First Bancorp trades at $46.32 per share and has stayed right on track with the overall market, gaining 24.8% over the last six months. At the same time, the S&P 500 has returned 25.5%.

Is now a good time to buy FBNC? Find out in our full research report, it’s free for active Edge members.

Why Does FBNC Stock Spark Debate?

Founded during the Great Depression in 1934 and originally known as Montgomery Bancorp, First Bancorp (NASDAQ: FBNC) is a community-oriented commercial bank providing a wide range of financial services to businesses and individuals in North and South Carolina.

Two Positive Attributes:

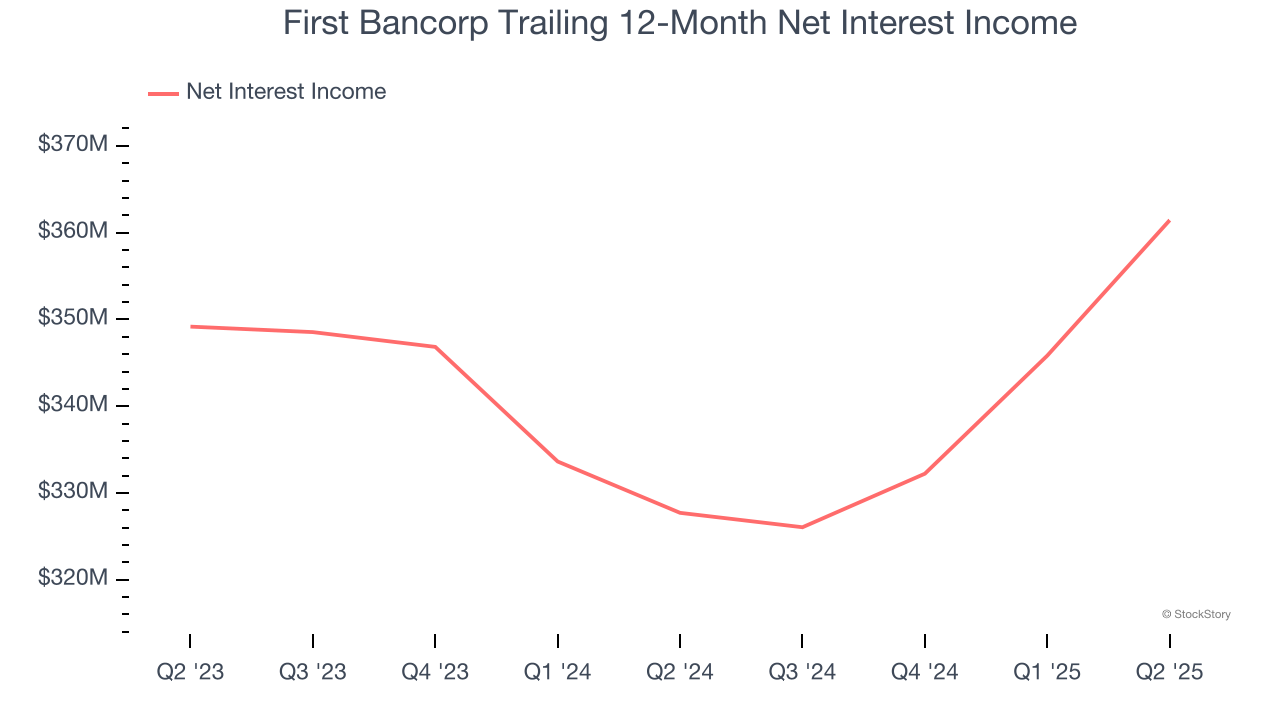

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

First Bancorp’s net interest income has grown at a 12% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue.

