As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the consumer internet industry, including Take-Two (NASDAQ: TTWO) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 47 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.1% since the latest earnings results.

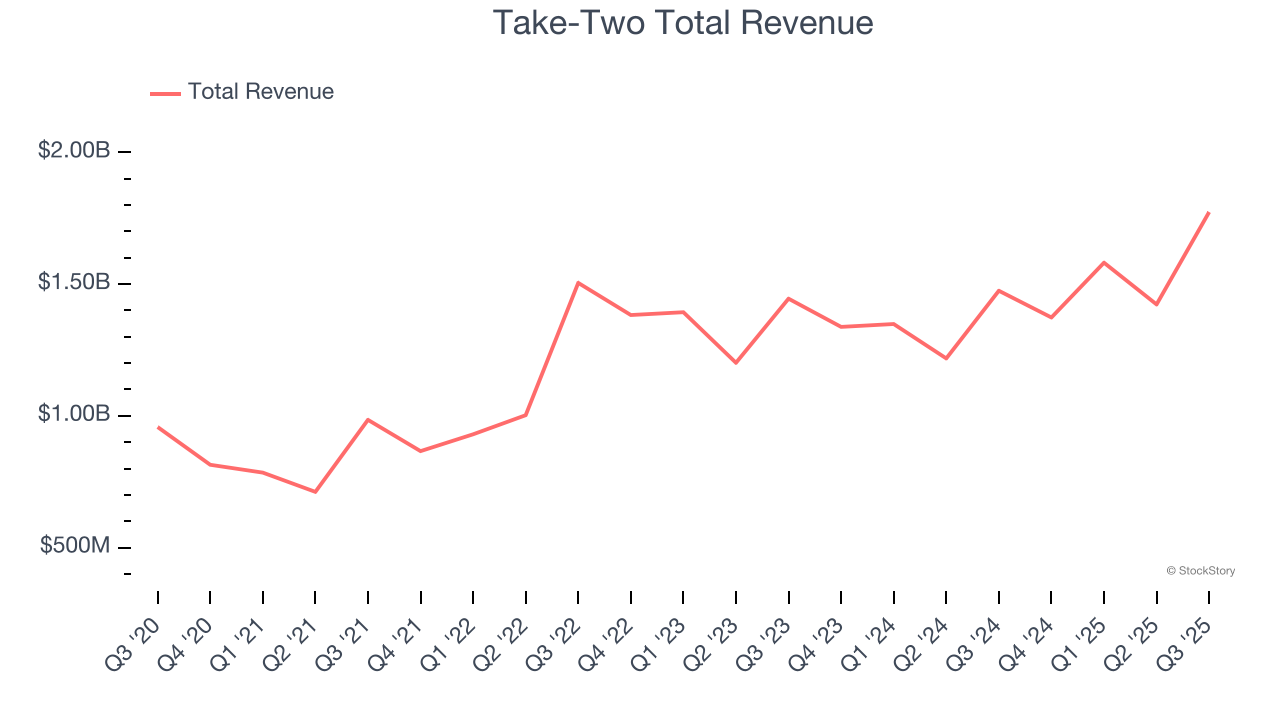

Take-Two (NASDAQ: TTWO)

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ: TTWO) is one of the world’s largest video game publishers.

Take-Two reported revenues of $1.77 billion, up 20.3% year on year. This print exceeded analysts’ expectations by 3.8%. Overall, it was a very strong quarter for the company with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Strauss Zelnick, Chairman and CEO of Take-Two Interactive, stated: “We achieved outstanding second quarter results by releasing new hit titles, driving innovation in live services, and maintaining our commitment to developing the highest quality products. With momentum across our business, particularly in mobile and NBA 2K, we are raising our Fiscal Year 2026 Net Bookings forecast for the second consecutive quarter. Rockstar Games will now release Grand Theft Auto VI on November 19, 2026, and we remain both excited and confident they will deliver an unrivalled blockbuster entertainment experience. With the most robust pipeline in our Company’s history, we expect to achieve record levels of Net Bookings in Fiscal 2027, which will establish a new baseline for our business and set us on a path of enhanced profitability.”

