Radiation safety company Mirion (NYSE: MIR) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 7.9% year on year to $223.1 million. Its non-GAAP profit of $0.12 per share was 17.1% above analysts’ consensus estimates.

Is now the time to buy Mirion? Find out by accessing our full research report, it’s free for active Edge members.

Mirion (MIR) Q3 CY2025 Highlights:

- Revenue: $223.1 million vs analyst estimates of $222.2 million (7.9% year-on-year growth, in line)

- Adjusted EPS: $0.12 vs analyst estimates of $0.10 (17.1% beat)

- Adjusted EBITDA: $52.4 million vs analyst estimates of $51.47 million (23.5% margin, 1.8% beat)

- Management reiterated its full-year Adjusted EPS guidance of $0.50 at the midpoint

- EBITDA guidance for the full year is $228 million at the midpoint, above analyst estimates of $223.4 million

- Operating Margin: 3.3%, up from 0.1% in the same quarter last year

- Free Cash Flow Margin: 5.8%, up from 1.9% in the same quarter last year

- Market Capitalization: $5.62 billion

“Mirion posted another strong quarter supported by the continued momentum in the nuclear power end-market,” commented Mirion’s Chairman and Chief Executive Officer Thomas Logan.

Company Overview

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE: MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $902.3 million in revenue over the past 12 months, Mirion is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

