Banking and retail technology provider Diebold Nixdorf (NYSE: DBD) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 2% year on year to $945.2 million. Its GAAP profit of $1.11 per share was 11% above analysts’ consensus estimates.

Is now the time to buy Diebold Nixdorf? Find out by accessing our full research report, it’s free for active Edge members.

Diebold Nixdorf (DBD) Q3 CY2025 Highlights:

- Revenue: $945.2 million vs analyst estimates of $929.5 million (2% year-on-year growth, 1.7% beat)

- EPS (GAAP): $1.11 vs analyst estimates of $1 (11% beat)

- Adjusted EBITDA: $121.9 million vs analyst estimates of $128.1 million (12.9% margin, 4.8% miss)

- EBITDA guidance for the full year is $480 million at the midpoint, below analyst estimates of $485 million

- Operating Margin: 7.8%, up from 5% in the same quarter last year

- Free Cash Flow was $24.5 million, up from -$24.9 million in the same quarter last year

- Market Capitalization: $2.06 billion

Company Overview

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE: DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

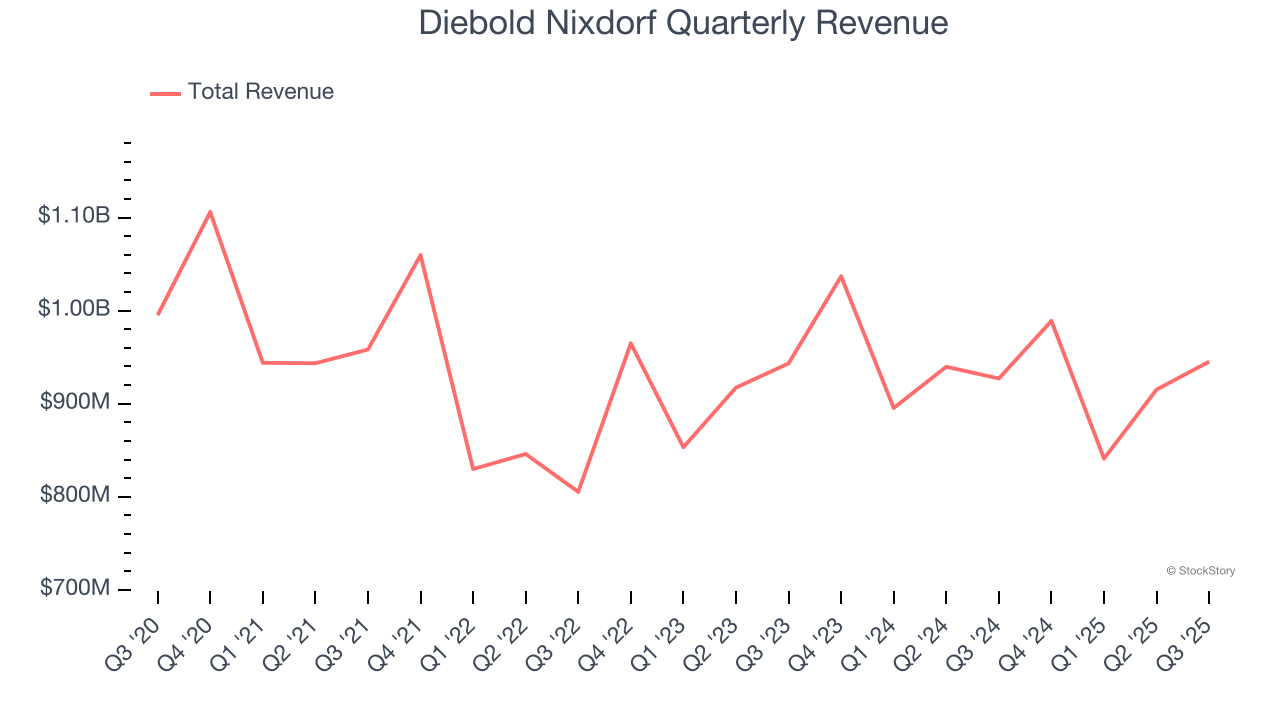

With $3.69 billion in revenue over the past 12 months, Diebold Nixdorf is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

