Outdoor specialty retailer Sportsman's Warehouse (NASDAQ: SPWH) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2.2% year on year to $331.3 million. Its non-GAAP profit of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy Sportsman's Warehouse? Find out by accessing our full research report, it’s free for active Edge members.

Sportsman's Warehouse (SPWH) Q3 CY2025 Highlights:

- Revenue: $331.3 million vs analyst estimates of $331.1 million (2.2% year-on-year growth, in line)

- Adjusted EPS: $0.08 vs analyst estimates of $0.08 (in line)

- Adjusted EBITDA: $18.62 million vs analyst estimates of $18.4 million (5.6% margin, 1.2% beat)

- EBITDA guidance for the full year is $24 million at the midpoint, below analyst estimates of $34.61 million

- Operating Margin: 1.3%, in line with the same quarter last year

- Free Cash Flow was $8.74 million, up from -$6.16 million in the same quarter last year

- Same-Store Sales rose 2.2% year on year (-5.7% in the same quarter last year)

- Market Capitalization: $92.62 million

“This quarter we delivered our third consecutive period of positive same-store sales growth, driven by strong performance in our hunting, fishing, firearms, and personal protection categories, while continuing to gain share in a highly promotional and challenging retail environment,” said Paul Stone, Chief Executive Officer of Sportsman’s Warehouse.

Company Overview

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ: SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.21 billion in revenue over the past 12 months, Sportsman's Warehouse is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

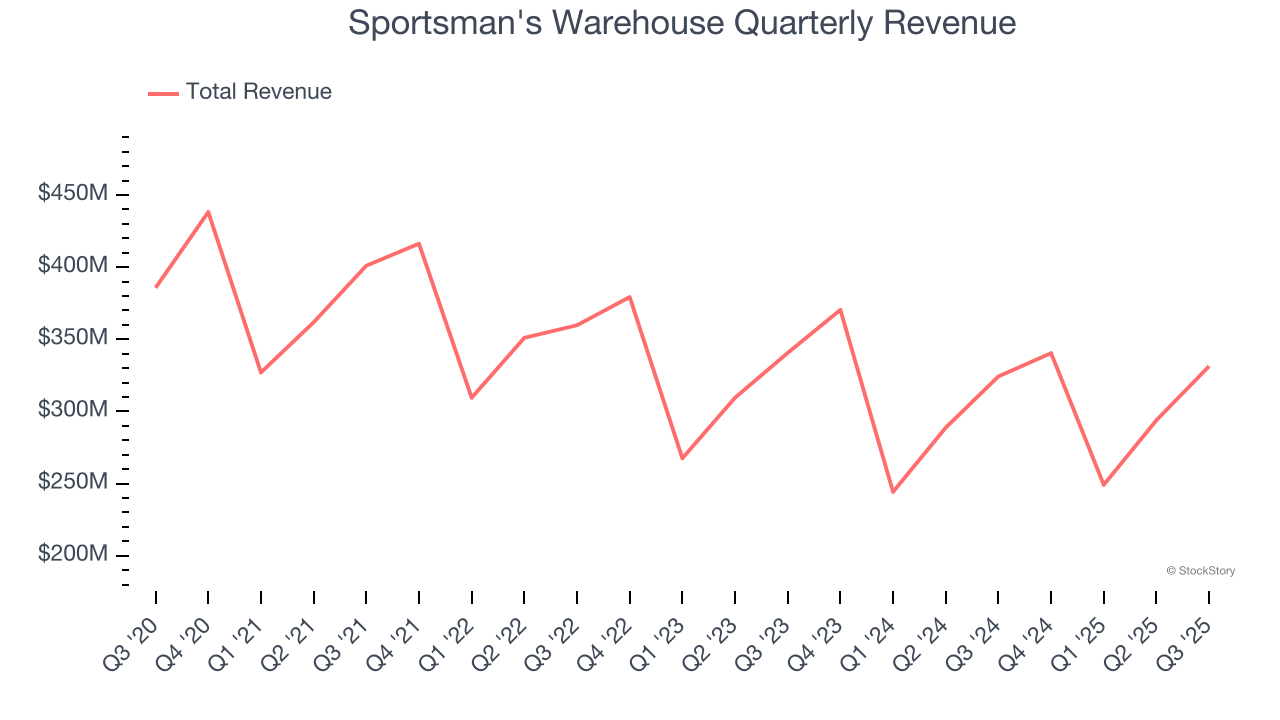

As you can see below, Sportsman's Warehouse’s demand was weak over the last three years (we compare to 2019 to normalize for COVID-19 impacts). Its sales fell by 5.4% annually, a rough starting point for our analysis.

