As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the payment processing industry, including Fiserv (NYSE: FI) and its peers.

Payment processors facilitate transactions between merchants, consumers, and financial institutions. Growth comes from e-commerce expansion, declining cash usage globally, and value-added services beyond basic processing. Headwinds include margin pressure from merchant negotiating power, rapid technological change requiring investment, and emerging competition from technology companies entering the payments ecosystem.

The 4 payment processing stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.4% since the latest earnings results.

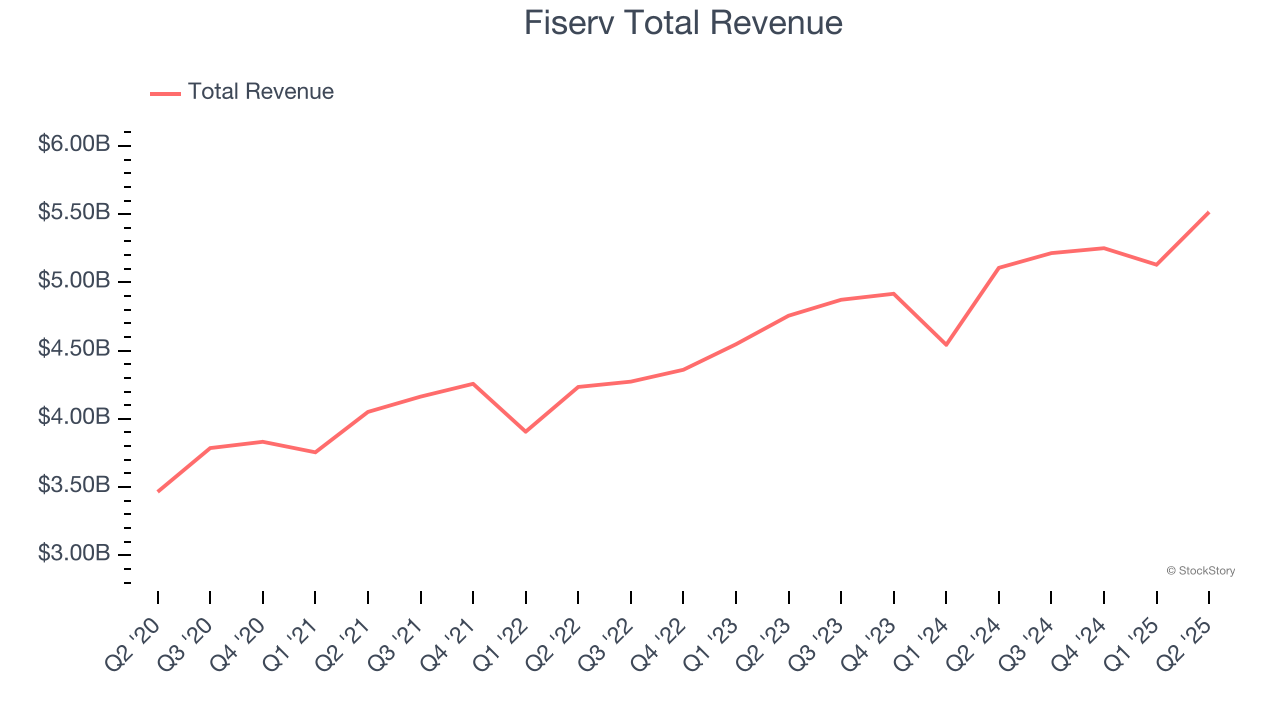

Fiserv (NYSE: FI)

Powering over 1 billion accounts and processing more than 12,000 financial transactions per second globally, Fiserv (NYSE: FI) provides payment processing and financial technology solutions that enable merchants, banks, and credit unions to accept payments and manage financial transactions.

Fiserv reported revenues of $5.52 billion, up 8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a narrow beat of analysts’ EBITDA estimates but a significant miss of analysts’ organic revenue estimates.

Fiserv delivered the slowest revenue growth of the whole group. The stock is down 22.6% since reporting and currently trades at $128.38.

Is now the time to buy Fiserv? Access our full analysis of the earnings results here, it’s free for active Edge members.

