Home healthcare provider Addus HomeCare (NASDAQ: ADUS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25% year on year to $362.3 million. Its non-GAAP profit of $1.56 per share was 1.7% above analysts’ consensus estimates.

Is now the time to buy Addus HomeCare? Find out by accessing our full research report, it’s free for active Edge members.

Addus HomeCare (ADUS) Q3 CY2025 Highlights:

- Revenue: $362.3 million vs analyst estimates of $354.5 million (25% year-on-year growth, 2.2% beat)

- Adjusted EPS: $1.56 vs analyst estimates of $1.53 (1.7% beat)

- Adjusted EBITDA: $45.15 million vs analyst estimates of $44.41 million (12.5% margin, 1.7% beat)

- Operating Margin: 9.1%, in line with the same quarter last year

- Sales Volumes rose 33.9% year on year (-2.3% in the same quarter last year)

- Market Capitalization: $2.12 billion

Commenting on the results, Dirk Allison, Chairman and Chief Executive Officer, said, “Our third quarter results reflect the continued strong momentum that we have experienced in our business throughout 2025, with net service revenues up 25.0% and adjusted EBITDA up 31.6% over the third quarter of 2024. During the quarter, we saw continued stable hiring trends, which supported our business, especially in our personal care segment. We continue to see favorable demand trends as consumers and payers continue to recognize the value and cost benefits of home-based healthcare services. Addus is well positioned to meet this growing demand with our expanding market coverage, along with our ability to provide the full continuum of care in certain markets. We are proud of our expanding team of capable and dedicated caregivers who provide outstanding care to a growing number of patients and families across the markets we serve.

Company Overview

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ: ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