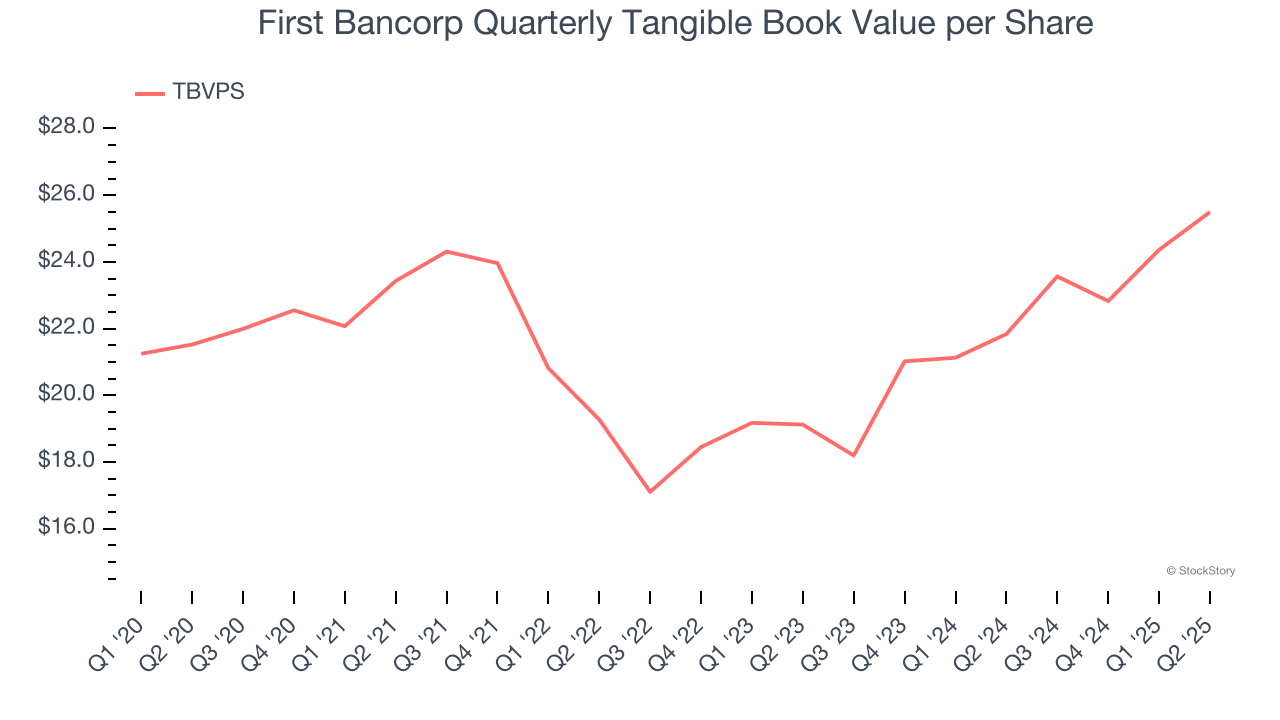

2. Projected TBVPS Growth Is Remarkable

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for First Bancorp’s TBVPS to grow by 14.4% to $29.17, top-notch growth rate.

One Reason to be Careful:

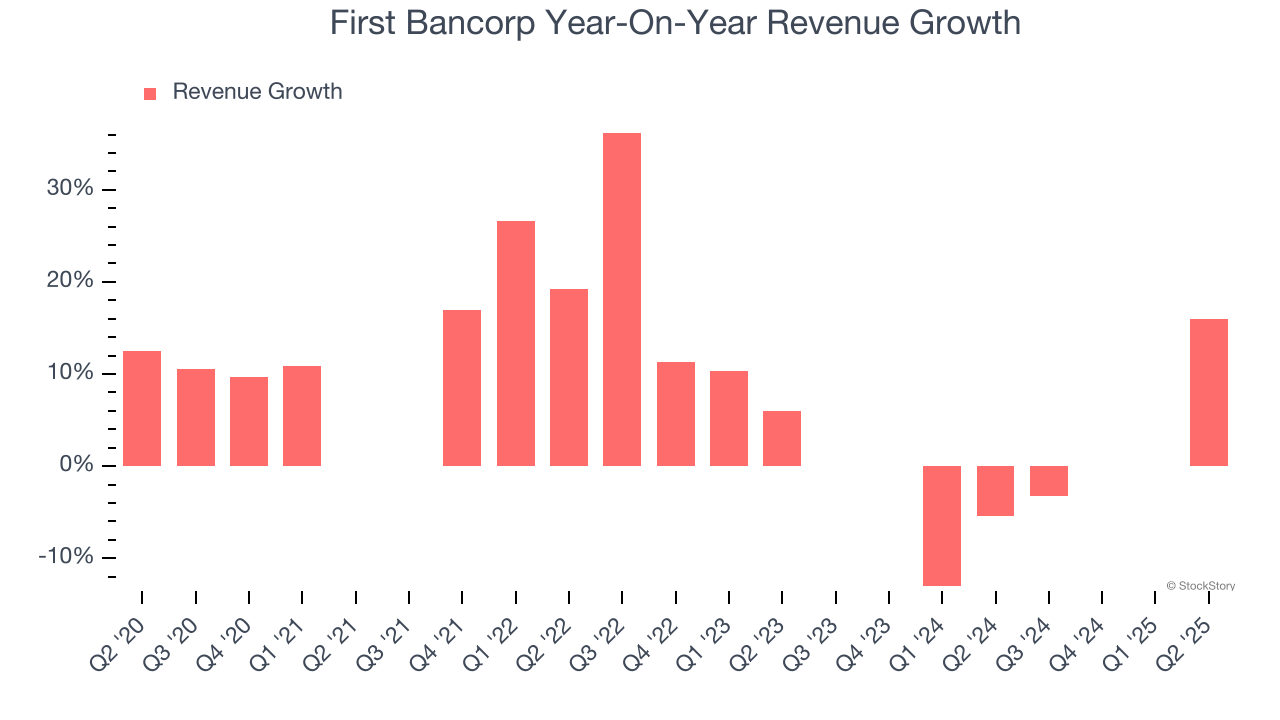

Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. First Bancorp’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.7% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

First Bancorp’s positive characteristics outweigh the negatives, but at $46.32 per share (or 1.2× forward P/B), is now the right time to buy the stock? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.