Over the past six months, Colgate-Palmolive’s stock price fell to $78.09. Shareholders have lost 13.5% of their capital, which is disappointing considering the S&P 500 has climbed by 22.7%. This might have investors contemplating their next move.

Given the weaker price action, is now the time to buy CL? Find out in our full research report, it’s free for active Edge members.

Why Does Colgate-Palmolive Spark Debate?

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE: CL) is a consumer products company that focuses on personal, household, and pet products.

Two Positive Attributes:

1. Elite Gross Margin Powers Best-In-Class Business Model

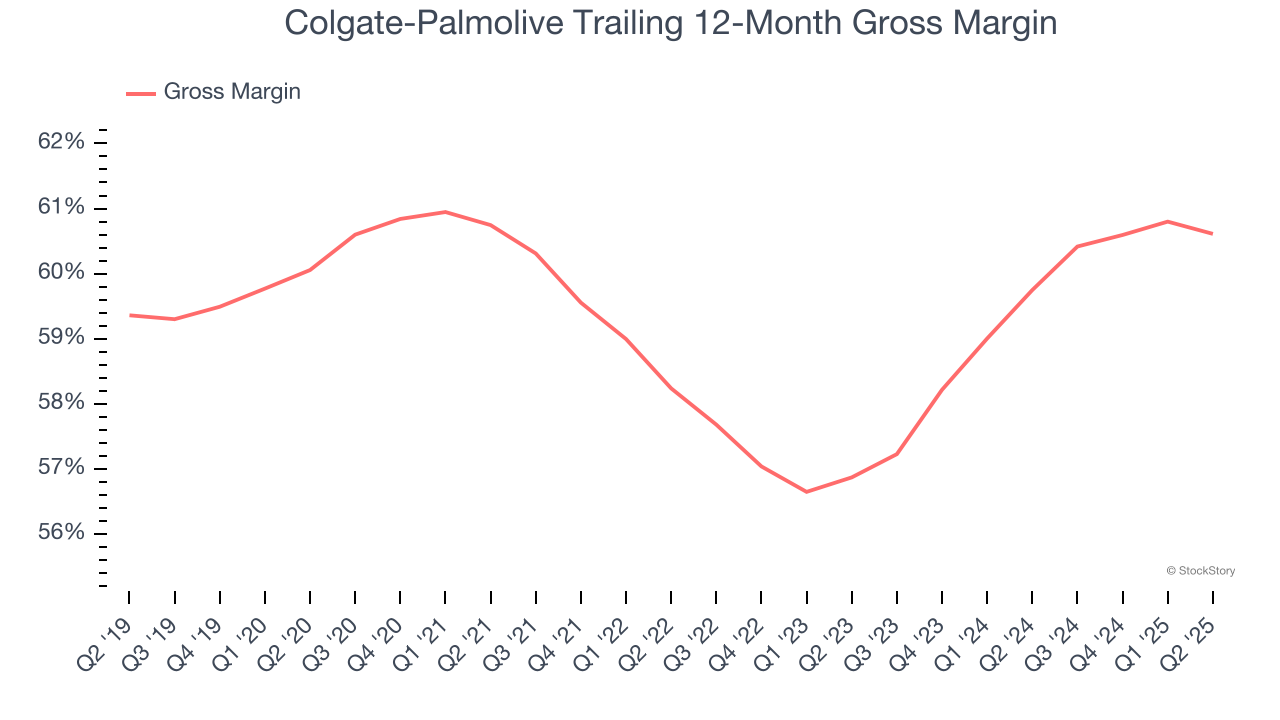

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Colgate-Palmolive has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 60.2% gross margin over the last two years. That means Colgate-Palmolive only paid its suppliers $39.82 for every $100 in revenue.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