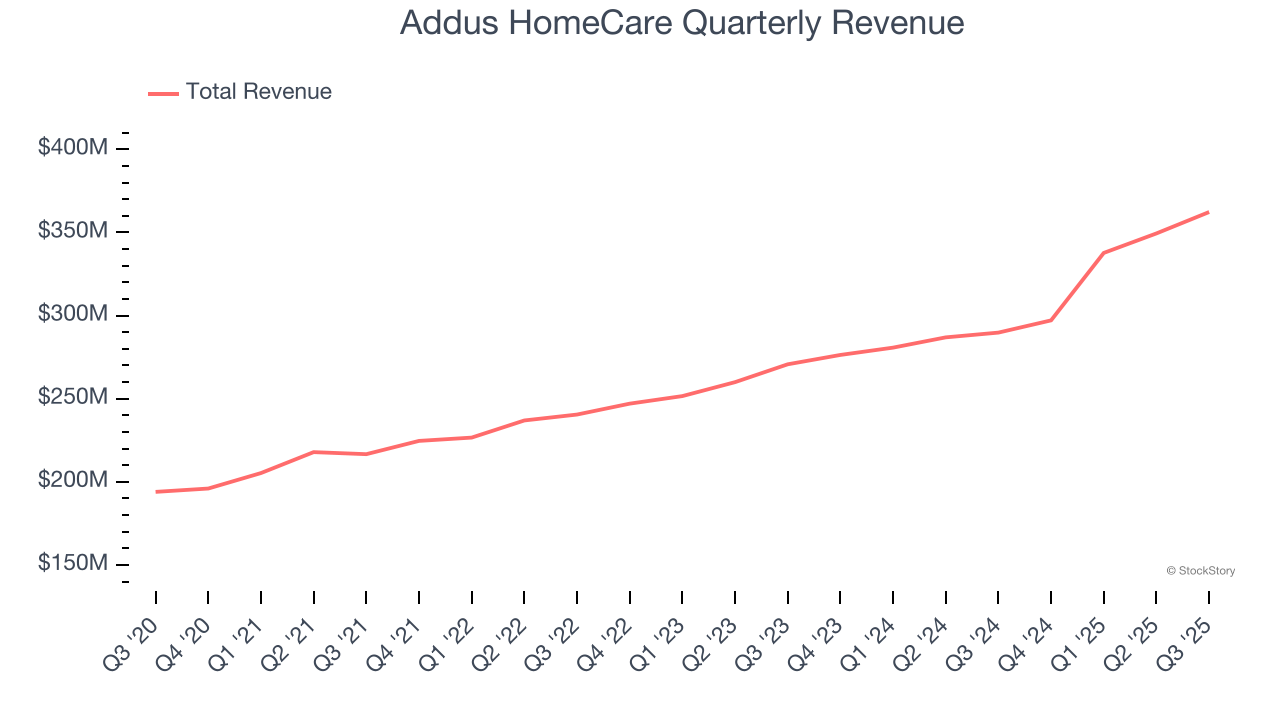

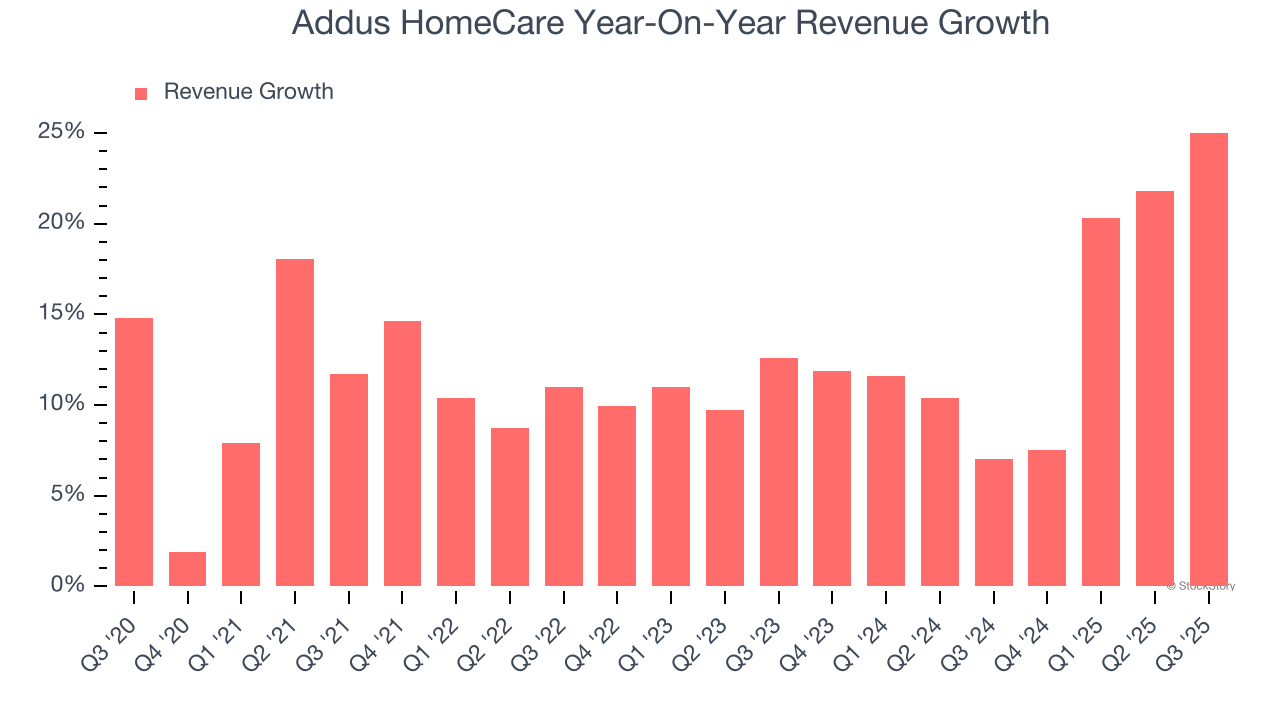

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Addus HomeCare’s sales grew at a solid 12.1% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Addus HomeCare’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

