As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the aerospace and defense industry, including Cadre (NYSE: CDRE) and its peers.

Emissions and automation are important in aerospace, so companies that boast advances in these areas can take market share. On the defense side, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression toward Taiwan–have highlighted the need for consistent or even elevated defense spending. As for challenges, demand for aerospace and defense products can ebb and flow with economic cycles and national defense budgets, which are unpredictable and particularly painful for companies with high fixed costs.

The 29 aerospace and defense stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 0.7% below.

While some aerospace and defense stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.3% since the latest earnings results.

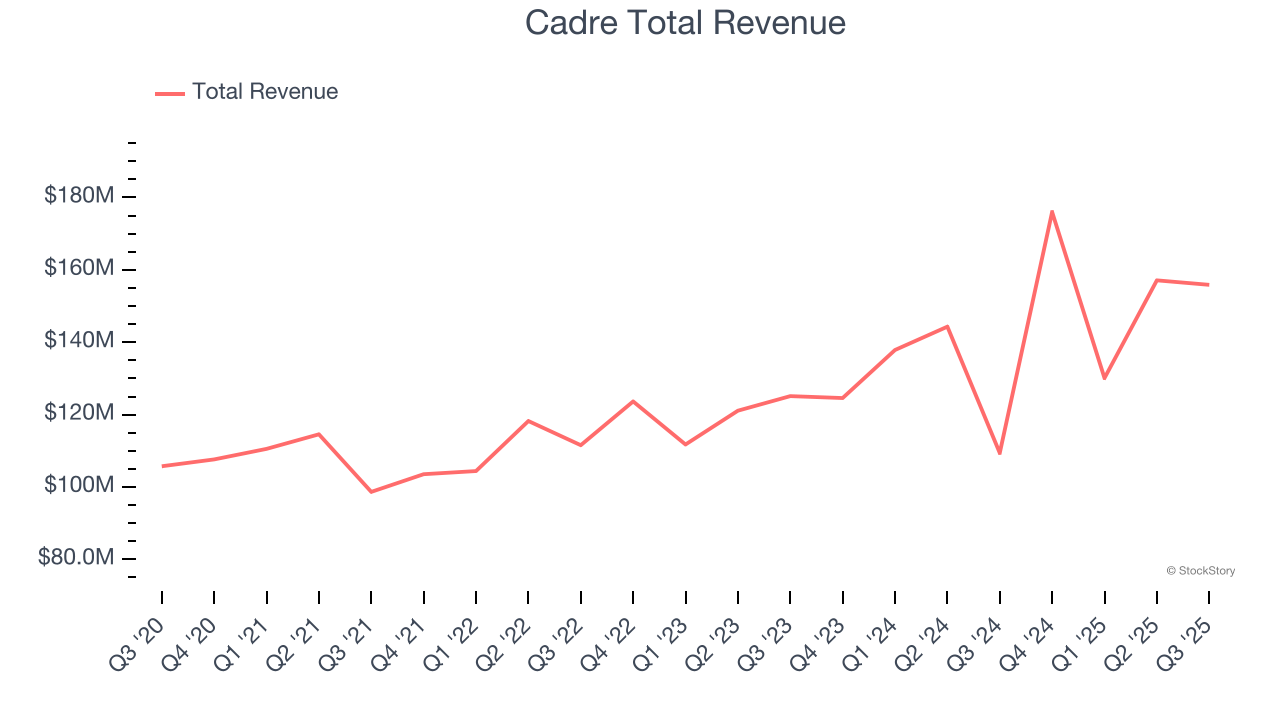

Cadre (NYSE: CDRE)

Originally known as Safariland, Cadre (NYSE: CDRE) specializes in manufacturing and distributing safety and survivability equipment for first responders.

Cadre reported revenues of $155.9 million, up 42.5% year on year. This print fell short of analysts’ expectations by 2.7%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ EBITDA estimates but a miss of analysts’ Products revenue estimates.

“We are pleased to report another quarter of strong performance, driven by Cadre’s industry leading brands and favorable trends across our law enforcement, first responder, military, and nuclear end-markets,” said Warren Kanders, CEO and Chairman.

Interestingly, the stock is up 3.3% since reporting and currently trades at $43.93.

Is now the time to buy Cadre? Access our full analysis of the earnings results here, it’s free for active Edge members.

