Intelligent lighting and space solutions provider Acuity Brands (NYSE: AYI) fell short of the market’s revenue expectations in Q3 CY2025, but sales rose 17.1% year on year to $1.21 billion. Its non-GAAP profit of $5.20 per share was 7.5% above analysts’ consensus estimates.

Is now the time to buy Acuity Brands? Find out by accessing our full research report, it’s free.

Acuity Brands (AYI) Q3 CY2025 Highlights:

- Revenue: $1.21 billion vs analyst estimates of $1.23 billion (17.1% year-on-year growth, 1.5% miss)

- Adjusted EPS: $5.20 vs analyst estimates of $4.84 (7.5% beat)

- Adjusted EBITDA: $240.7 million vs analyst estimates of $210.8 million (19.9% margin, 14.2% beat)

- Operating Margin: 14.9%, in line with the same quarter last year

- Free Cash Flow Margin: 14.7%, similar to the same quarter last year

- Organic Revenue rose 17.1% year on year vs analyst estimates of 4.1% growth (1,295.5 basis point beat)

- Market Capitalization: $10.45 billion

“Our fiscal 2025 fourth quarter performance was strong. We grew net sales, expanded our adjusted operating profit and adjusted operating profit margin, and increased our adjusted diluted earnings per share," stated Neil Ashe, Chairman, President and Chief Executive Officer of Acuity Inc.

Company Overview

One of the pioneers of smart lights, Acuity (NYSE: AYI) designs and manufactures light fixtures and building management systems used in various industries.

