Doughnut chain Krispy Kreme (NASDAQ: DNUT) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 1.2% year on year to $375.3 million. Its non-GAAP profit of $0.01 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Krispy Kreme? Find out by accessing our full research report, it’s free for active Edge members.

Krispy Kreme (DNUT) Q3 CY2025 Highlights:

- Revenue: $375.3 million vs analyst estimates of $378.2 million (1.2% year-on-year decline, 0.8% miss)

- Adjusted EPS: $0.01 vs analyst estimates of -$0.05 (significant beat)

- Adjusted EBITDA: $40.6 million vs analyst estimates of $28.33 million (10.8% margin, 43.3% beat)

- Operating Margin: -1.9%, up from -4.2% in the same quarter last year

- Free Cash Flow was $15.54 million, up from -$22.88 million in the same quarter last year

- Locations: 14,851 at quarter end, down from 15,811 in the same quarter last year

- Market Capitalization: $645.4 million

“Looking ahead to the remainder of 2025 and beyond, we expect further improvement in adjusted EBITDA and positive free cash flow. We also anticipate progress on our refranchising agenda and continued profitable expansion with key customers in the U.S., all while reducing capital spending and paying down debt,” said Krispy Kreme CEO Josh Charlesworth.

Company Overview

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ: DNUT) is one of the most beloved and well-known fast-food chains in the world.

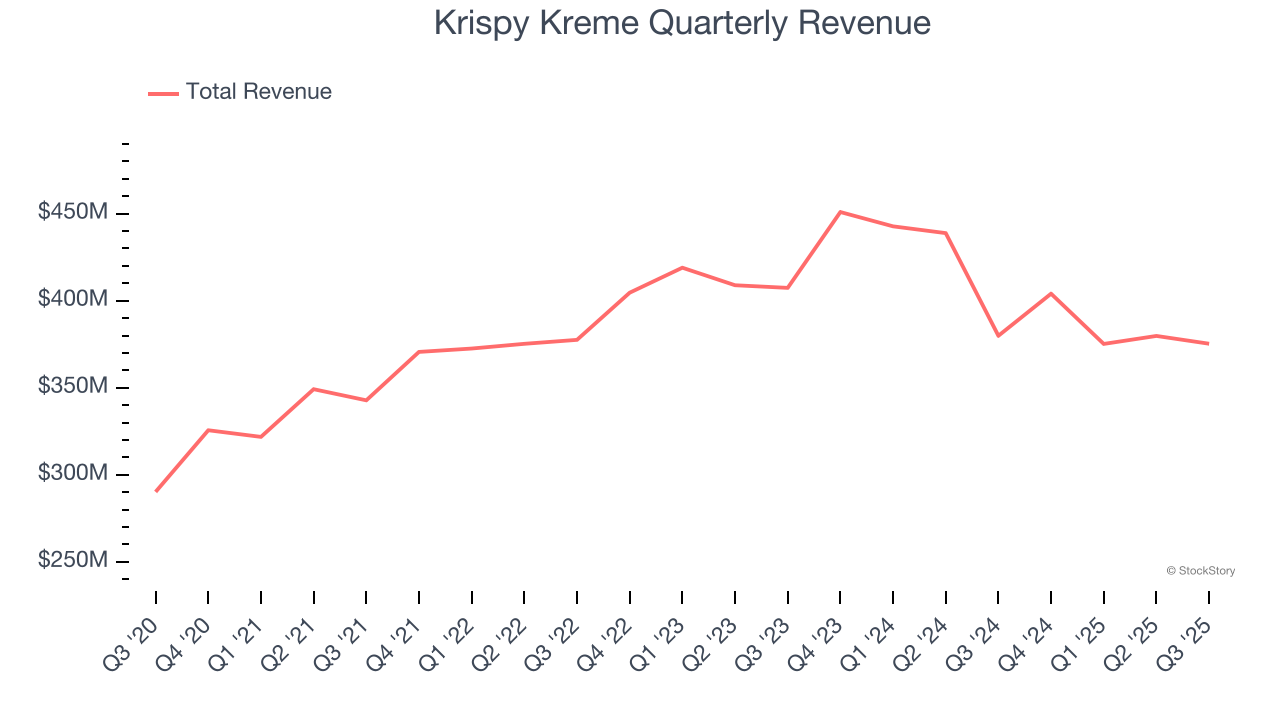

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.53 billion in revenue over the past 12 months, Krispy Kreme is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Krispy Kreme grew its sales at a decent 8.5% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and expanded its reach.