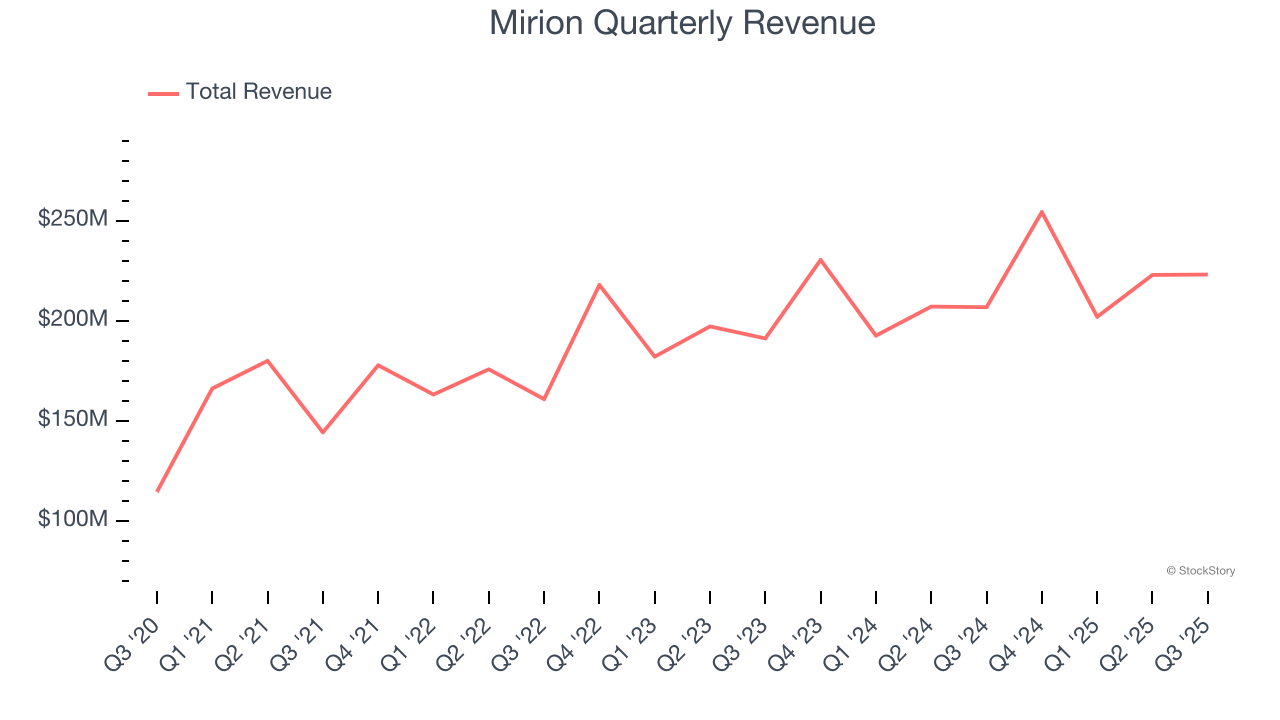

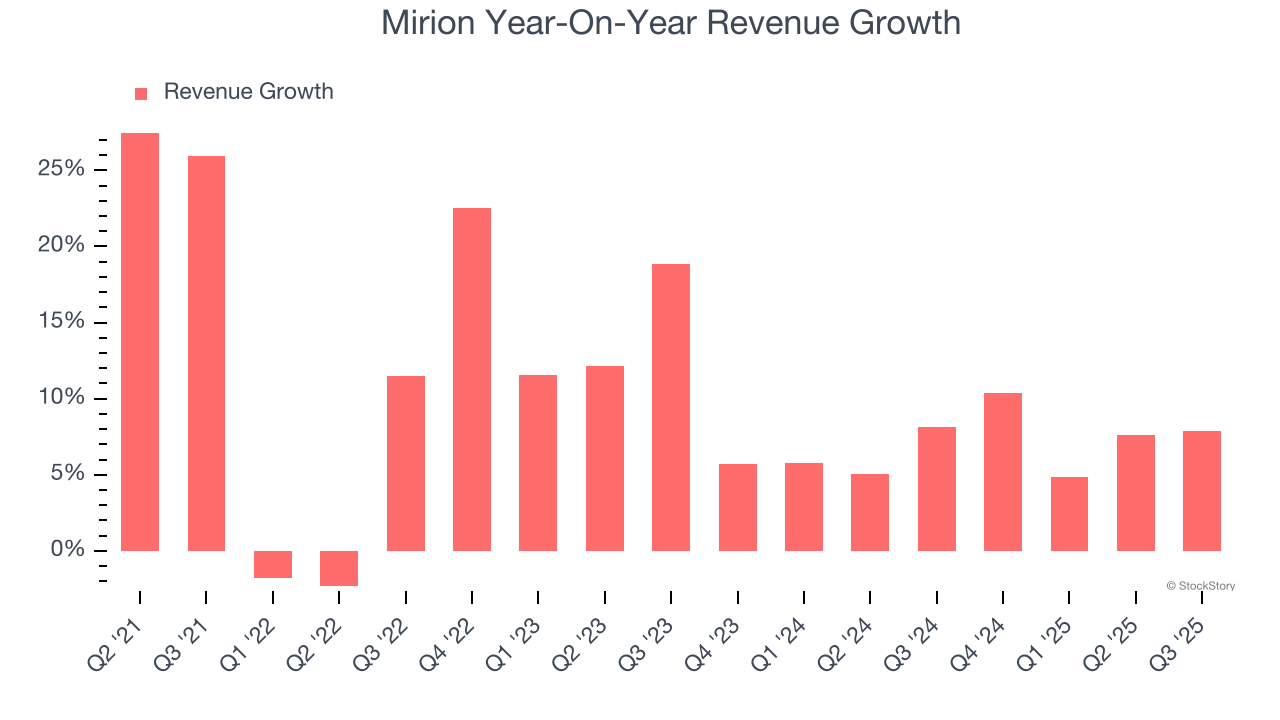

As you can see below, Mirion’s 11.8% annualized revenue growth over the last five years was excellent. This is an encouraging starting point for our analysis because it shows Mirion’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Mirion’s annualized revenue growth of 7% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Mirion grew its revenue by 7.9% year on year, and its $223.1 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 19.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

