Apple device management company Jamf (NASDAQ: JAMF) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 15.2% year on year to $183.5 million. Its non-GAAP profit of $0.25 per share was 7.7% above analysts’ consensus estimates.

Is now the time to buy Jamf? Find out by accessing our full research report, it’s free for active Edge members.

Jamf (JAMF) Q3 CY2025 Highlights:

- Revenue: $183.5 million vs analyst estimates of $177.4 million (15.2% year-on-year growth, 3.4% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.23 (7.7% beat)

- Adjusted Operating Income: $47.24 million vs analyst estimates of $42.17 million (25.7% margin, 12% beat)

- Operating Margin: -1.9%, up from -10% in the same quarter last year

- Free Cash Flow Margin: 35.4%, up from 20.9% in the previous quarter

- Market Capitalization: $1.71 billion

Company Overview

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ: JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

Revenue Growth

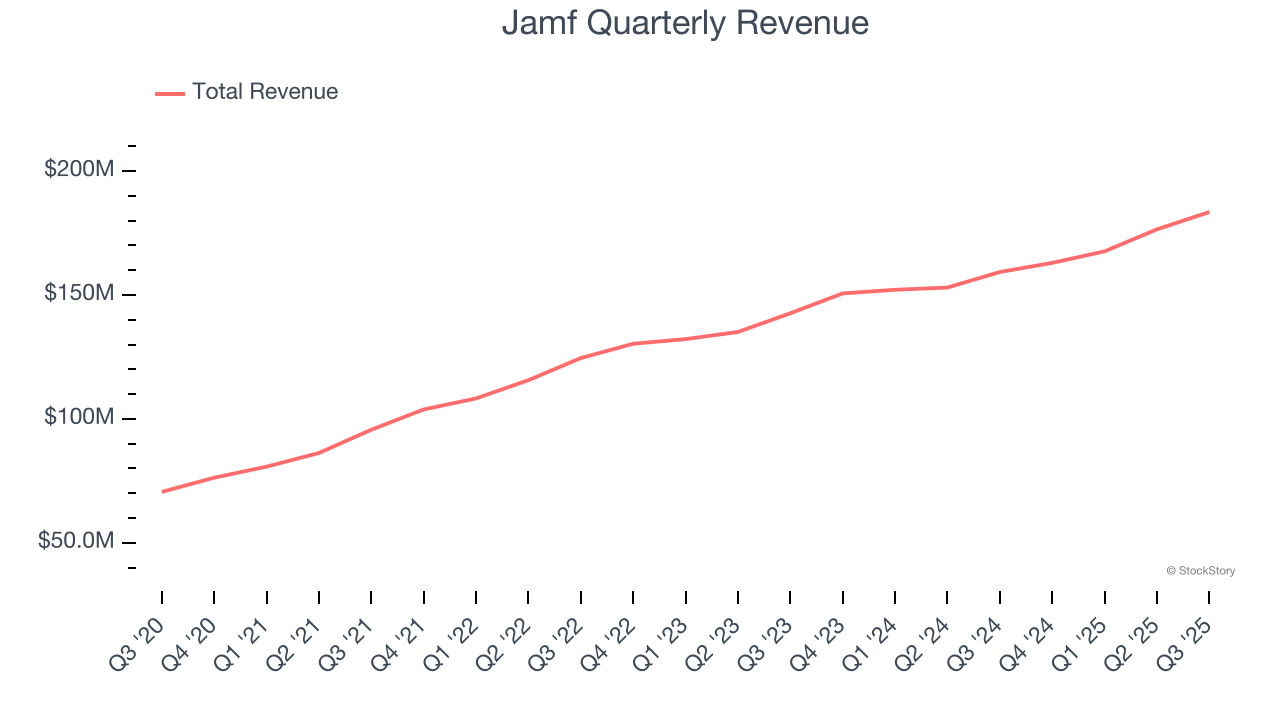

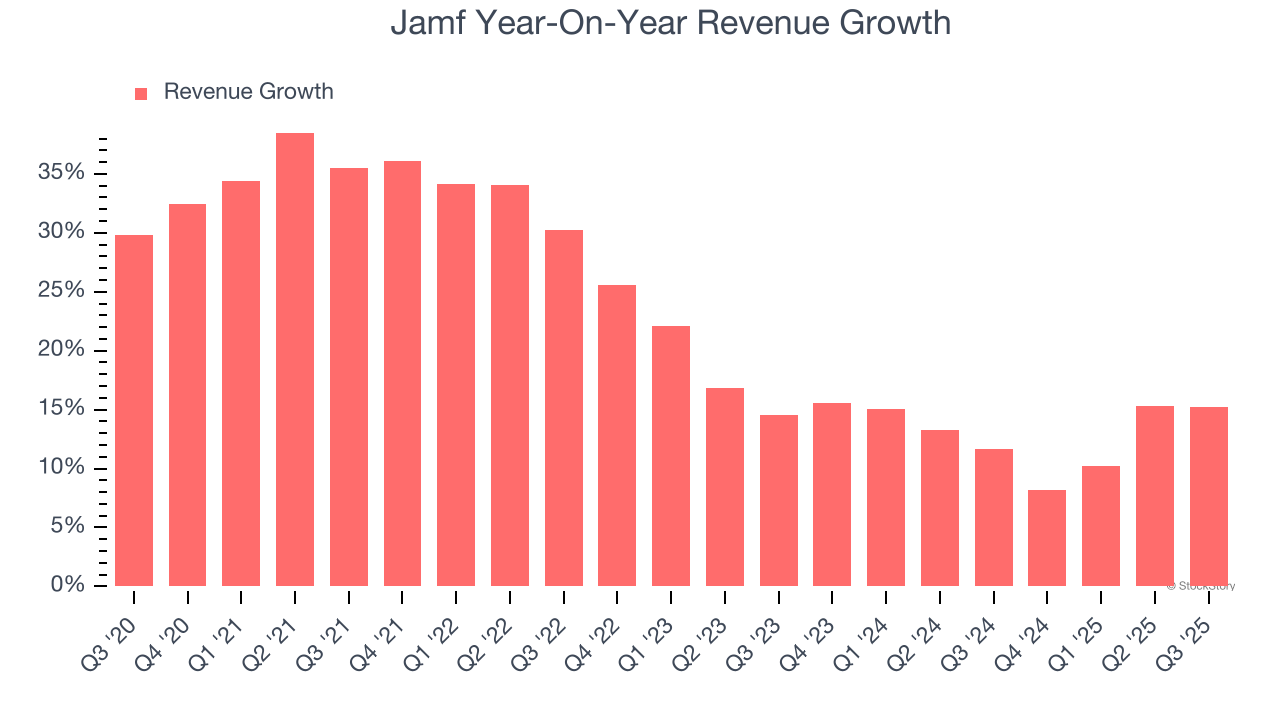

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Jamf’s sales grew at a solid 22.5% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Jamf’s recent performance shows its demand has slowed as its annualized revenue growth of 13.1% over the last two years was below its five-year trend.

This quarter, Jamf reported year-on-year revenue growth of 15.2%, and its $183.5 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 8.9% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Jamf does a decent job acquiring new customers, and its CAC payback period checked in at 43.5 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Jamf’s Q3 Results

We were impressed by how significantly Jamf blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $12.87 immediately following the results.

Jamf put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.