This quarter, Krispy Kreme missed Wall Street’s estimates and reported a rather uninspiring 1.2% year-on-year revenue decline, generating $375.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and suggests its menu offerings will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

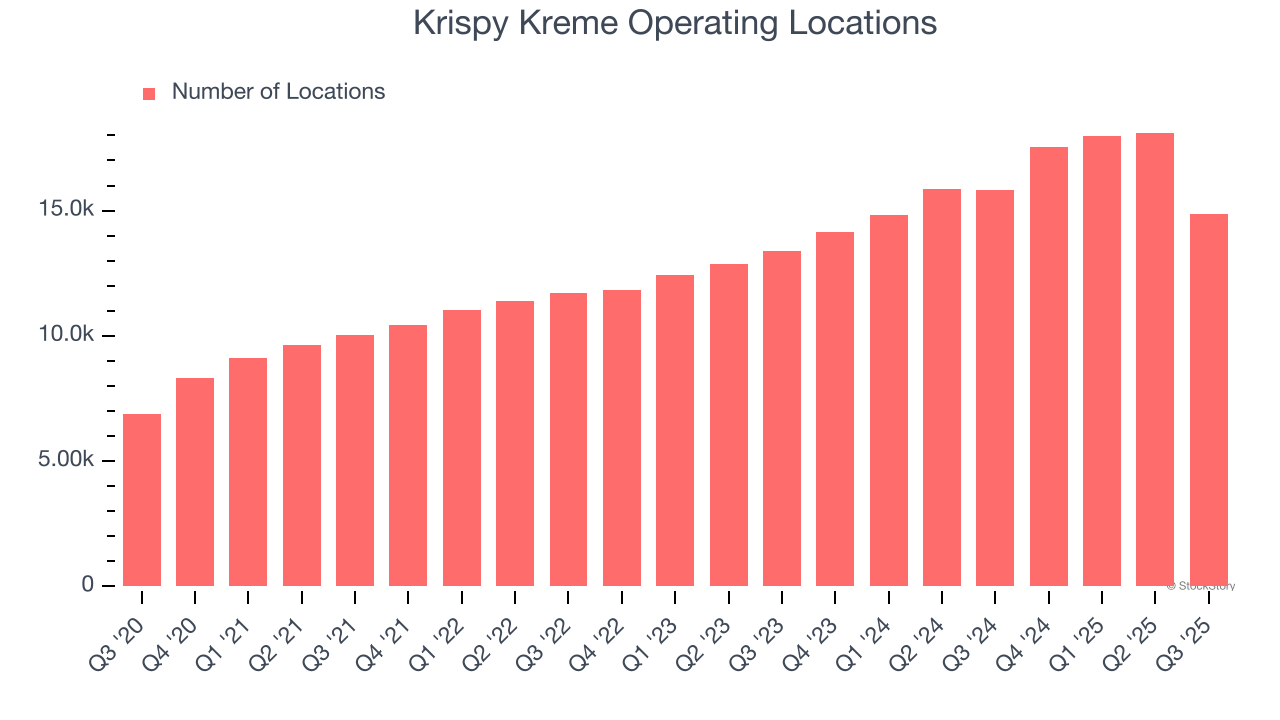

Number of Restaurants

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Krispy Kreme operated 14,851 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 16.7% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Key Takeaways from Krispy Kreme’s Q3 Results

It was good to see Krispy Kreme beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue slightly missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 9.6% to $4.15 immediately after reporting.

Krispy Kreme had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.