Local television broadcasting and media company Gray Television (NYSE: GTN) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 21.2% year on year to $749 million. On the other hand, next quarter’s revenue guidance of $774.5 million was less impressive, coming in 4.8% below analysts’ estimates. Its GAAP loss of $0.24 per share was 50% above analysts’ consensus estimates.

Is now the time to buy Gray Television? Find out by accessing our full research report, it’s free for active Edge members.

Gray Television (GTN) Q3 CY2025 Highlights:

- Revenue: $749 million vs analyst estimates of $746.1 million (21.2% year-on-year decline, in line)

- EPS (GAAP): -$0.24 vs analyst estimates of -$0.48 (50% beat)

- Adjusted EBITDA: $162 million vs analyst estimates of $138.8 million (21.6% margin, 16.7% beat)

- Revenue Guidance for Q4 CY2025 is $774.5 million at the midpoint, below analyst estimates of $813.3 million

- Operating Margin: 13.6%, down from 26.3% in the same quarter last year

- Market Capitalization: $478.1 million

Company Overview

Specializing in local media coverage, Gray Television (NYSE: GTN) is a broadcast company supplying digital media to various markets in the United States.

Revenue Growth

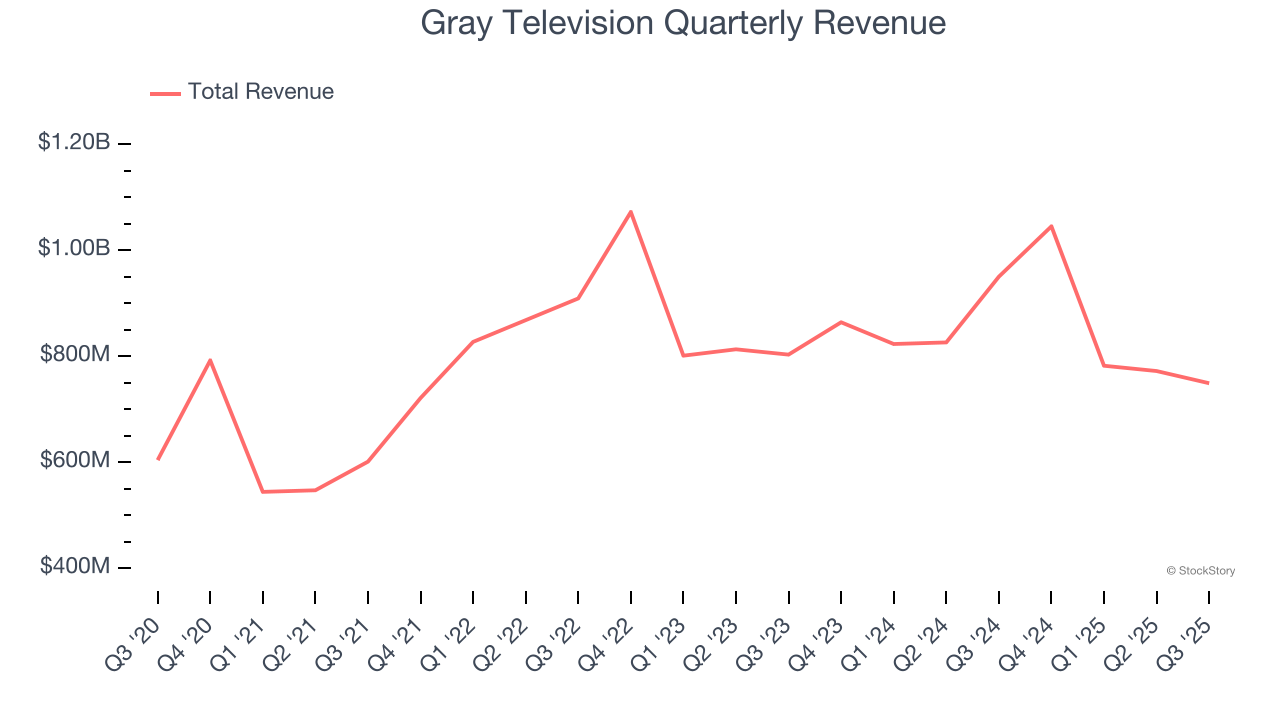

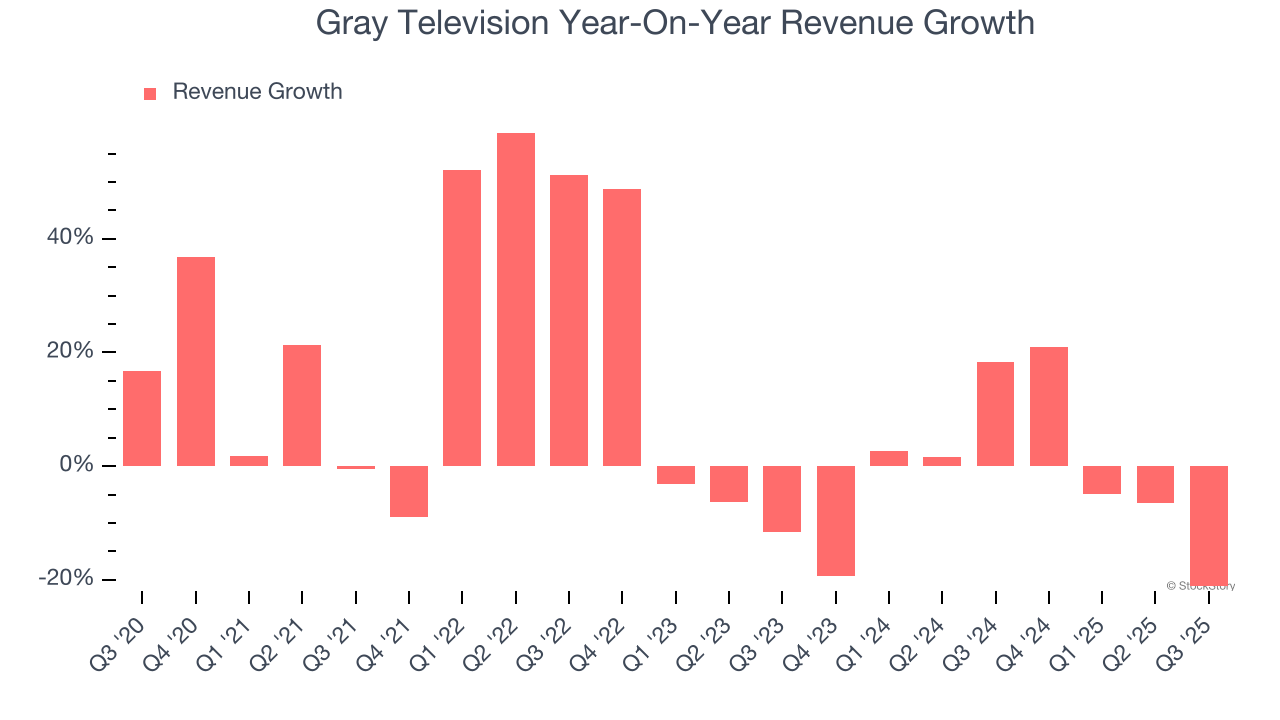

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Gray Television’s 9.1% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Gray Television’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2% annually.

