Cruise and exploration company Lindblad Expeditions (NASDAQ: LIND) will be reporting results this Tuesday morning. Here’s what to look for.

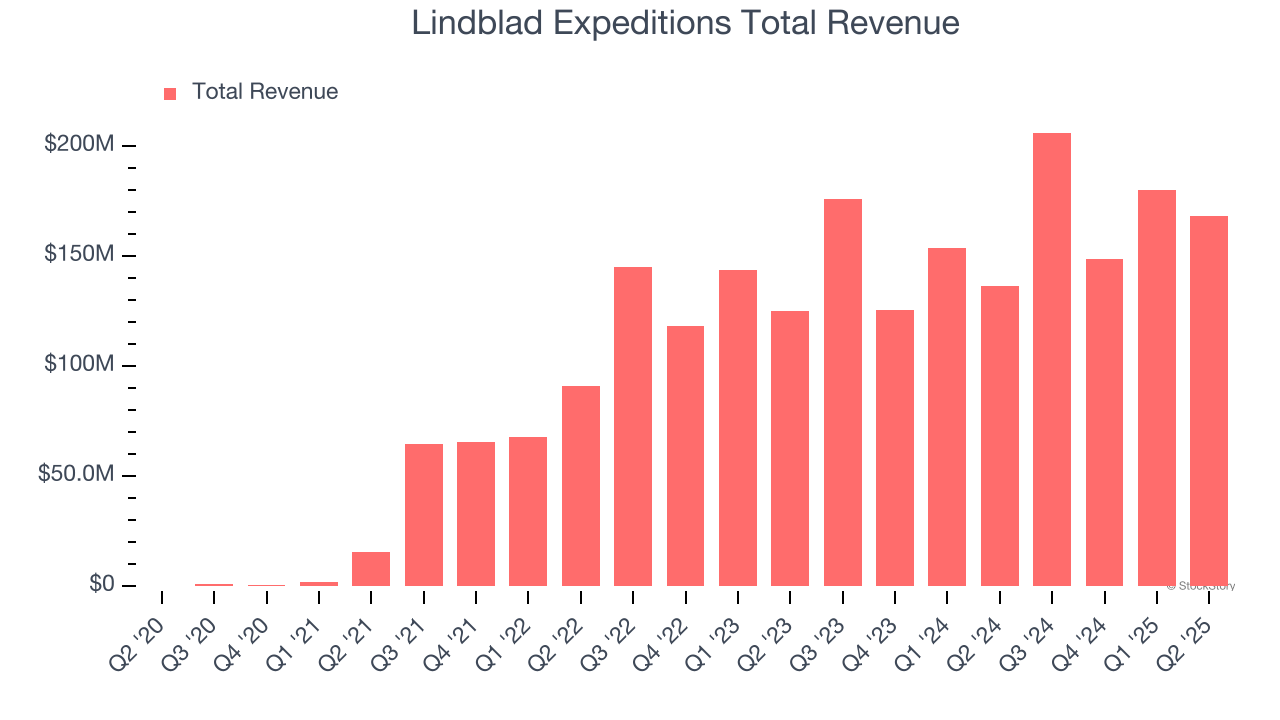

Lindblad Expeditions beat analysts’ revenue expectations by 5.6% last quarter, reporting revenues of $167.9 million, up 23% year on year. It was a very strong quarter for the company, with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Is Lindblad Expeditions a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Lindblad Expeditions’s revenue to grow 11.5% year on year to $229.7 million, slowing from the 17.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.22 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Lindblad Expeditions has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time since going public by 12.2% on average.

Looking at Lindblad Expeditions’s peers in the travel and vacation providers segment, some have already reported their Q3 results, giving us a hint as to what we can expect. American Airlines posted flat year-on-year revenue, meeting analysts’ expectations, and Delta reported revenues up 6.4%, topping estimates by 3.8%. American Airlines traded up 14.3% following the results while Delta’s stock price was unchanged.

Read our full analysis of American Airlines’s results here and Delta’s results here.

The outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. While some of the travel and vacation providers stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 4.7% on average over the last month. Lindblad Expeditions is down 3.3% during the same time and is heading into earnings with an average analyst price target of $15.33 (compared to the current share price of $12.06).

P.S. STOP buying the AI stocks everyone’s talking about. The real money? It’s in the profitable pick nobody’s watching yet. We’ve identified an AI profit machine that’s flying under Wall Street’s radar—for now. We can’t keep this research public forever—grab your FREE copy before we pull it offline. GO HERE NOW.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.