Take-Two delivered the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 6.7% since reporting and currently trades at $235.47.

Is now the time to buy Take-Two? Access our full analysis of the earnings results here, it’s free for active Edge members.

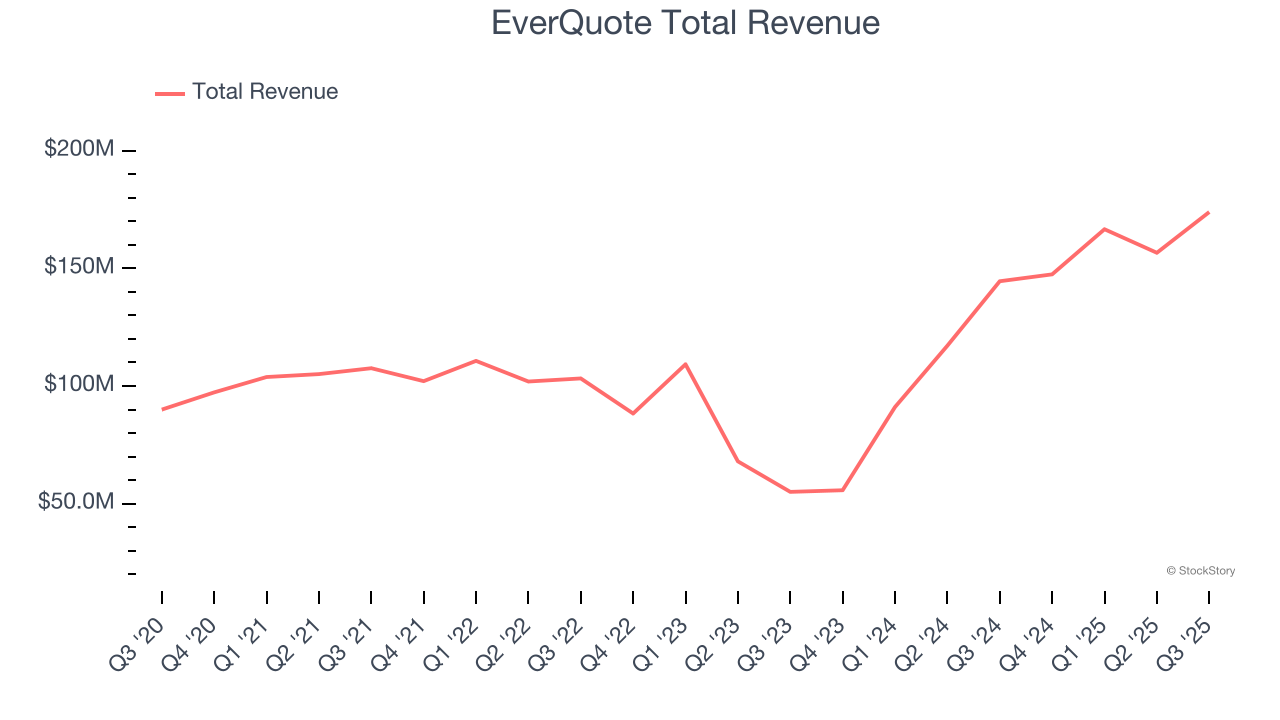

Best Q3: EverQuote (NASDAQ: EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ: EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 16% since reporting. It currently trades at $26.00.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ACV Auctions (NYSE: ACVA)

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

As expected, the stock is down 21.1% since the results and currently trades at $6.43.

Read our full analysis of ACV Auctions’s results here.

Sea (NYSE: SE)

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE: SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $5.99 billion, up 36.5% year on year. This result beat analysts’ expectations by 6.1%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and impressive growth in its users.

The company reported 65.9 million users, up 31.3% year on year. The stock is down 8.9% since reporting and currently trades at $141.26.

Read our full, actionable report on Sea here, it’s free for active Edge members.

Snap (NYSE: SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.51 billion, up 9.8% year on year. This number surpassed analysts’ expectations by 1%. It was a strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The company reported 477 million daily active users, up 7.7% year on year. The stock is up 16.7% since reporting and currently trades at $8.58.

Read our full, actionable report on Snap here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.