Financial guidance platform NerdWallet (NASDAQ: NRDS) announced better-than-expected revenue in Q3 CY2025, with sales up 12.4% year on year to $215.1 million. Its non-GAAP profit of $0.34 per share was 7.3% above analysts’ consensus estimates.

Is now the time to buy NerdWallet? Find out by accessing our full research report, it’s free for active Edge members.

NerdWallet (NRDS) Q3 CY2025 Highlights:

Company Overview

Born from founder Tim Chen's frustration with the lack of transparent credit card information when helping his sister in 2009, NerdWallet (NASDAQ: NRDS) is a digital platform that provides financial guidance to help consumers and small businesses make smarter decisions about credit cards, loans, insurance, and other financial products.

Revenue Growth

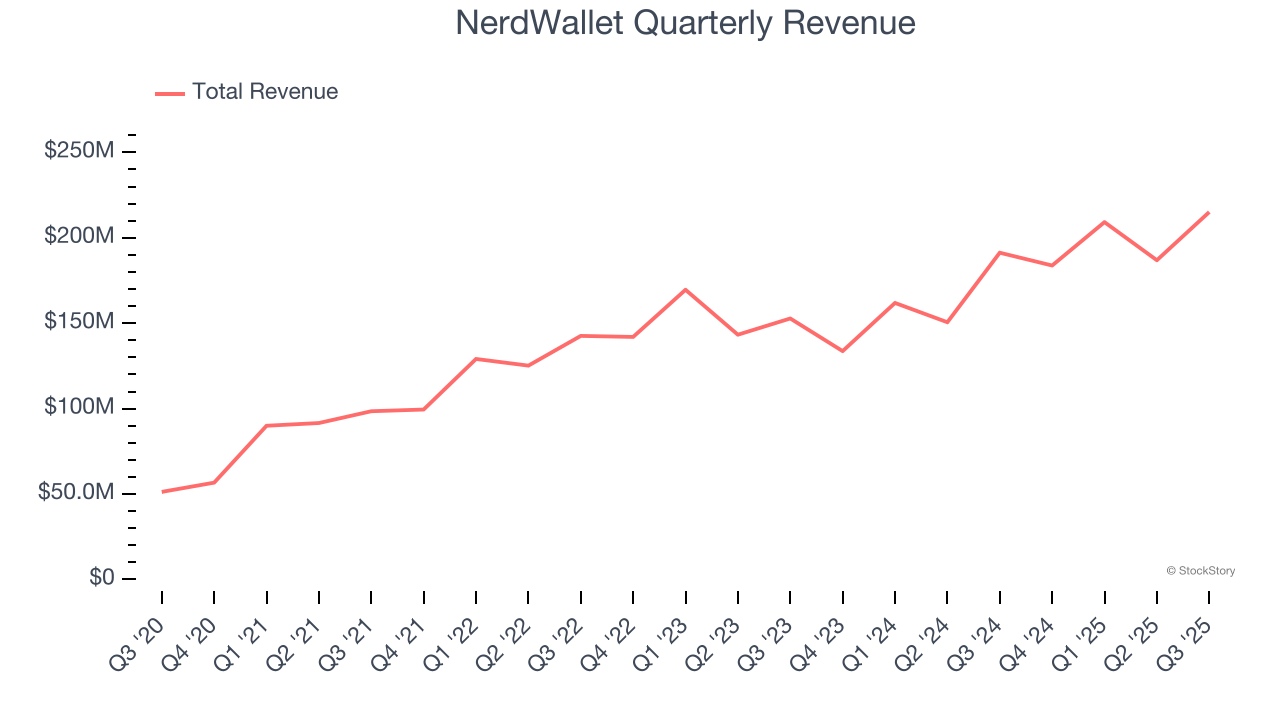

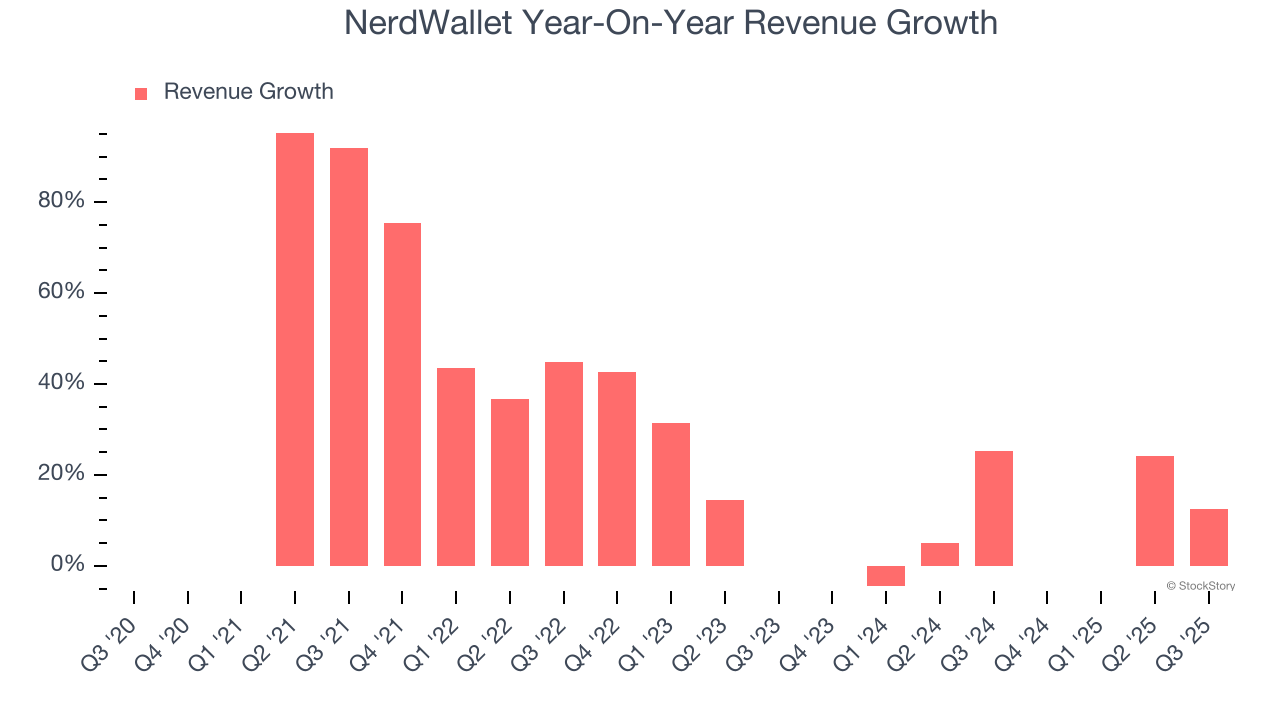

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, NerdWallet’s 26.5% annualized revenue growth over the last five years was incredible. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. NerdWallet’s annualized revenue growth of 14.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, NerdWallet reported year-on-year revenue growth of 12.4%, and its $215.1 million of revenue exceeded Wall Street’s estimates by 11.3%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Key Takeaways from NerdWallet’s Q3 Results

We were impressed by how significantly NerdWallet blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.3% to $12.77 immediately after reporting.

NerdWallet had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.