Revenue Growth

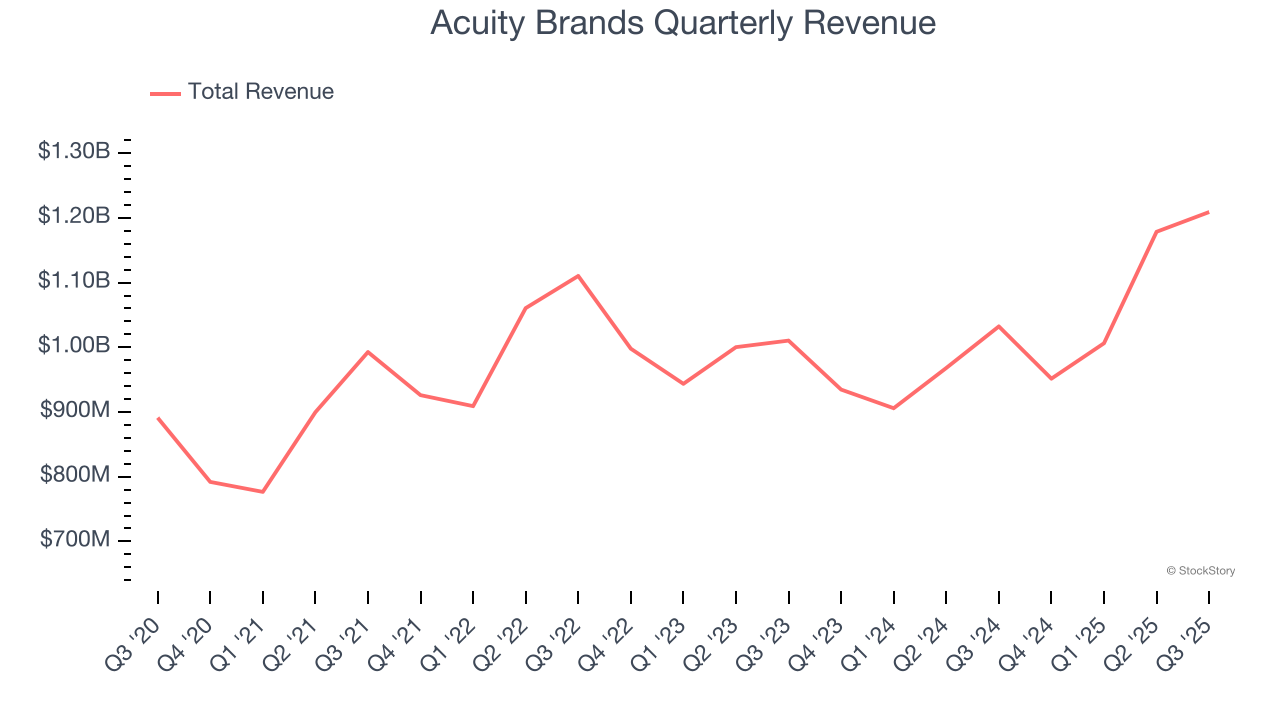

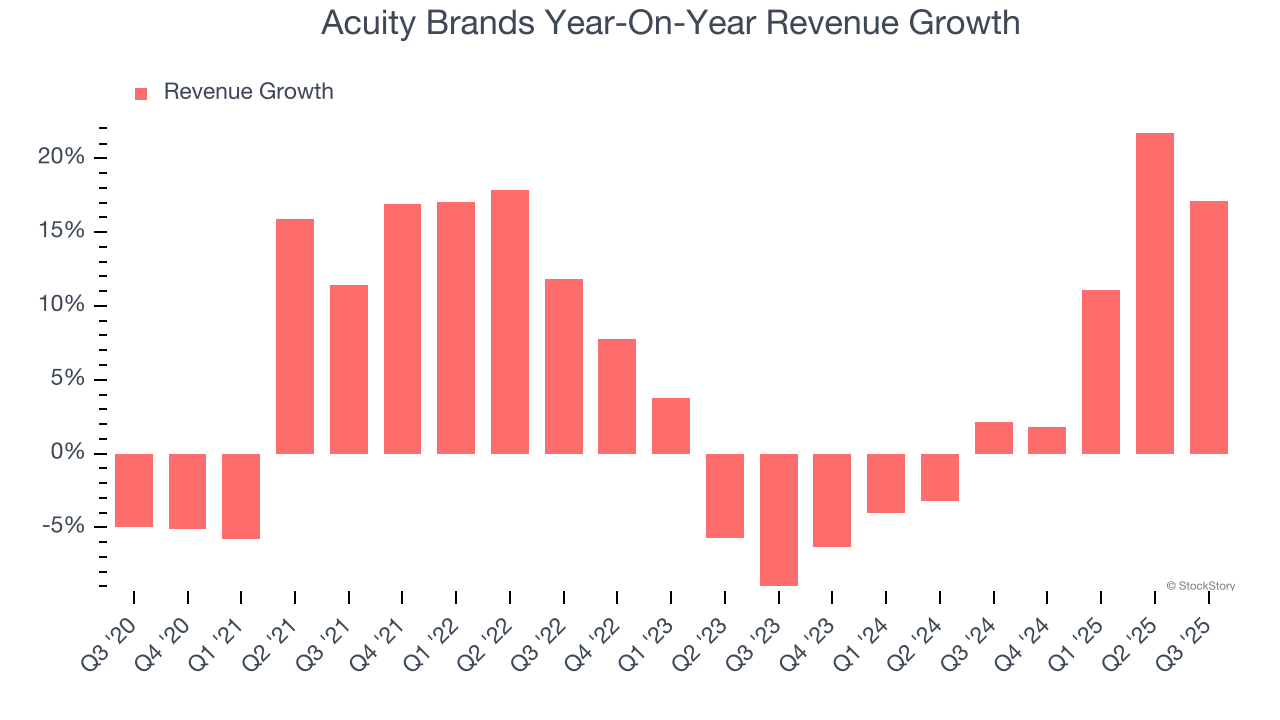

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Acuity Brands grew its sales at a tepid 5.5% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Acuity Brands’s annualized revenue growth of 4.9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak. We also note many other Electrical Systems businesses have faced declining sales because of cyclical headwinds. While Acuity Brands grew slower than we’d like, it did do better than its peers.