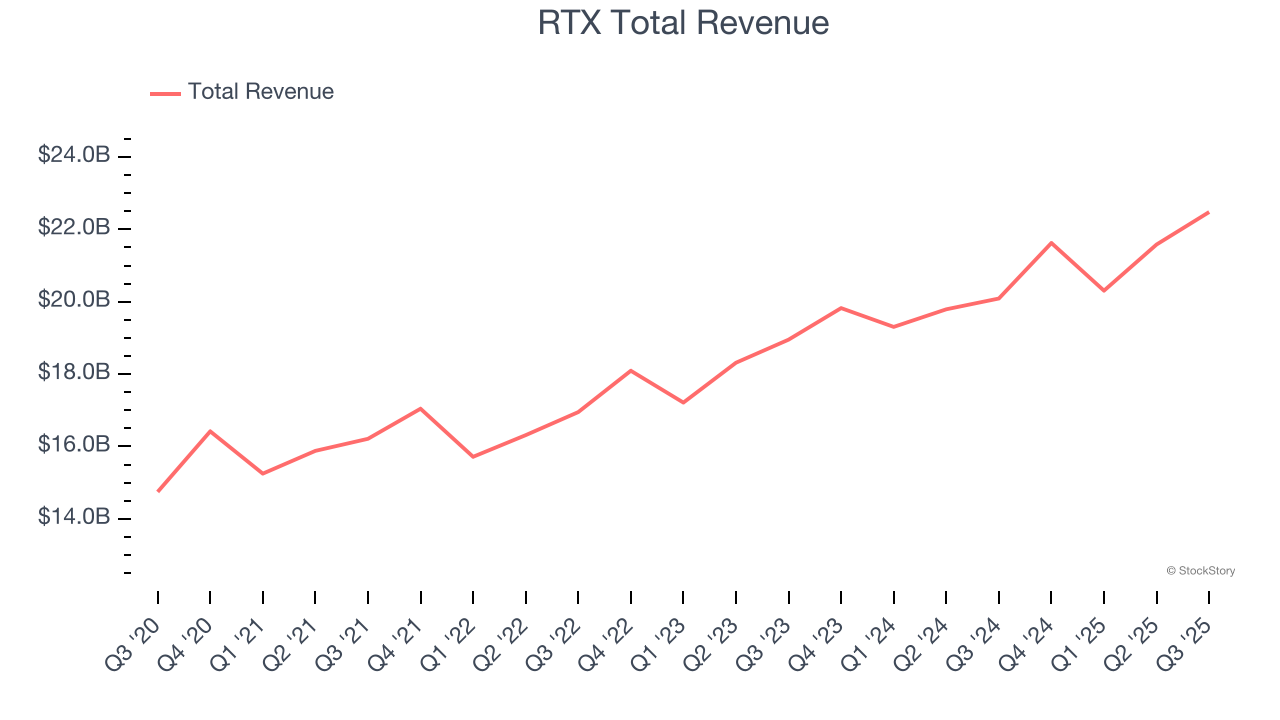

Best Q3: RTX (NYSE: RTX)

Originally focused on refrigeration technology, Raytheon (NSYE:RTX) provides a a variety of products and services to the aerospace and defense industries.

RTX reported revenues of $22.48 billion, up 11.9% year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 7.7% since reporting. It currently trades at $173.46.

Is now the time to buy RTX? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: AerSale (NASDAQ: ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ: ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $71.19 million, down 13.9% year on year, falling short of analysts’ expectations by 30.5%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

AerSale delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 7.6% since the results and currently trades at $6.46.

Read our full analysis of AerSale’s results here.

CACI (NYSE: CACI)

Founded to commercialize SIMSCRIPT, CACI International (NYSE: CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI reported revenues of $2.29 billion, up 11.2% year on year. This print beat analysts’ expectations by 1.1%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 18.4% since reporting and currently trades at $616.33.

Read our full, actionable report on CACI here, it’s free for active Edge members.

Woodward (NASDAQ: WWD)

Initially designing controls for water wheels in the early 1900s, Woodward (NASDAQ: WWD) designs, services, and manufactures energy control products and optimization solutions.

Woodward reported revenues of $995.3 million, up 16.5% year on year. This number surpassed analysts’ expectations by 5.9%. It was a very strong quarter as it also logged a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 10.8% since reporting and currently trades at $293.68.

Read our full, actionable report on Woodward here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.