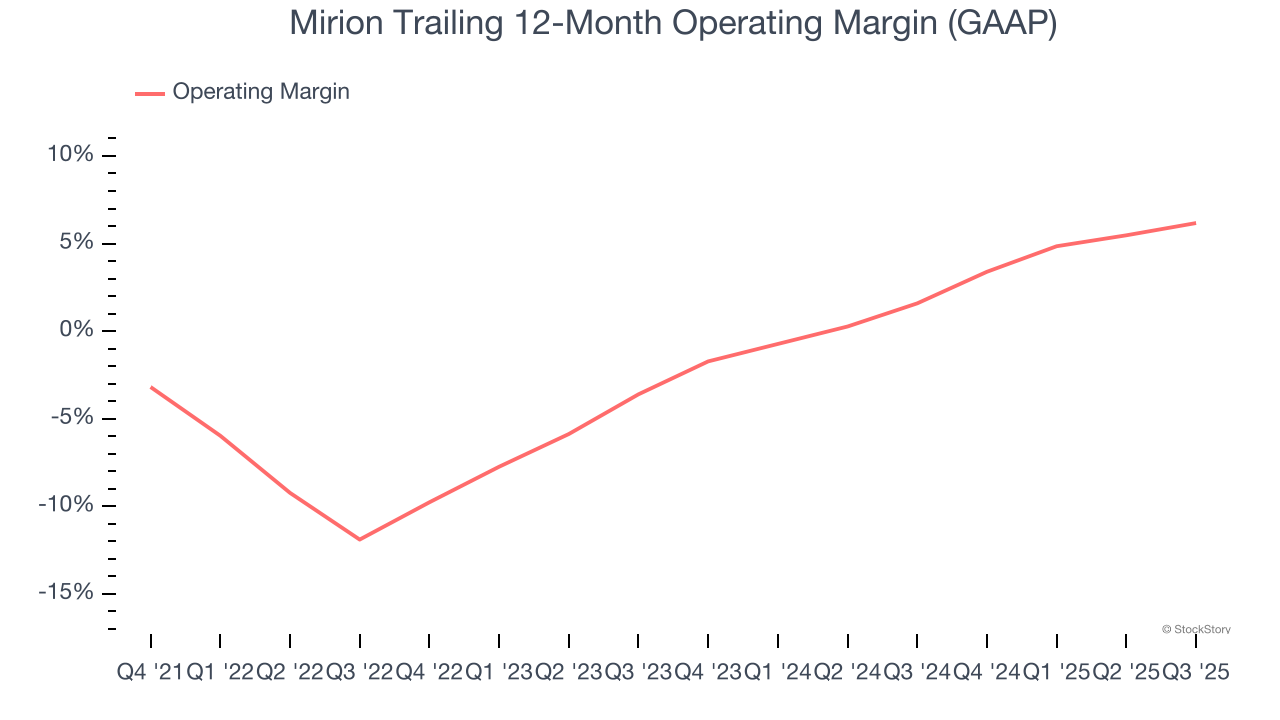

Although Mirion was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Mirion’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Mirion generated an operating margin profit margin of 3.3%, up 3.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

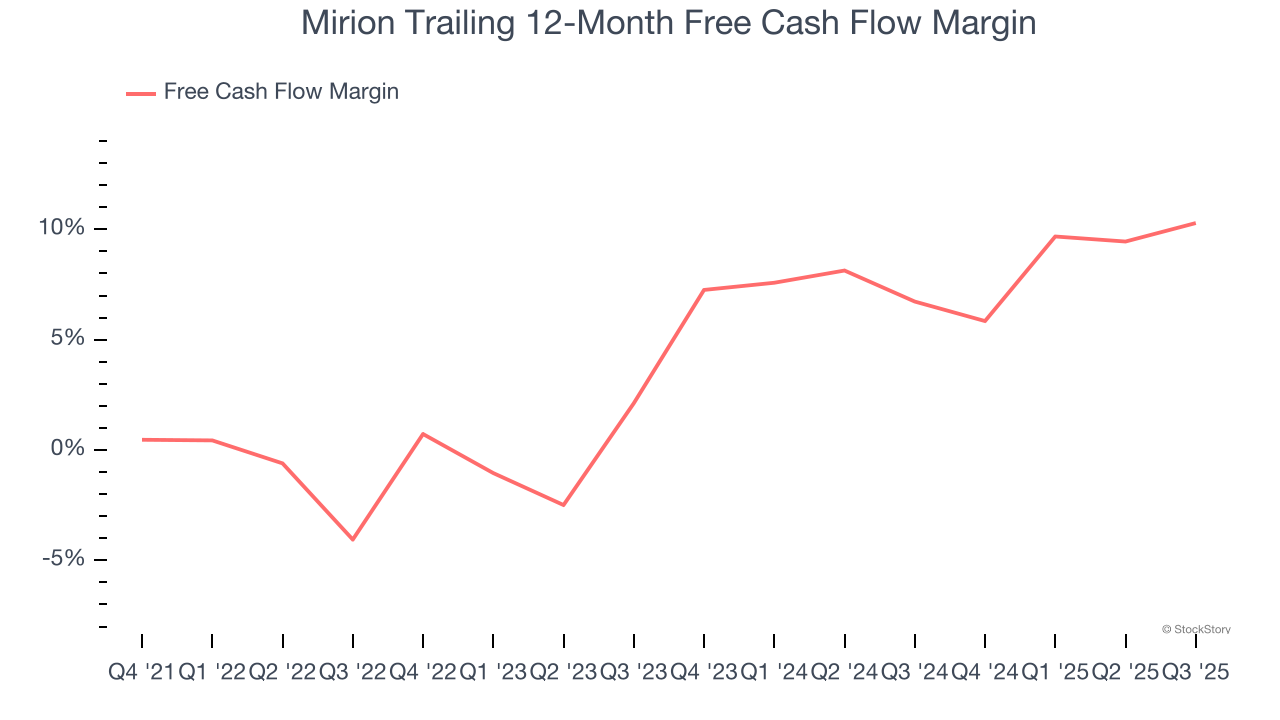

Mirion has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.3%, subpar for a business services business.

Taking a step back, an encouraging sign is that Mirion’s margin expanded by 2.2 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Mirion’s free cash flow clocked in at $13 million in Q3, equivalent to a 5.8% margin. This result was good as its margin was 3.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Mirion’s Q3 Results

It was good to see Mirion beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 3.2% to $26 immediately after reporting.

Sure, Mirion had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.