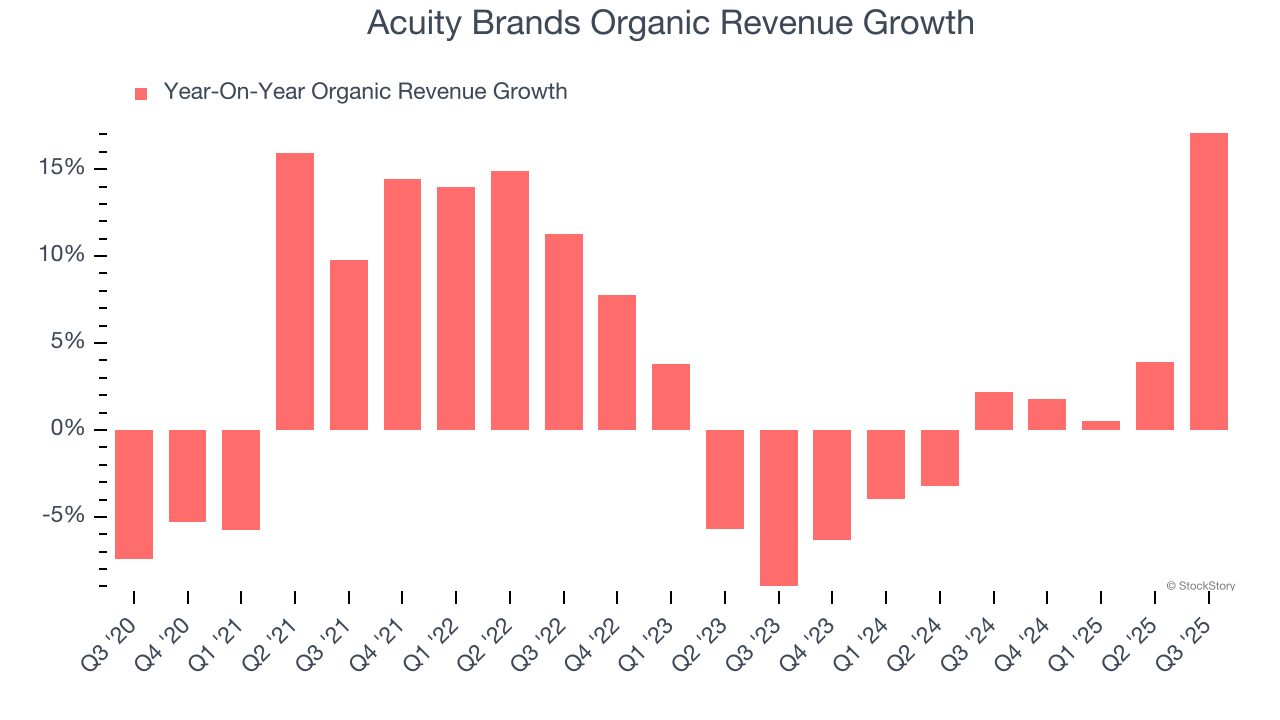

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Acuity Brands’s organic revenue averaged 1.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Acuity Brands’s revenue grew by 17.1% year on year to $1.21 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