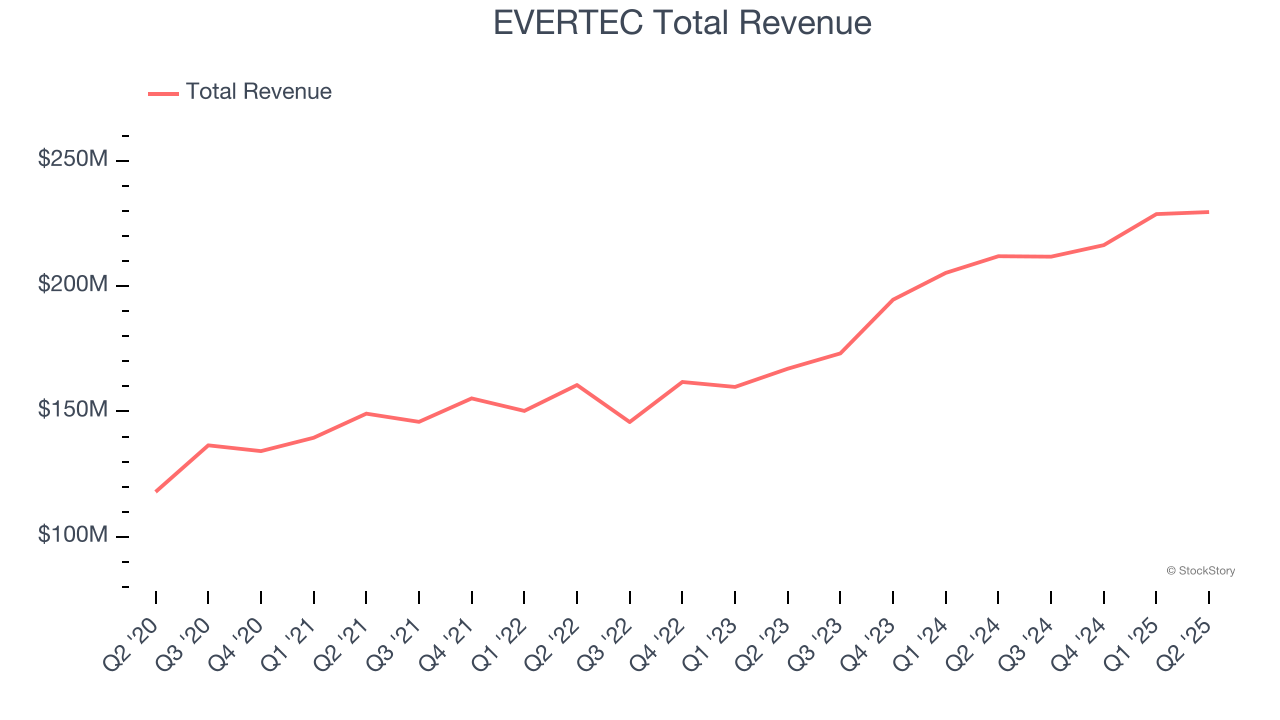

Best Q2: EVERTEC (NYSE: EVTC)

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE: EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

EVERTEC reported revenues of $229.6 million, up 8.3% year on year, outperforming analysts’ expectations by 3.3%. The business had a strong quarter with a decent beat of analysts’ EBITDA and EPS estimates.

EVERTEC pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $32.56.

Is now the time to buy EVERTEC? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Shift4 (NYSE: FOUR)

Starting as a payment gateway provider in 1999 and now processing over $200 billion in annual payment volume, Shift4 Payments (NYSE: FOUR) provides integrated payment processing solutions and software that help businesses accept and manage transactions across in-store, online, and mobile channels.

Shift4 reported revenues of $966.2 million, up 16.8% year on year, falling short of analysts’ expectations by 1%. It was a softer quarter as it posted a significant miss of analysts’ transaction volumes and EPS estimates.

Shift4 delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 13.6% since the results and currently trades at $76.94.

Read our full analysis of Shift4’s results here.

Jack Henry (NASDAQ: JKHY)

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ: JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Jack Henry reported revenues of $615.4 million, up 9.9% year on year. This number topped analysts’ expectations by 1.8%. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ Processing segment estimates but a slight miss of analysts’ EBITDA estimates.

The stock is down 8.9% since reporting and currently trades at $146.26.

Read our full, actionable report on Jack Henry here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.