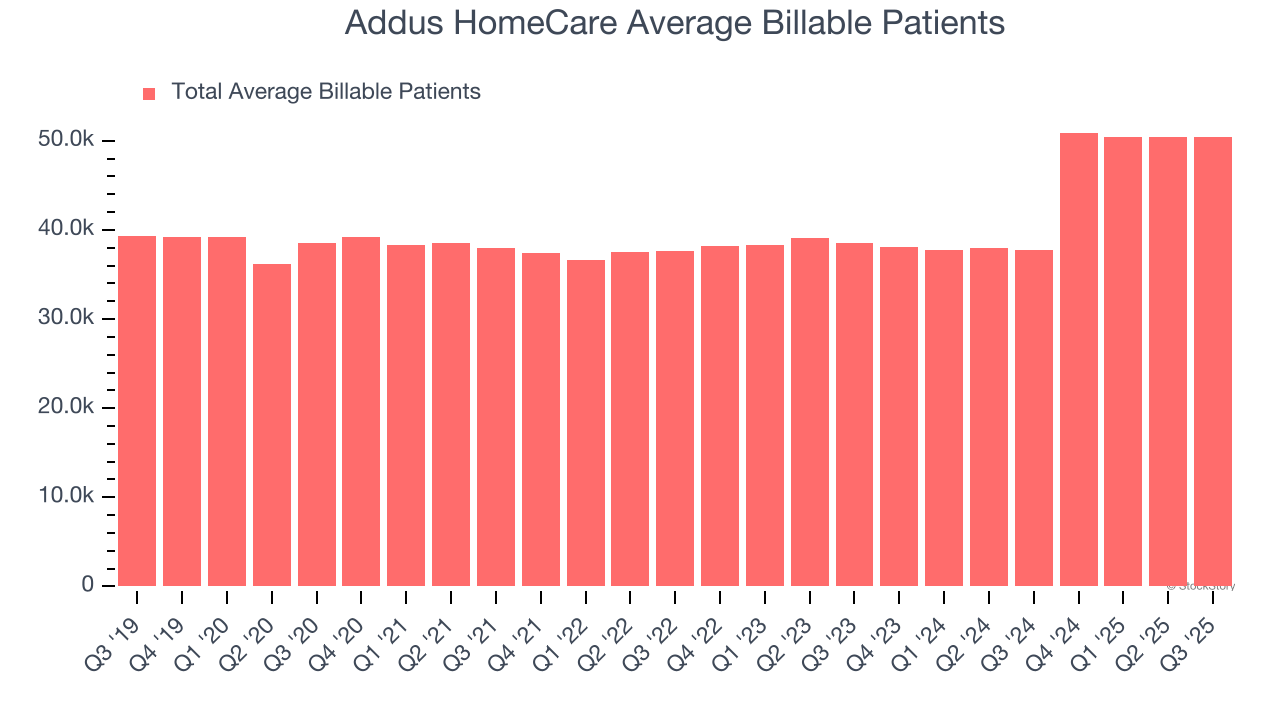

Addus HomeCare also reports its number of average billable patients, which reached 50,480 in the latest quarter. Over the last two years, Addus HomeCare’s average billable patients averaged 15.9% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Addus HomeCare reported robust year-on-year revenue growth of 25%, and its $362.3 million of revenue topped Wall Street estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market sees success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

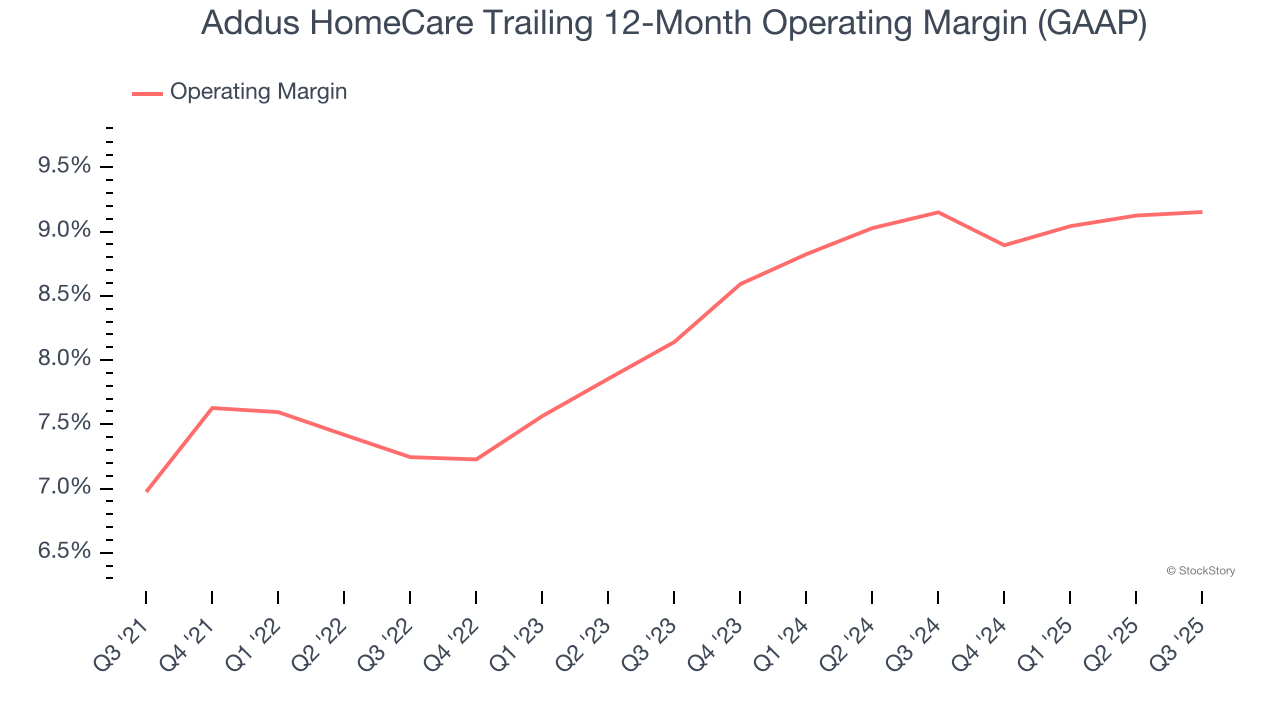

Addus HomeCare was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.3% was weak for a healthcare business.

