As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the tech hardware & electronics industry, including TD SYNNEX (NYSE: SNX) and its peers.

Tech hardware and electronics companies will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware itself, which could dent demand and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

The 5 tech hardware & electronics stocks we track reported an exceptional Q3. As a group, revenues beat analysts’ consensus estimates by 5.5% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.3% on average since the latest earnings results.

TD SYNNEX (NYSE: SNX)

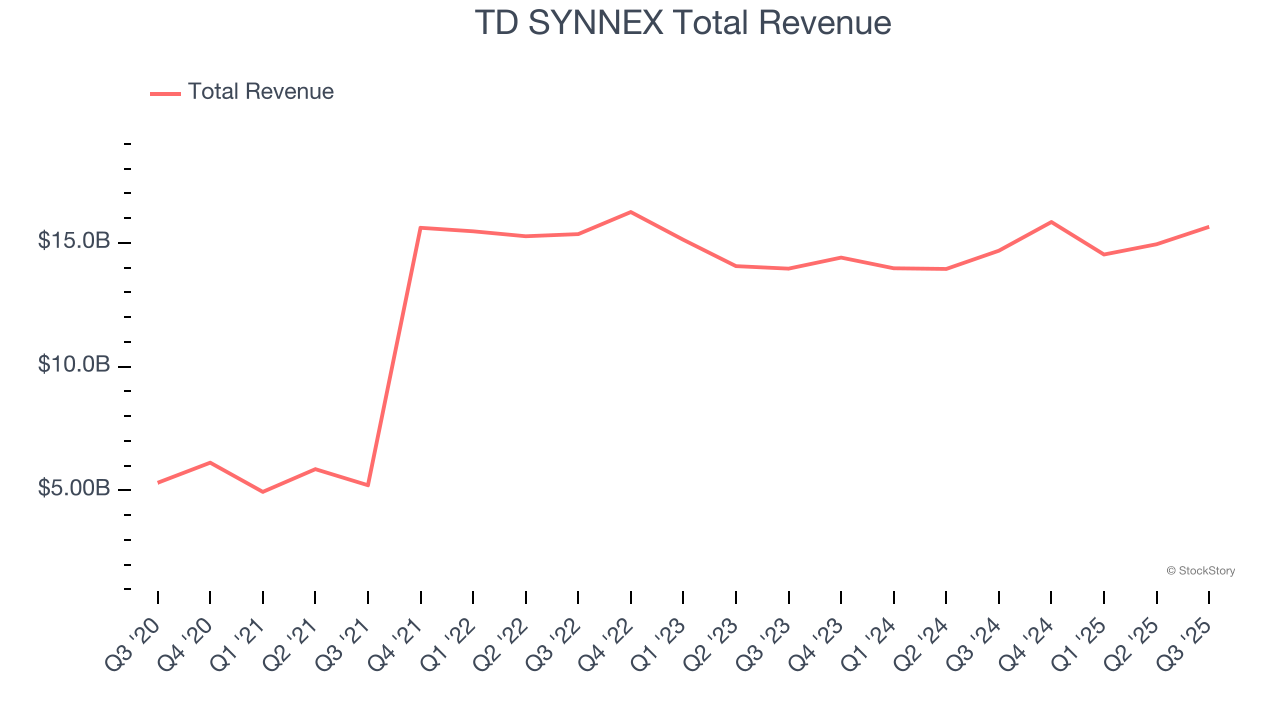

Serving as the crucial middleman in the technology supply chain, TD SYNNEX (NYSE: SNX) is a global technology distributor that connects thousands of IT manufacturers with resellers, helping businesses access hardware, software, and technology solutions.

TD SYNNEX reported revenues of $15.65 billion, up 6.6% year on year. This print exceeded analysts’ expectations by 3.5%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ EPS guidance for next quarter estimates.

“Our third quarter non-GAAP gross billings and diluted earnings per share established new records for our company” said Patrick Zammit, CEO of TD SYNNEX.

Interestingly, the stock is up 2.1% since reporting and currently trades at $153.54.