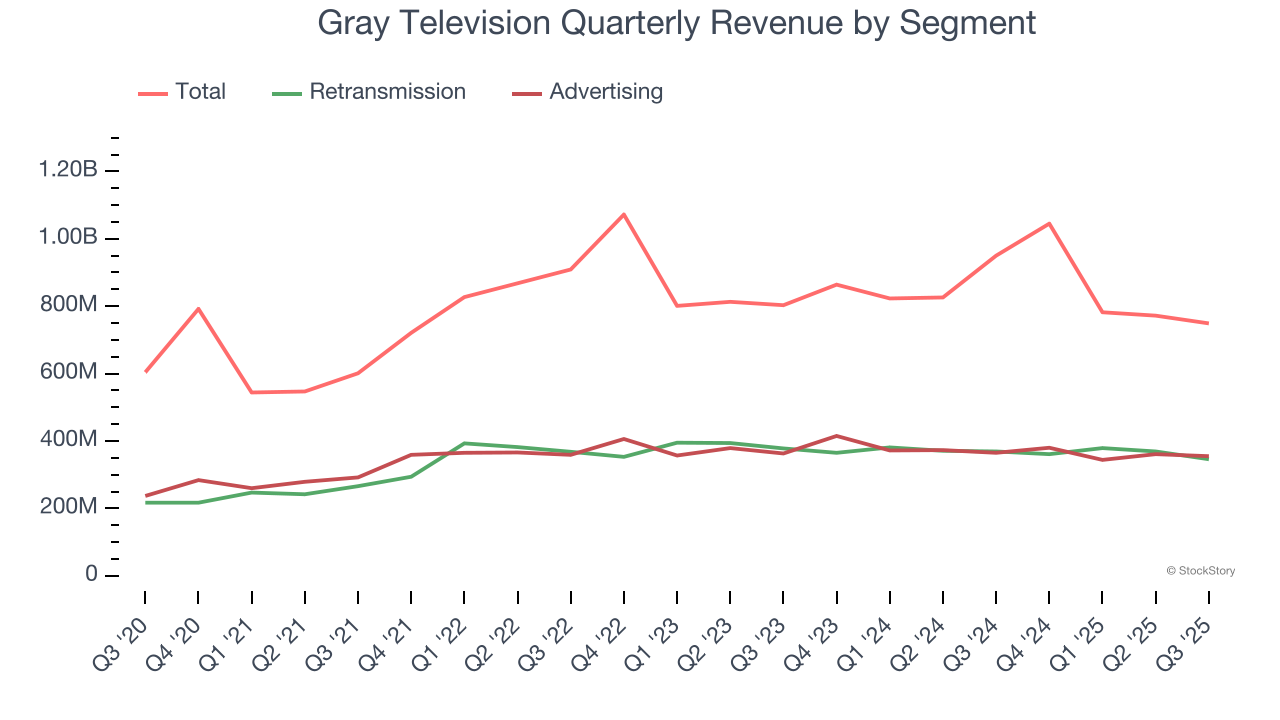

Gray Television also breaks out the revenue for its most important segments, Retransmission and Advertising, which are 46.2% and 47.4% of revenue. Over the last two years, Gray Television’s Retransmission revenue (affiliate and licensing fees) averaged 2.1% year-on-year declines while its Advertising revenue (marketing services) averaged 2.1% declines.

This quarter, Gray Television reported a rather uninspiring 21.2% year-on-year revenue decline to $749 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 25.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