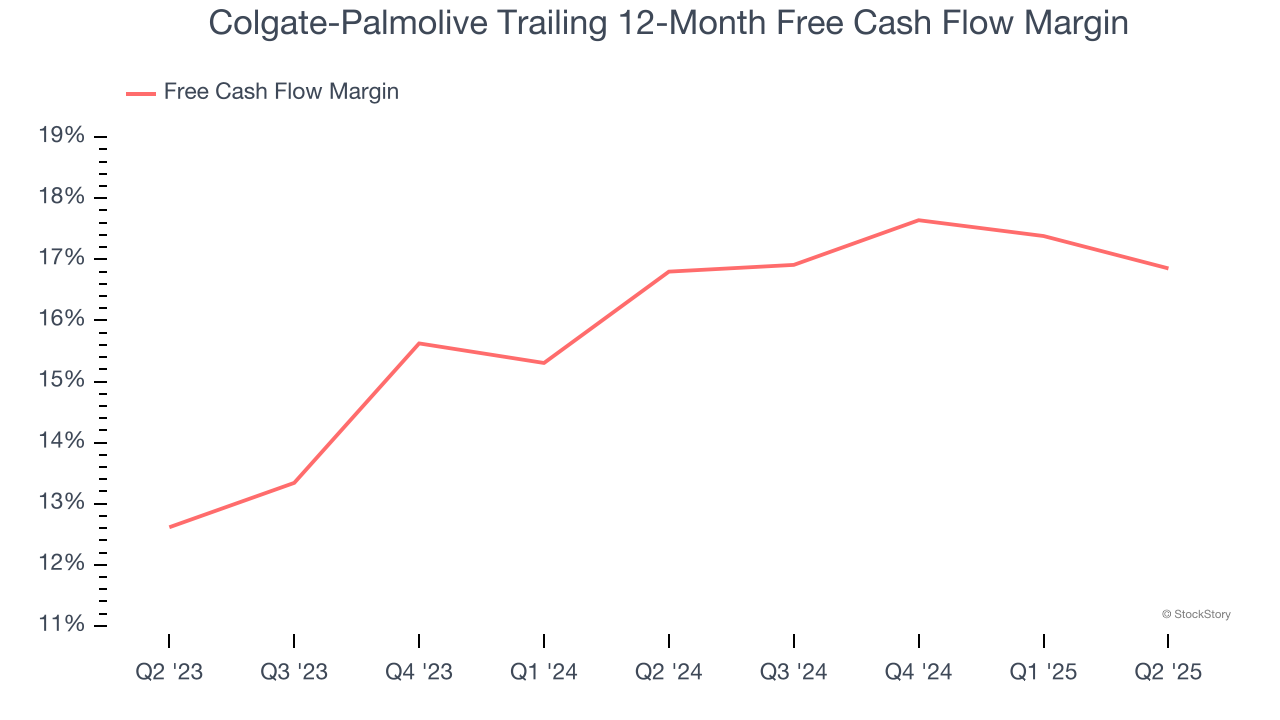

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Colgate-Palmolive has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 16.8% over the last two years.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

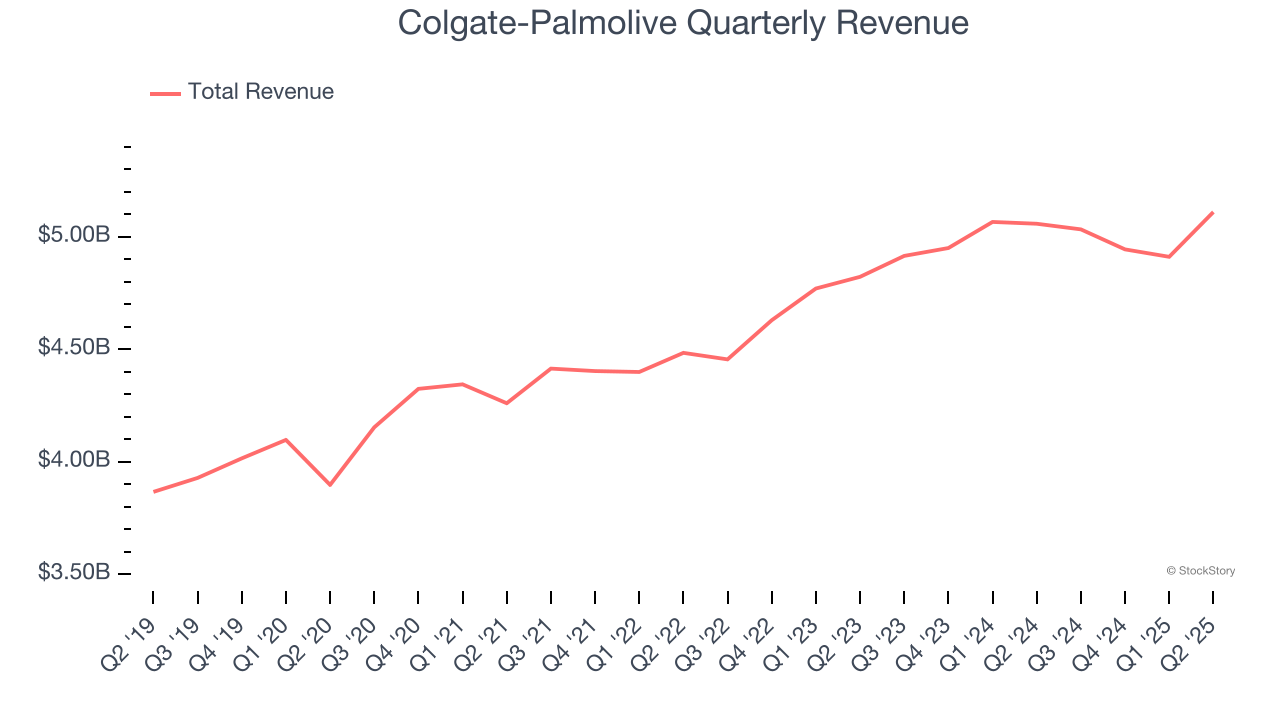

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Colgate-Palmolive grew its sales at a sluggish 4.2% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer staples sector, but there are still things to like about Colgate-Palmolive.

Final Judgment

Colgate-Palmolive’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 20.7× forward P/E (or $78.09 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.