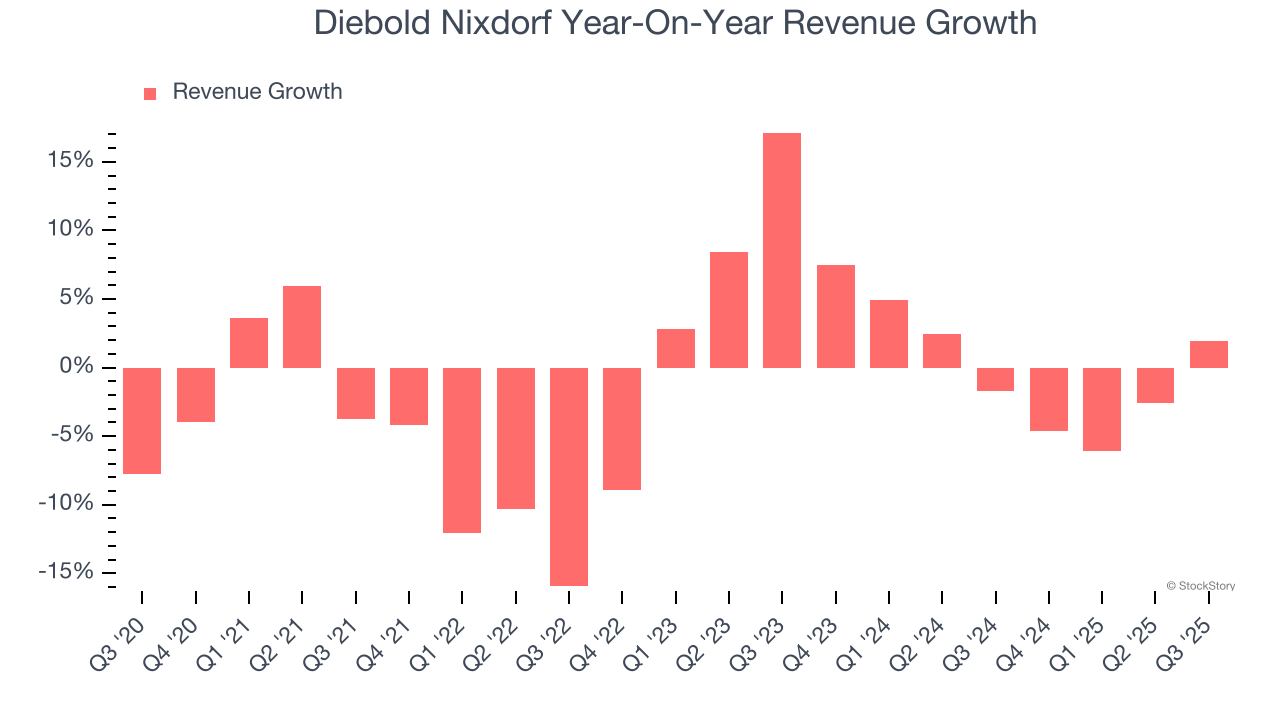

As you can see below, Diebold Nixdorf’s demand was weak over the last five years. Its sales fell by 1.3% annually, a tough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Diebold Nixdorf’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

This quarter, Diebold Nixdorf reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and suggests its newer products and services will fuel better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

