Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at AIG (NYSE: AIG) and the best and worst performers in the insurance industry.

The insurance industry absorbs and diversifies risk, providing financial protection against unforeseen life, health, property, and liability events. Profits come from underwriting—collecting more in premiums than paid in claims—and investing the 'float'. This cyclical industry benefits from 'hard markets' with strong pricing power and higher interest rates that enhance investment income. AI adoption is improving underwriting through sophisticated data analysis and reducing costs via automation. However, 'soft markets' and low rates create headwinds, while the industry faces elevated claims costs from climate catastrophes, inflation, and rising litigation expenses.

The 57 insurance stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 3.8%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

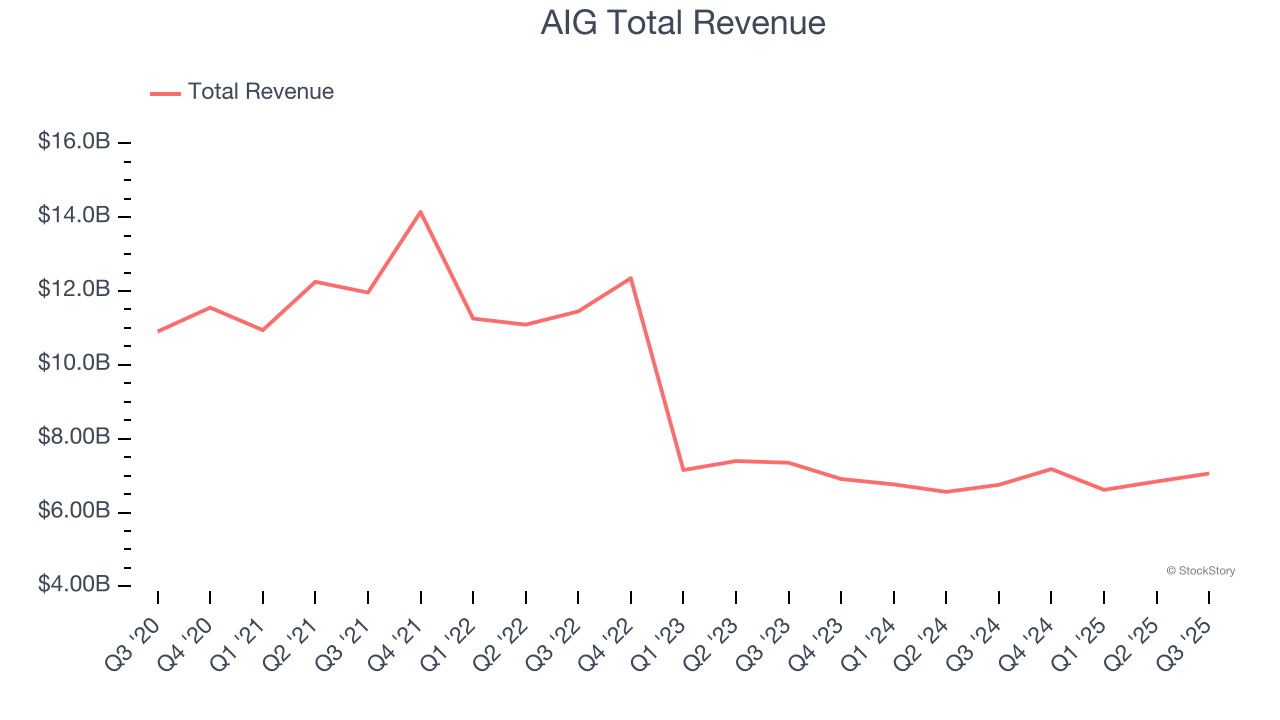

AIG (NYSE: AIG)

With roots dating back to 1919 when it began as a small insurance agency in Shanghai, China, AIG (NYSE: AIG) is a global insurance organization that provides commercial and personal insurance solutions to businesses and individuals across more than 200 countries.

AIG reported revenues of $7.06 billion, up 4.5% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ net premiums earned estimates.

Unsurprisingly, the stock is down 5.1% since reporting and currently trades at $76.56.

Is now the time to buy AIG? Access our full analysis of the earnings results here, it’s free for active Edge members.