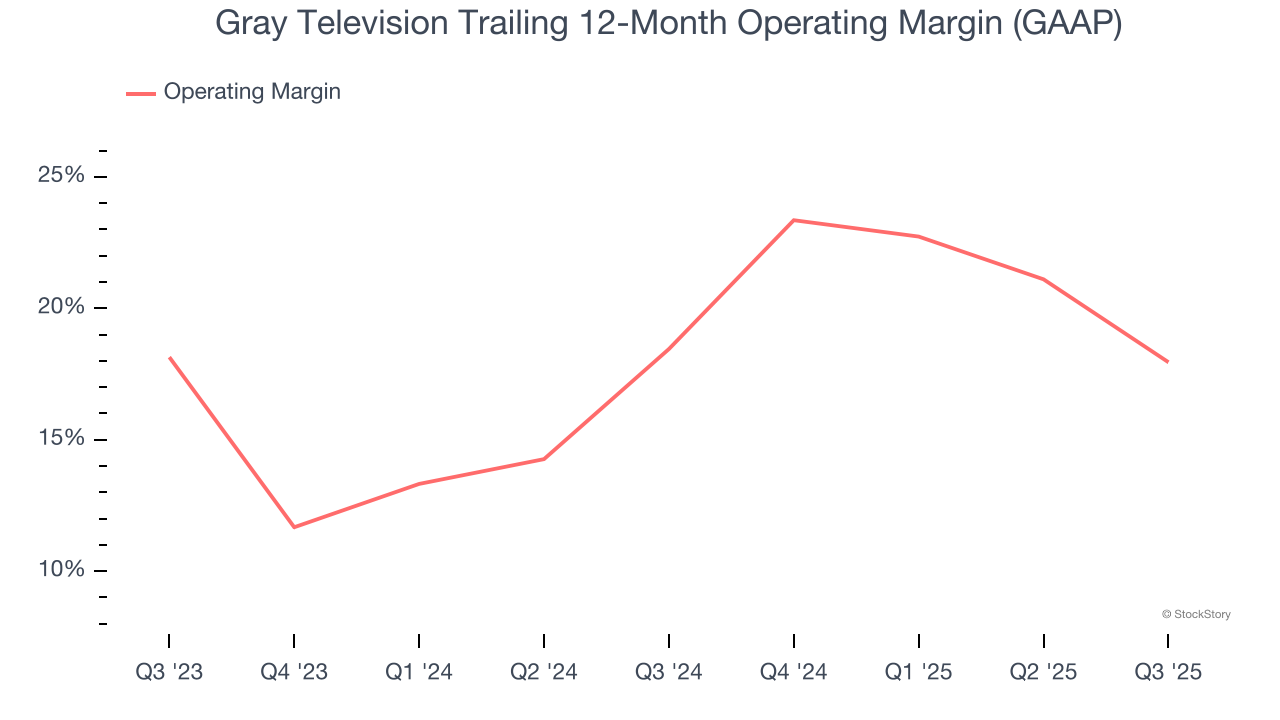

Gray Television’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 18.2% over the last two years. This profitability was top-notch for a consumer discretionary business, showing it’s an well-run company with an efficient cost structure.

This quarter, Gray Television generated an operating margin profit margin of 13.6%, down 12.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

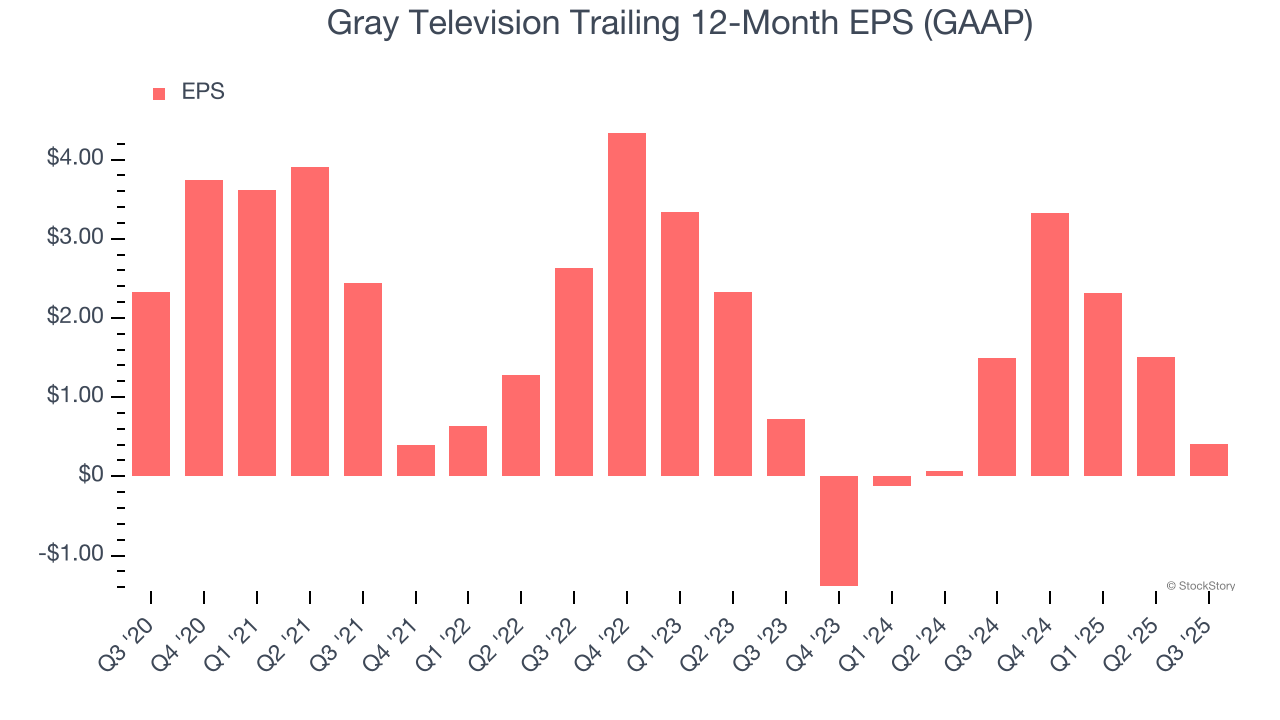

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Gray Television, its EPS declined by 29.4% annually over the last five years while its revenue grew by 9.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Gray Television reported EPS of negative $0.24, down from $0.86 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Gray Television’s full-year EPS of $0.41 to shrink by 18.3%.

Key Takeaways from Gray Television’s Q3 Results

It was good to see Gray Television beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 5.7% to $4.36 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.