The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how United Bankshares (NASDAQ: UBSI) and the rest of the regional banks stocks fared in Q3.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 94 regional banks stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 1.2%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

United Bankshares (NASDAQ: UBSI)

With roots dating back to 1982 and a strong presence in the Mid-Atlantic region, United Bankshares (NASDAQ: UBSI) is a bank holding company that provides commercial and retail banking services through its United Bank subsidiary across multiple states.

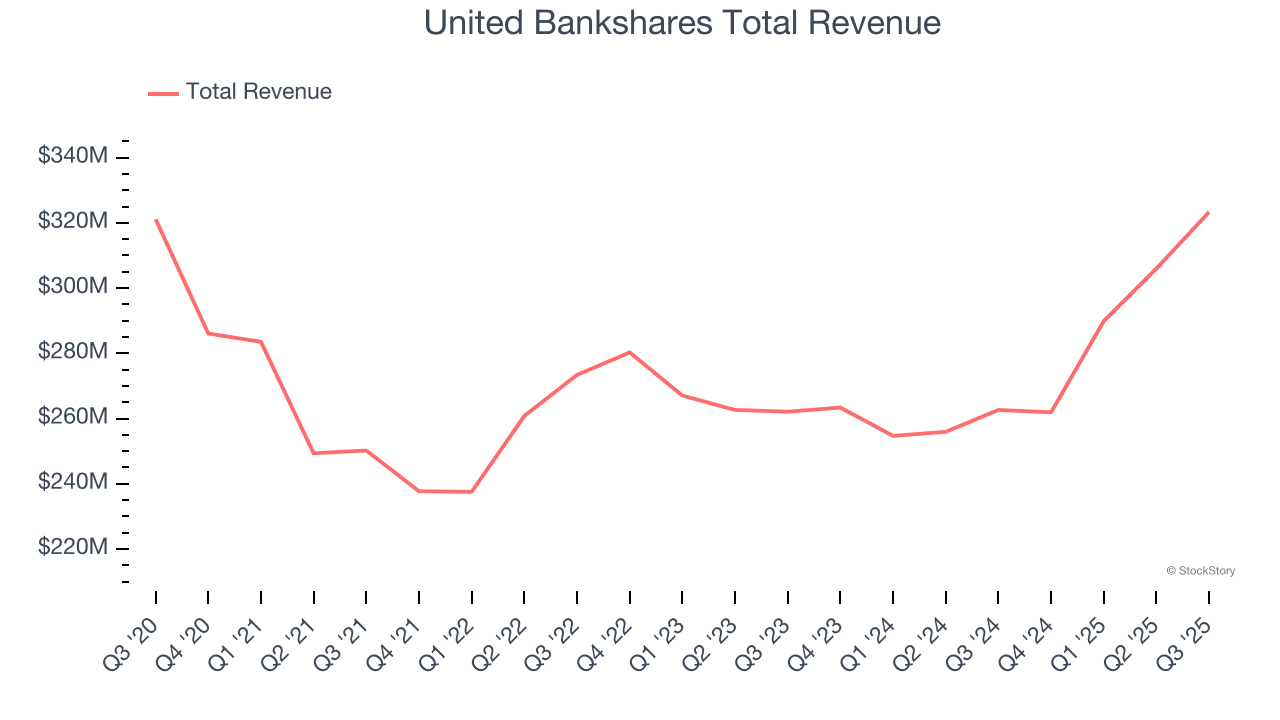

United Bankshares reported revenues of $323.3 million, up 23.1% year on year. This print exceeded analysts’ expectations by 5.1%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 1.6% since reporting and currently trades at $36.01.

Is now the time to buy United Bankshares? Access our full analysis of the earnings results here, it’s free for active Edge members.