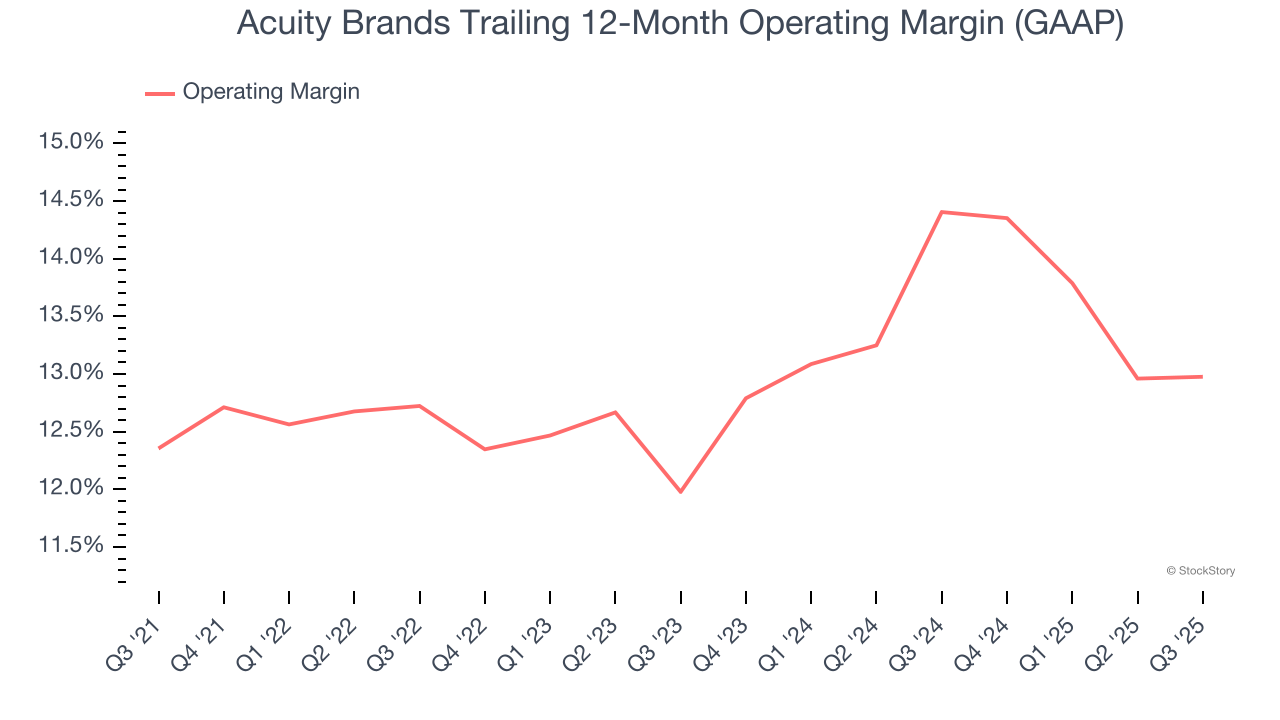

Operating Margin

Acuity Brands’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 12.9% over the last five years. This profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Acuity Brands’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Acuity Brands generated an operating margin profit margin of 14.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