Is now the time to buy TD SYNNEX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Amphenol (NYSE: APH)

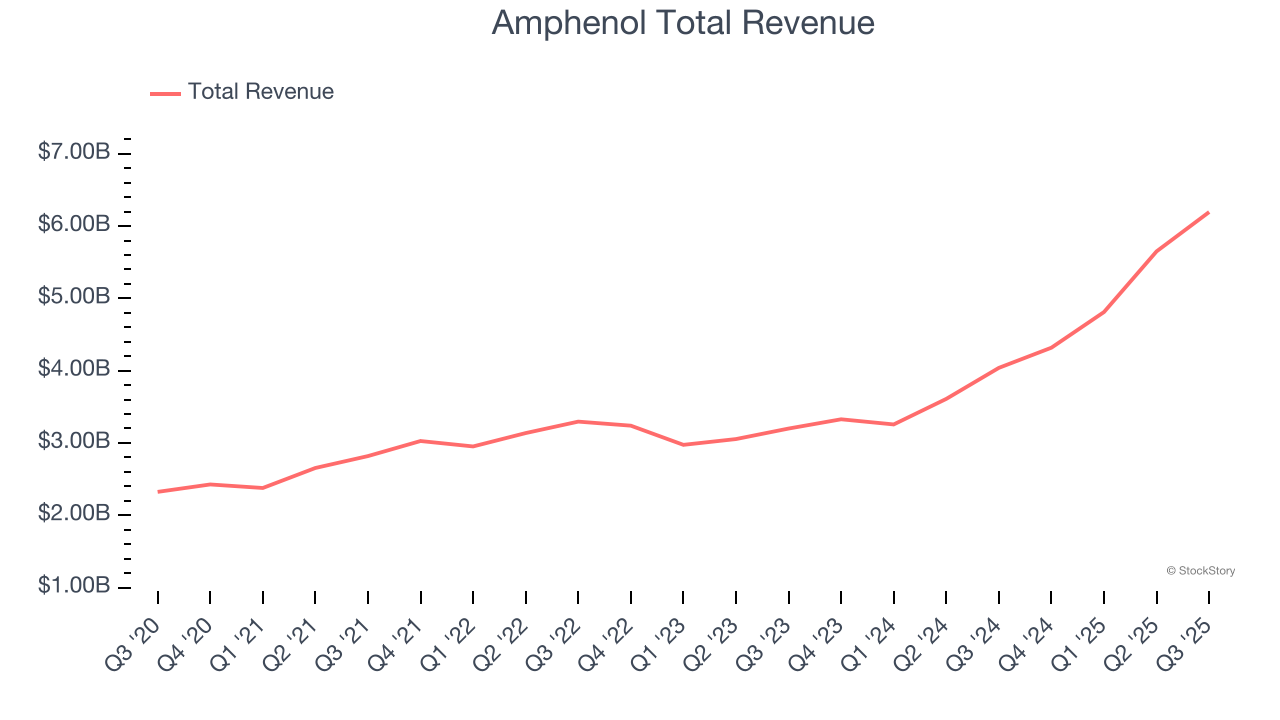

With over 90 years of connecting the world's technologies, Amphenol (NYSE: APH) designs and manufactures connectors, cables, sensors, and interconnect systems that enable electrical and electronic connections across virtually every industry.

Amphenol reported revenues of $6.19 billion, up 53.4% year on year, outperforming analysts’ expectations by 10.9%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EPS guidance for next quarter estimates.

Amphenol pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 8% since reporting. It currently trades at $134.34.

Is now the time to buy Amphenol? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Plexus (NASDAQ: PLXS)

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ: PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

Plexus reported revenues of $1.06 billion, flat year on year, exceeding analysts’ expectations by 1.1%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a beat of analysts’ EPS estimates and revenue guidance for next quarter beating analysts’ expectations.

Plexus delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 1.1% since the results and currently trades at $147.51.

Read our full analysis of Plexus’s results here.

Jabil (NYSE: JBL)

With manufacturing facilities spanning the globe from China to Mexico to the United States, Jabil (NYSE: JBL) provides electronics design, manufacturing, and supply chain solutions to companies across various industries, from healthcare to automotive to cloud computing.

Jabil reported revenues of $8.25 billion, up 18.5% year on year. This number topped analysts’ expectations by 9.5%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EPS guidance for next quarter estimates and a solid beat of analysts’ revenue estimates.

Jabil had the weakest full-year guidance update among its peers. The stock is down 5.9% since reporting and currently trades at $212.

Read our full, actionable report on Jabil here, it’s free for active Edge members.

Knowles (NYSE: KN)

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE: KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Knowles reported revenues of $152.9 million, up 7.3% year on year. This print beat analysts’ expectations by 2.6%. It was a very strong quarter as it also logged an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 1.4% since reporting and currently trades at $24.35.

Read our full, actionable report on Knowles here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.