This quarter, Sportsman's Warehouse grew its revenue by 2.2% year on year, and its $331.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. While this projection indicates its newer products will catalyze better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Same-Store Sales

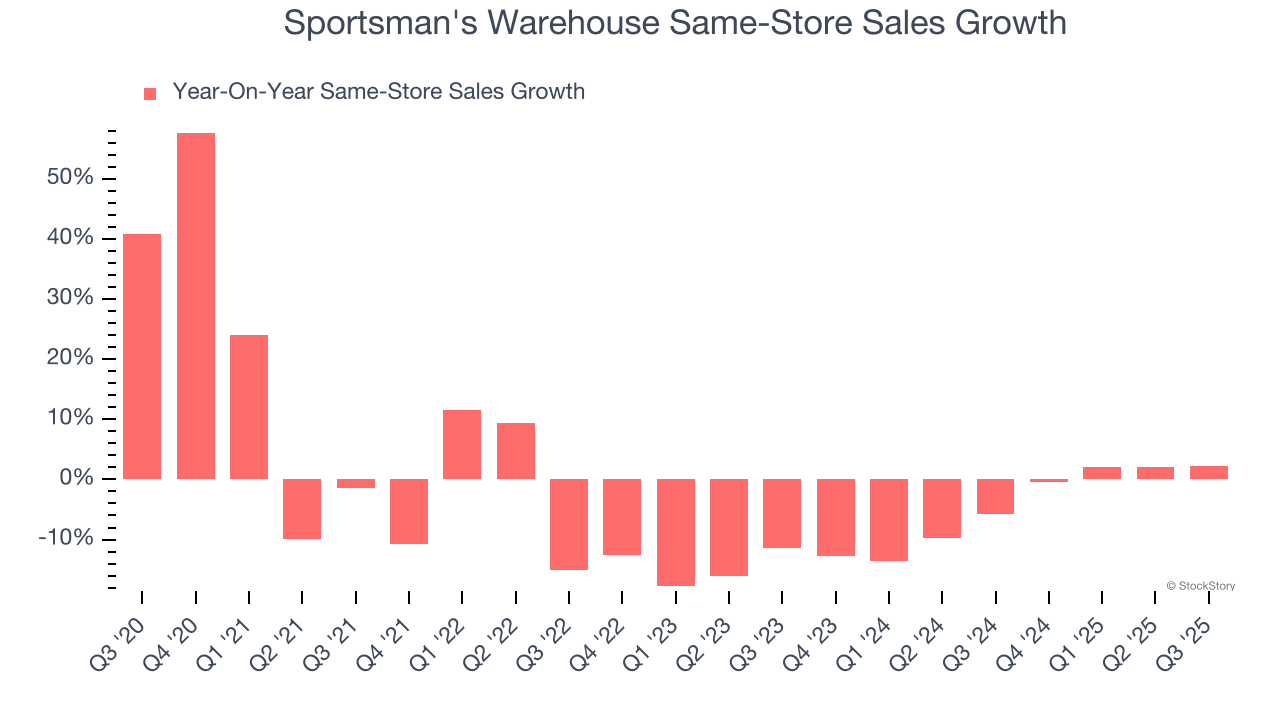

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Sportsman's Warehouse’s demand has been shrinking over the last two years as its same-store sales have averaged 4.5% annual declines.

In the latest quarter, Sportsman's Warehouse’s same-store sales rose 2.2% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Sportsman's Warehouse’s Q3 Results

It was encouraging to see Sportsman's Warehouse beat analysts’ gross margin expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed. Overall, this was a weaker quarter. The stock traded down 6.8% to $2.34 immediately after reporting.

The latest quarter from Sportsman's Warehouse’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.