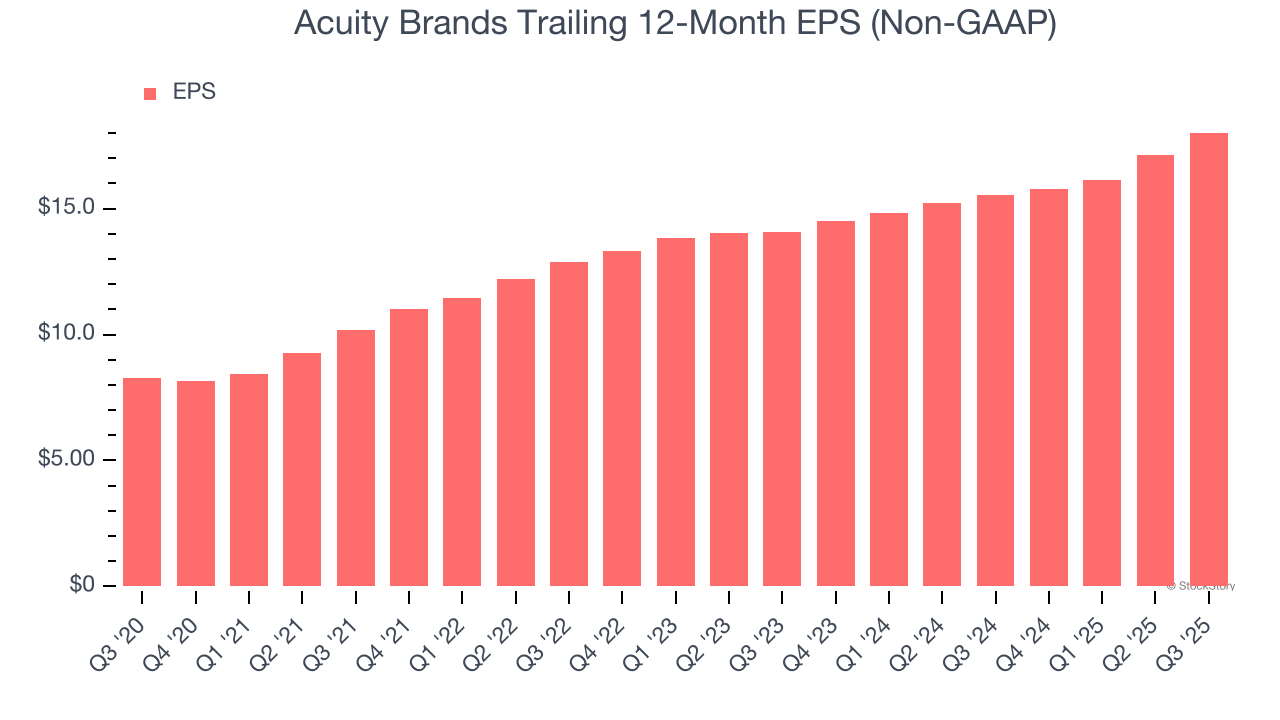

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

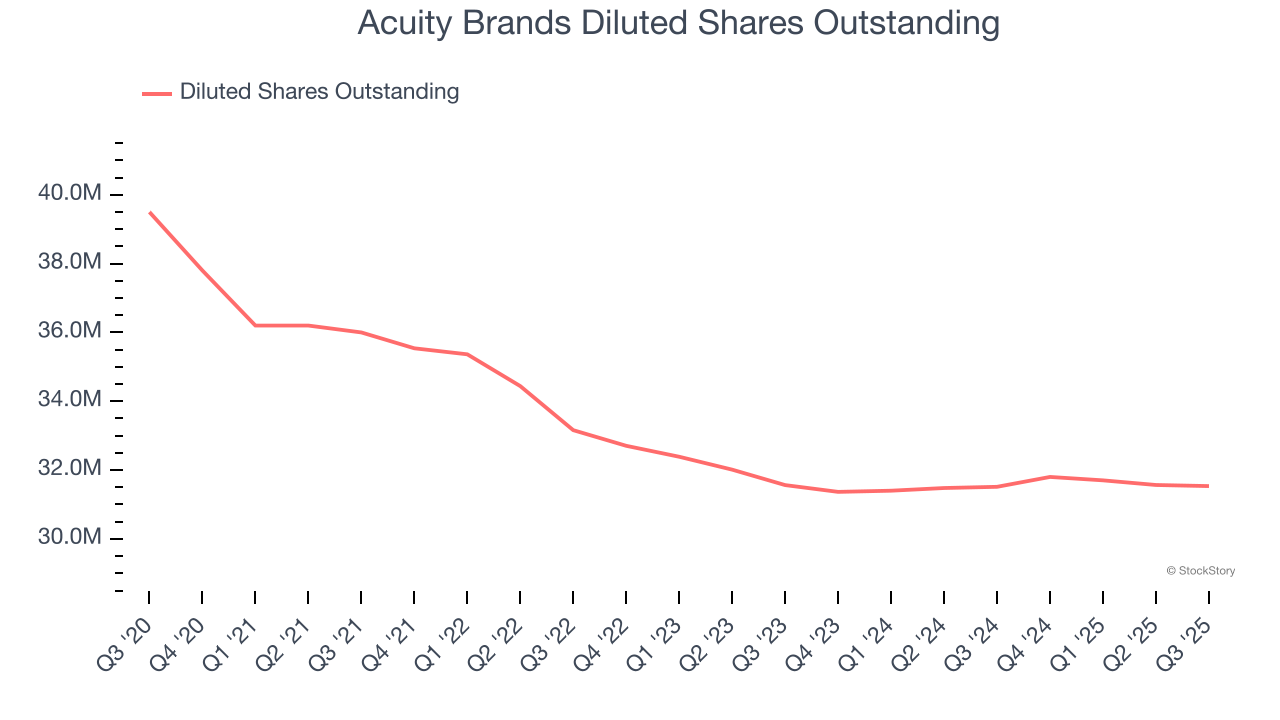

Acuity Brands’s EPS grew at a spectacular 16.9% compounded annual growth rate over the last five years, higher than its 5.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Acuity Brands’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Acuity Brands has repurchased its stock, shrinking its share count by 20.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Acuity Brands, its two-year annual EPS growth of 13.2% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Acuity Brands reported adjusted EPS of $5.20, up from $4.30 in the same quarter last year. This print beat analysts’ estimates by 7.5%. Over the next 12 months, Wall Street expects Acuity Brands’s full-year EPS of $18.02 to grow 6.2%.

Key Takeaways from Acuity Brands’s Q3 Results

We were impressed that EPS beat expectations. On the other hand, its revenue missed. Overall, we think this was a mixed quarter. The stock remained flat at $346.19 immediately following the results.

Indeed, Acuity Brands had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.