State Street has had an impressive run over the past six months as its shares have beaten the S&P 500 by 7.5%. The stock now trades at $116.88, marking a 28.8% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in State Street, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is State Street Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about State Street. Here are two reasons there are better opportunities than STT and a stock we'd rather own.

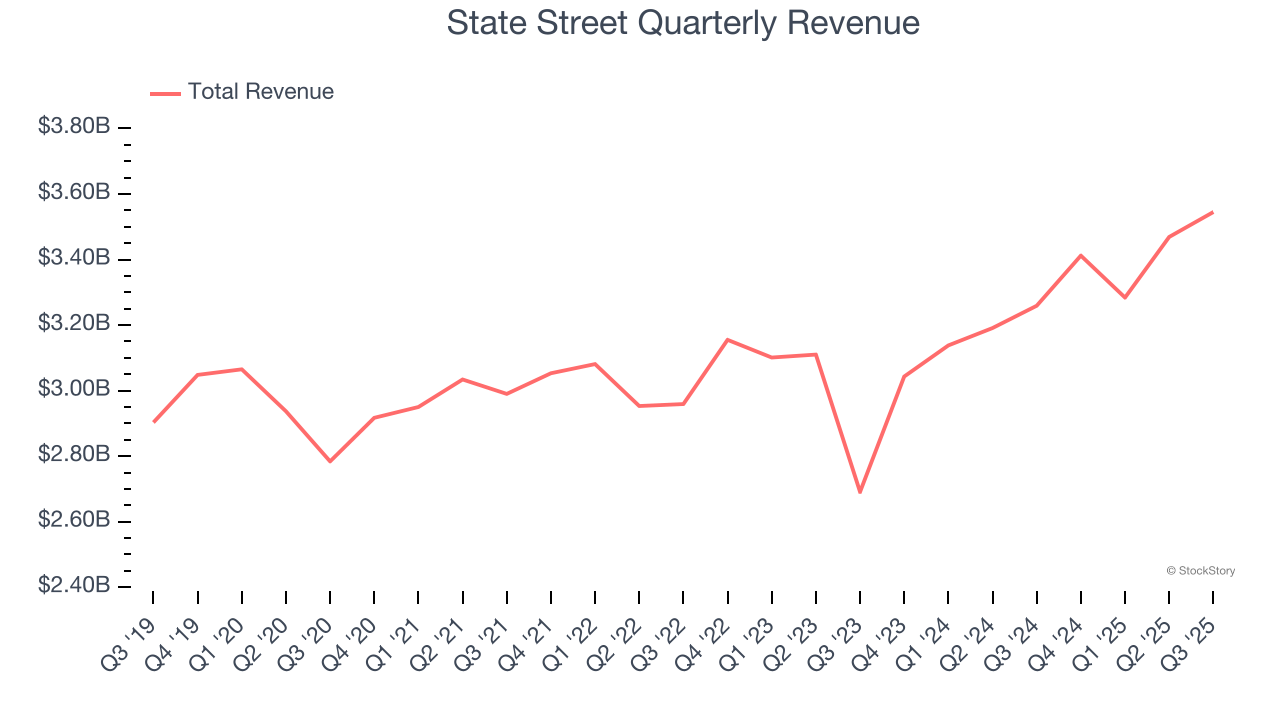

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Unfortunately, State Street’s 3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks.

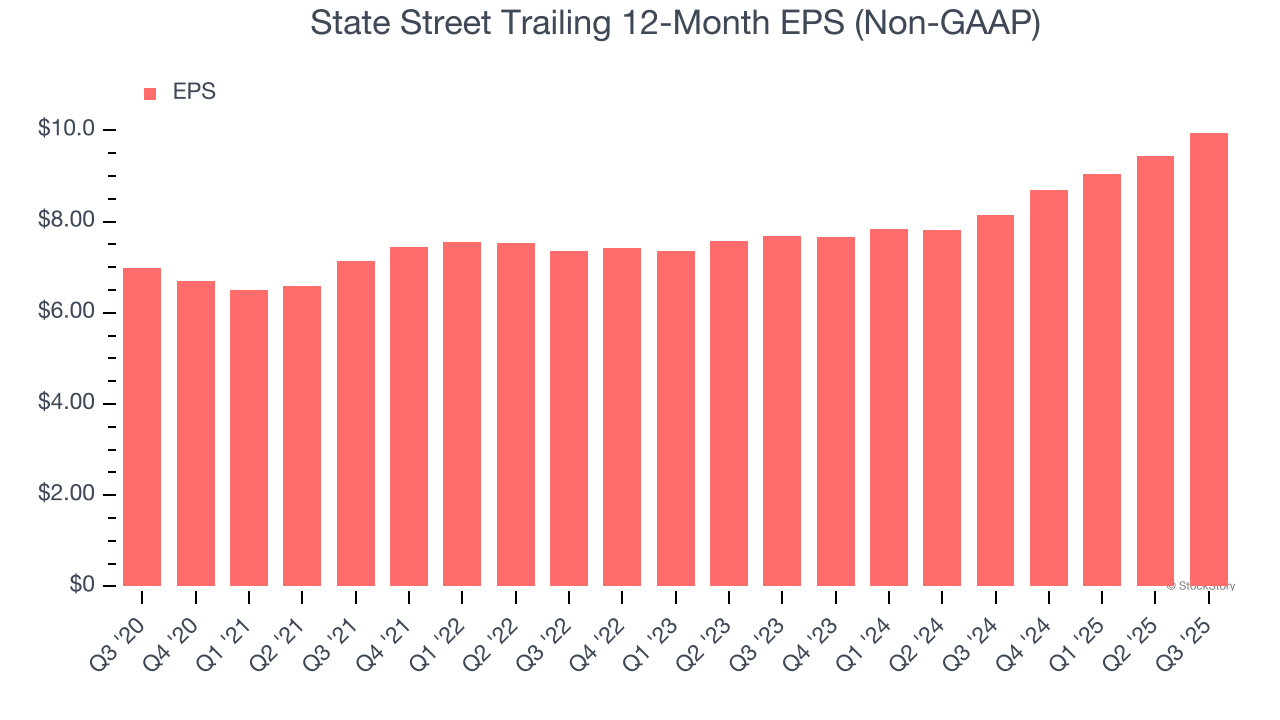

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

State Street’s EPS grew at an unimpressive 7.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

State Street isn’t a terrible business, but it doesn’t pass our bar. With its shares beating the market recently, the stock trades at 10.5× forward P/E (or $116.88 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of State Street

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.