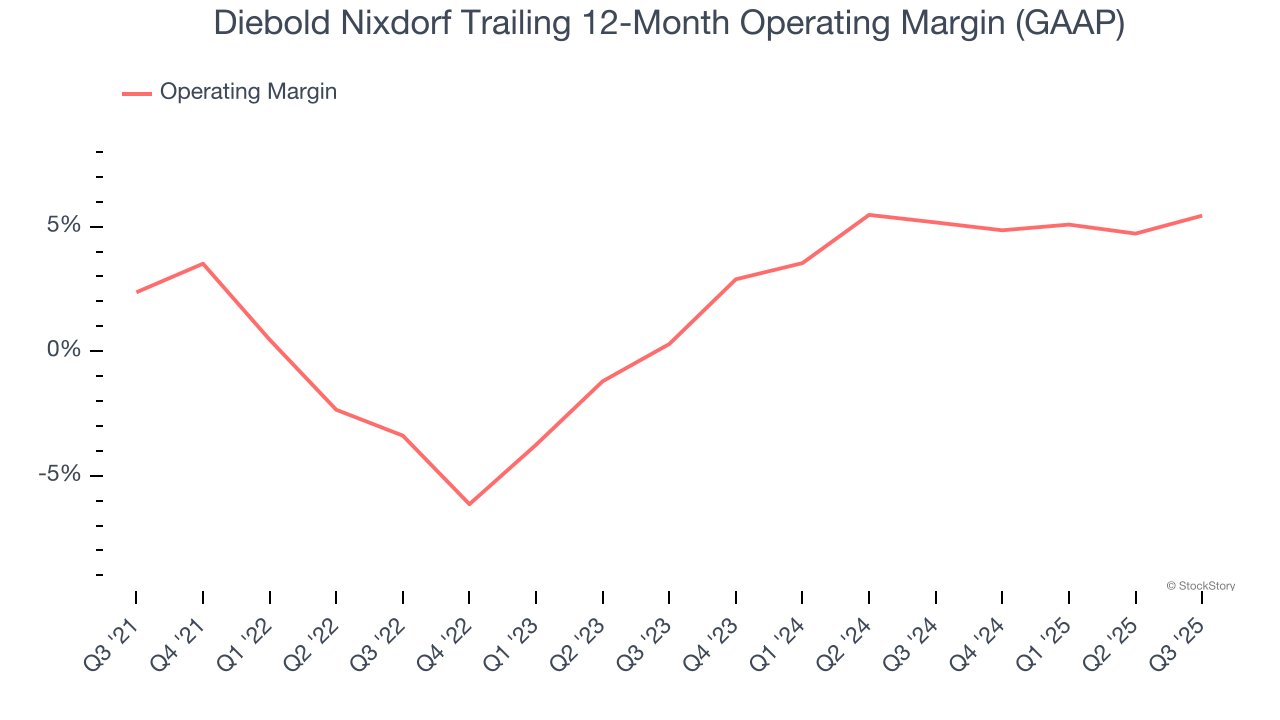

Operating Margin

Diebold Nixdorf was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for a business services business.

On the plus side, Diebold Nixdorf’s operating margin rose by 3.1 percentage points over the last five years.

In Q3, Diebold Nixdorf generated an operating margin profit margin of 7.8%, up 2.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

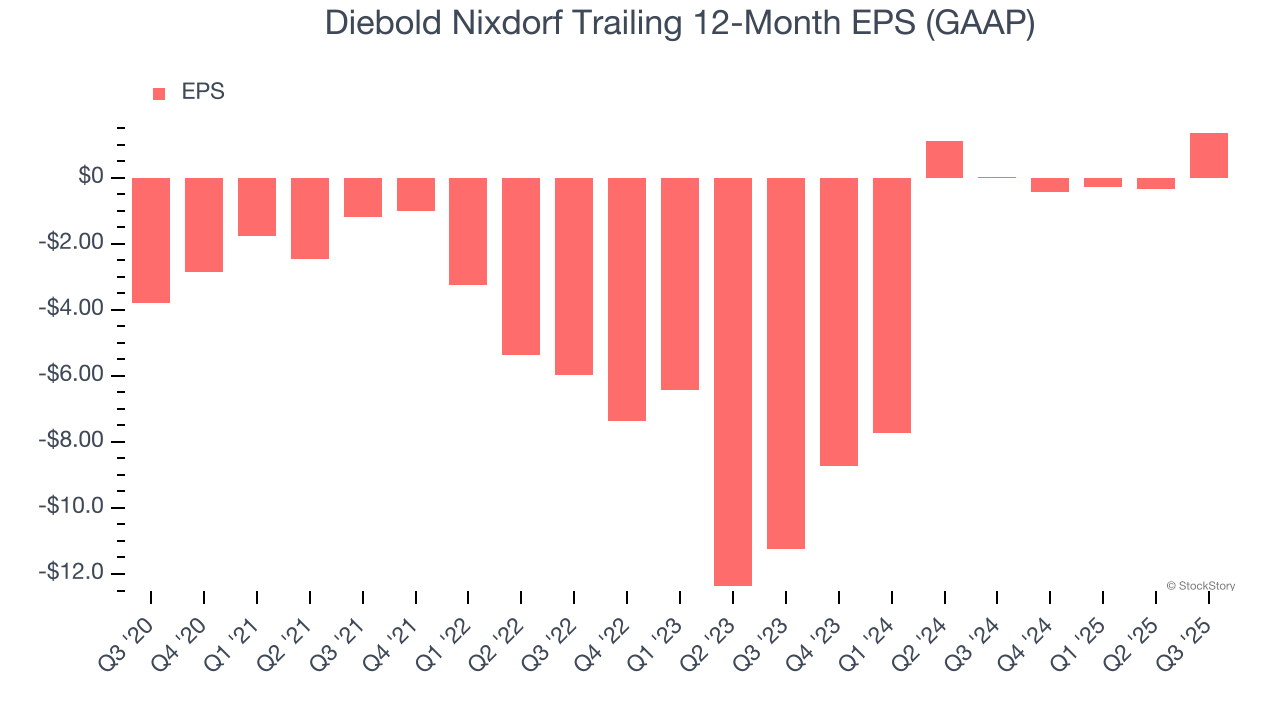

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Diebold Nixdorf’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Diebold Nixdorf, its two-year annual EPS growth of 45.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Diebold Nixdorf reported EPS of $1.11, up from negative $0.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Diebold Nixdorf’s full-year EPS of $1.37 to grow 153%.

Key Takeaways from Diebold Nixdorf’s Q3 Results

It was good to see Diebold Nixdorf beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 3% to $58 immediately after reporting.

Indeed, Diebold Nixdorf had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.