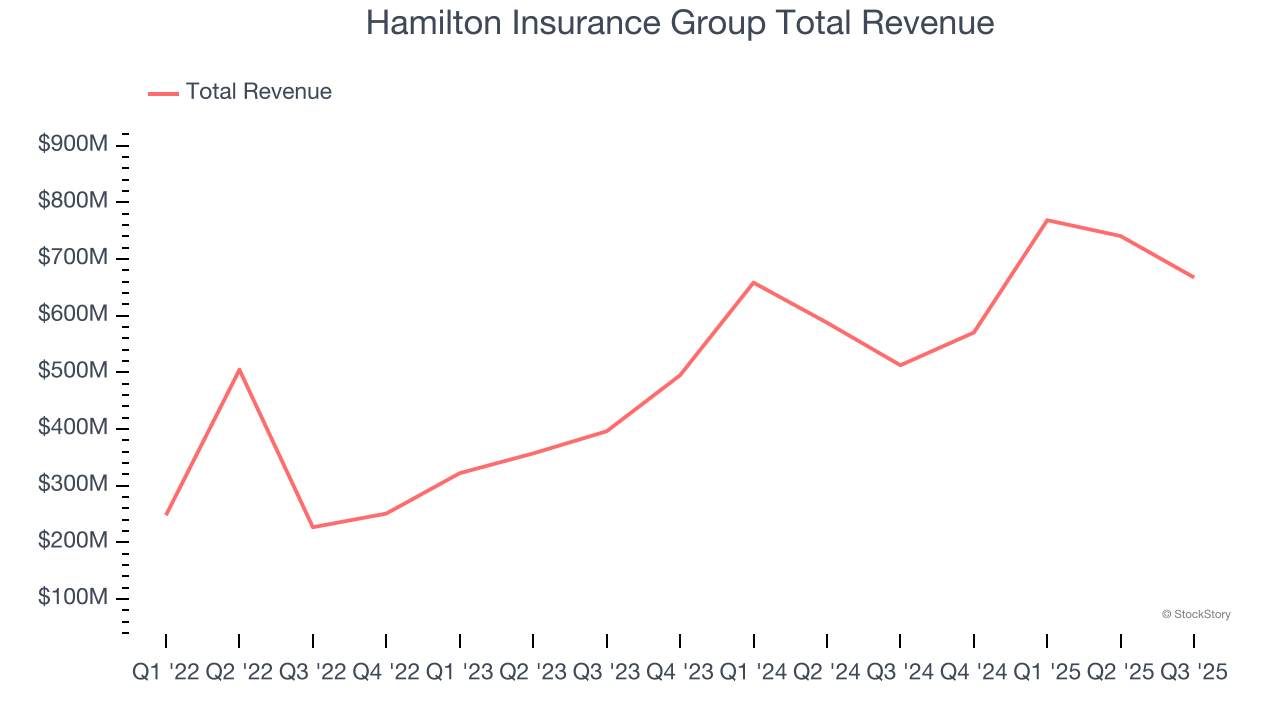

Best Q3: Hamilton Insurance Group (NYSE: HG)

Founded in 2013 and operating through three distinct underwriting platforms across four countries, Hamilton Insurance Group (NYSE: HG) operates global specialty insurance and reinsurance platforms across Lloyd's, Ireland, Bermuda, and the United States.

Hamilton Insurance Group reported revenues of $667.7 million, up 30.2% year on year, outperforming analysts’ expectations by 10.3%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 8.6% since reporting. It currently trades at $25.62.

Is now the time to buy Hamilton Insurance Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Brighthouse Financial (NASDAQ: BHF)

Spun off from MetLife in 2017 to focus specifically on retail financial products, Brighthouse Financial (NASDAQ: BHF) provides annuity contracts and life insurance products designed to help individuals protect wealth, generate income, and transfer assets.

Brighthouse Financial reported revenues of $2.17 billion, flat year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net premiums earned estimates.

The stock is flat since the results and currently trades at $65.64.

Read our full analysis of Brighthouse Financial’s results here.

W. R. Berkley (NYSE: WRB)

Founded in 1967 and operating through more than 50 specialized insurance units across the globe, W. R. Berkley (NYSE: WRB) underwrites commercial insurance and reinsurance through specialized subsidiaries serving industries from healthcare to construction to transportation.

W. R. Berkley reported revenues of $3.77 billion, up 10.8% year on year. This number surpassed analysts’ expectations by 1.7%. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ book value per share estimates and EPS in line with analysts’ estimates.

The stock is up 4.4% since reporting and currently trades at $76.95.

Read our full, actionable report on W. R. Berkley here, it’s free for active Edge members.

Root (NASDAQ: ROOT)

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $387.8 million, up 26.9% year on year. This result topped analysts’ expectations by 4.5%. It was an incredible quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ net premiums earned estimates.

The stock is down 14.4% since reporting and currently trades at $76.66.

Read our full, actionable report on Root here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.