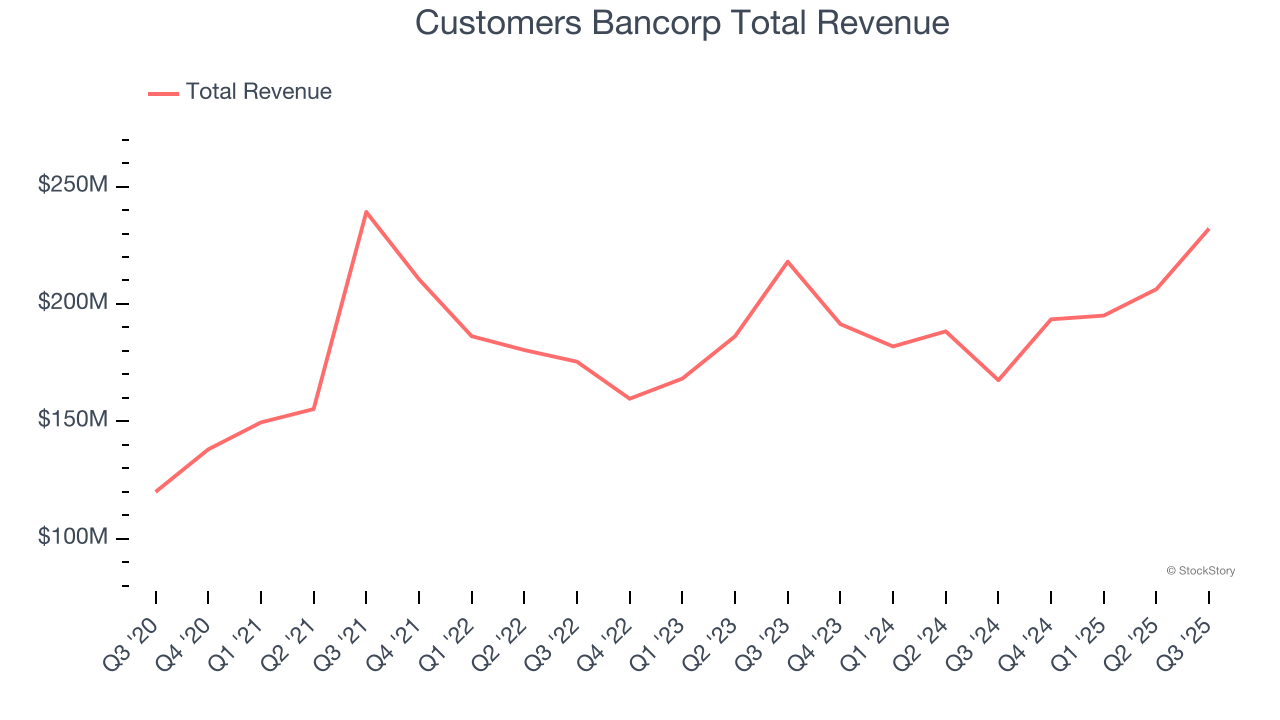

Best Q3: Customers Bancorp (NYSE: CUBI)

Originally founded with a "high-tech, high-touch" branch-light banking strategy, Customers Bancorp (NYSE: CUBI) is a bank holding company that provides commercial and consumer banking services through its Customers Bank subsidiary, with a focus on business lending and digital banking.

Customers Bancorp reported revenues of $232.1 million, up 38.5% year on year, outperforming analysts’ expectations by 7%. The business had a stunning quarter with an impressive beat of analysts’ net interest income estimates and a solid beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 3.7% since reporting. It currently trades at $68.

Is now the time to buy Customers Bancorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: The Bancorp (NASDAQ: TBBK)

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp (NASDAQ: TBBK) is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $174.6 million, up 38.8% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and net interest income estimates.

As expected, the stock is down 17.9% since the results and currently trades at $63.26.

Read our full analysis of The Bancorp’s results here.

Fifth Third Bancorp (NASDAQ: FITB)

Named after the merger of Third National Bank and Fifth National Bank in 1908, Fifth Third Bancorp (NASDAQ: FITB) is a financial services company that provides banking, lending, wealth management, and investment services to individuals and businesses across the Midwest and Southeast.

Fifth Third Bancorp reported revenues of $2.30 billion, up 5.8% year on year. This result beat analysts’ expectations by 0.6%. It was a satisfactory quarter as it also produced a narrow beat of analysts’ tangible book value per share estimates.

The stock is up 2.8% since reporting and currently trades at $41.53.

Read our full, actionable report on Fifth Third Bancorp here, it’s free for active Edge members.

Seacoast Banking (NASDAQ: SBCF)

Founded during the Florida land boom of 1926 and surviving the Great Depression, Seacoast Banking Corporation of Florida (NASDAQ: SBCF) is a financial holding company that provides commercial and retail banking, wealth management, and mortgage services throughout Florida.

Seacoast Banking reported revenues of $157.3 million, up 20.7% year on year. This print was in line with analysts’ expectations. It was a very strong quarter as it also logged a solid beat of analysts’ tangible book value per share estimates and a beat of analysts’ EPS estimates.

The stock is down 3.1% since reporting and currently trades at $30.44.

Read our full, actionable report on Seacoast Banking here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.