On the plus side, Addus HomeCare’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1 percentage points on a two-year basis.

In Q3, Addus HomeCare generated an operating margin profit margin of 9.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

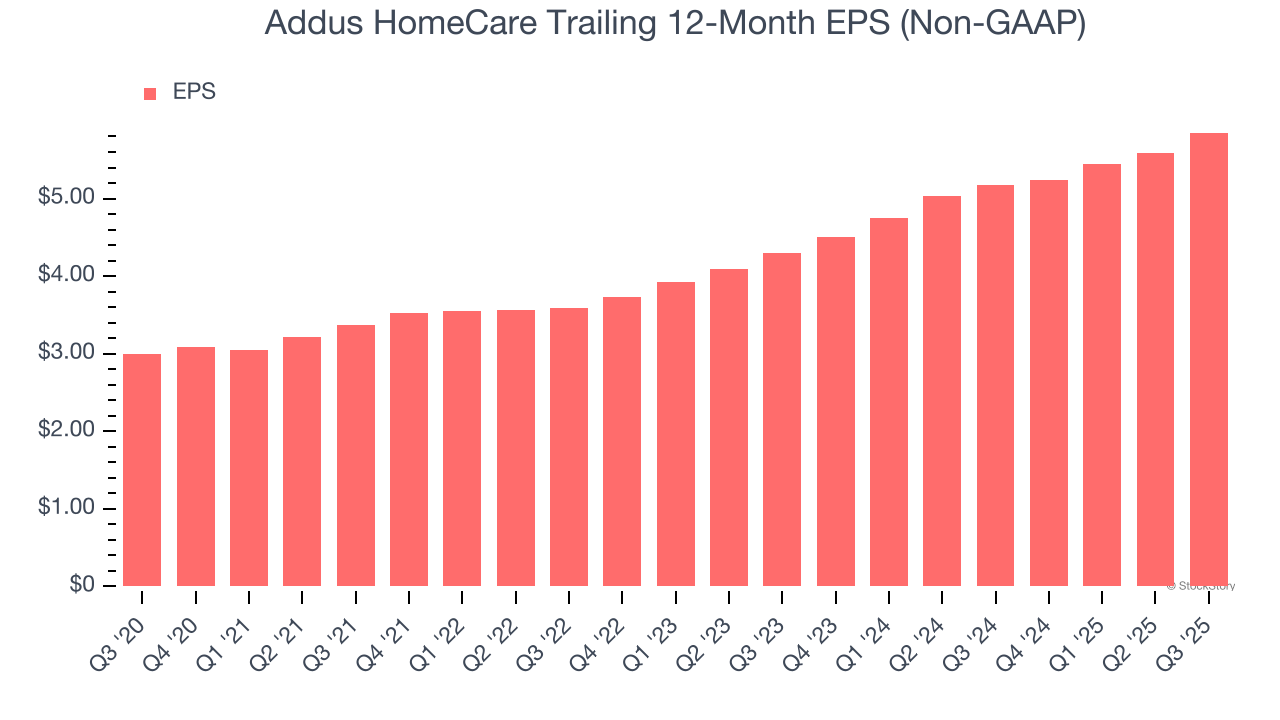

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Addus HomeCare’s EPS grew at a spectacular 14.4% compounded annual growth rate over the last five years, higher than its 12.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Addus HomeCare’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Addus HomeCare’s operating margin was flat this quarter but expanded by 2.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Addus HomeCare reported adjusted EPS of $1.56, up from $1.30 in the same quarter last year. This print beat analysts’ estimates by 1.7%. Over the next 12 months, Wall Street expects Addus HomeCare’s full-year EPS of $5.85 to grow 14.4%.

Key Takeaways from Addus HomeCare’s Q3 Results

It was encouraging to see Addus HomeCare beat analysts’ revenue expectations this quarter. EPS also exceeded expectations. Overall, this print had some key positives. The stock remained flat at $118 immediately following the results.

So should you invest in Addus HomeCare right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.