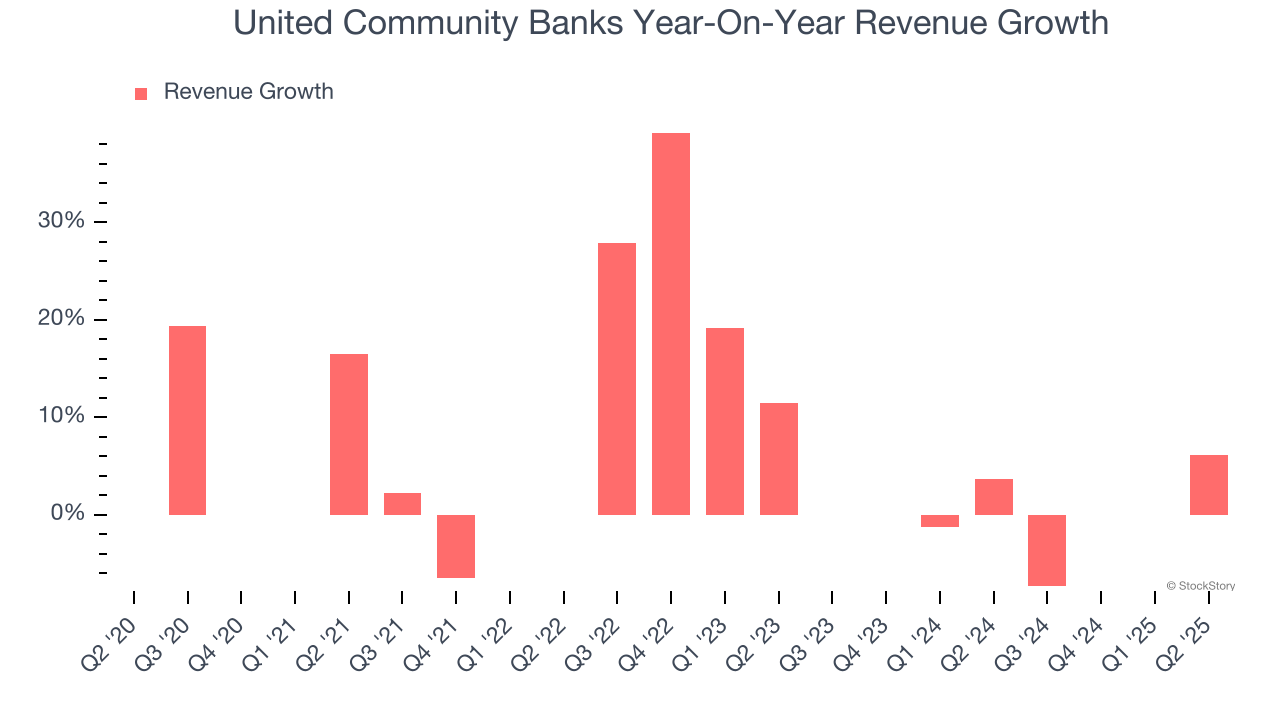

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. United Community Banks’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.2% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Low Net Interest Margin Hinders Flexibility

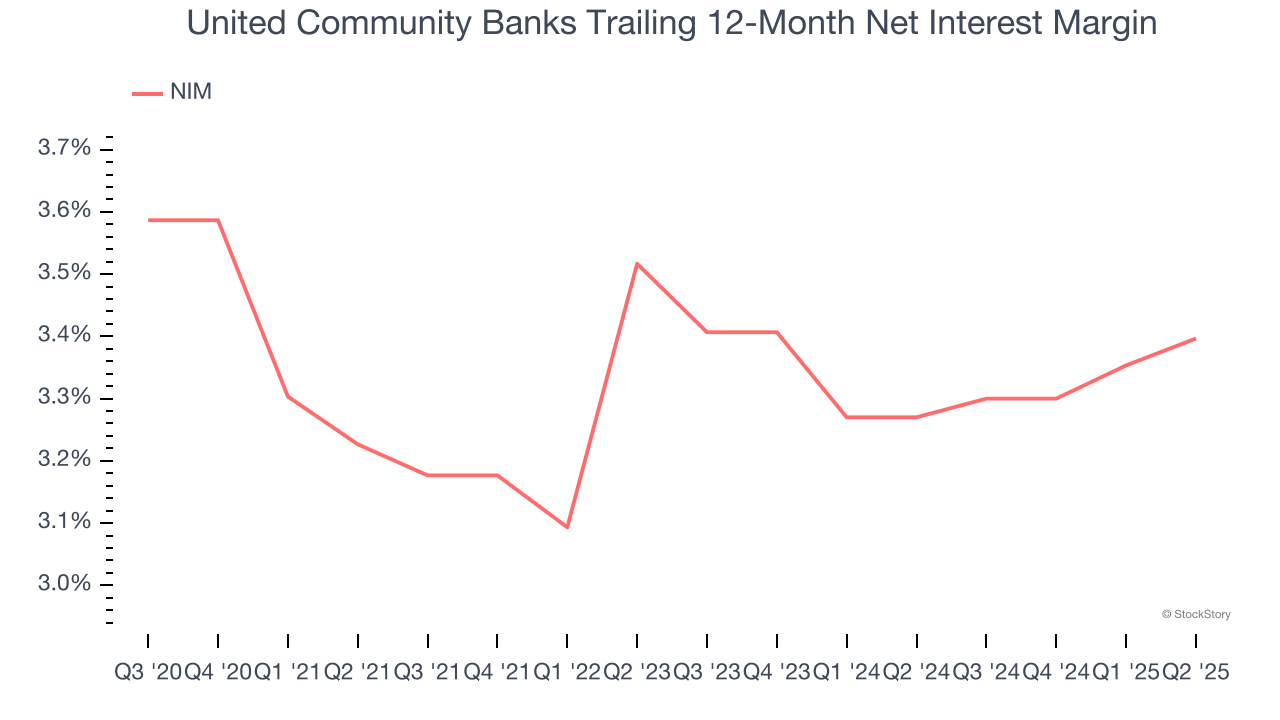

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that United Community Banks’s net interest margin averaged a subpar 3.3%, reflecting its high servicing and capital costs.

Final Judgment

United Community Banks isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 1× forward P/B (or $31.35 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of United Community Banks

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.