As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at analog semiconductors stocks, starting with Himax (NASDAQ: HIMX).

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 7,676% above.

While some analog semiconductors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

Himax (NASDAQ: HIMX)

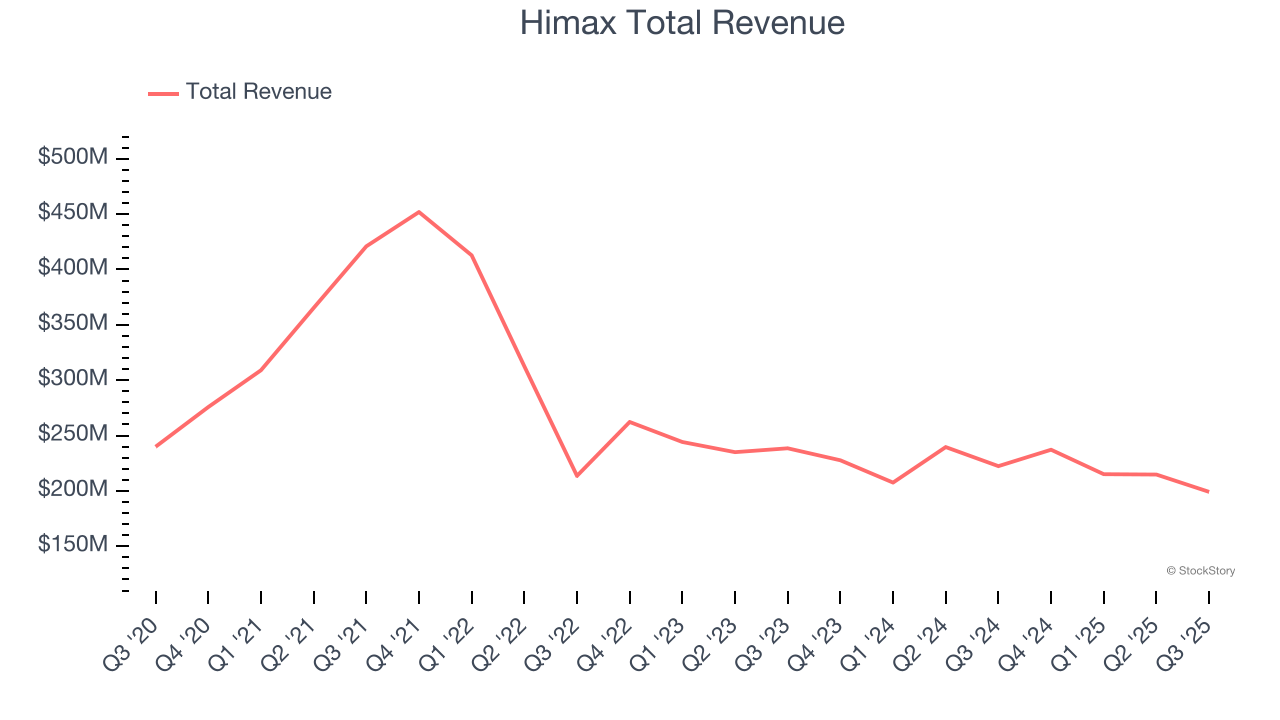

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $199.2 million, down 10.5% year on year. This print exceeded analysts’ expectations by 7%. Overall, it was a very strong quarter for the company with EPS in line with analysts’ estimates and an impressive beat of analysts’ revenue estimates.

“Despite the limited short-term visibility in the automotive market, we remain optimistic about our automotive business outlook for the next few years, backed by our leading new technology offerings and comprehensive customer coverage. Meanwhile, we continue to focus on the expansion into emerging areas beyond display ICs, including ultralow power AI, CPO, and smart glasses, all novel applications characterized by high growth potential, high added value, and high technological barriers that are well positioned to become new growth drivers for Himax soon,” said Mr. Jordan Wu, President and Chief Executive Officer of Himax.

Himax scored the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 9.3% since reporting and currently trades at $8.24.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Skyworks Solutions (NASDAQ: SWKS)

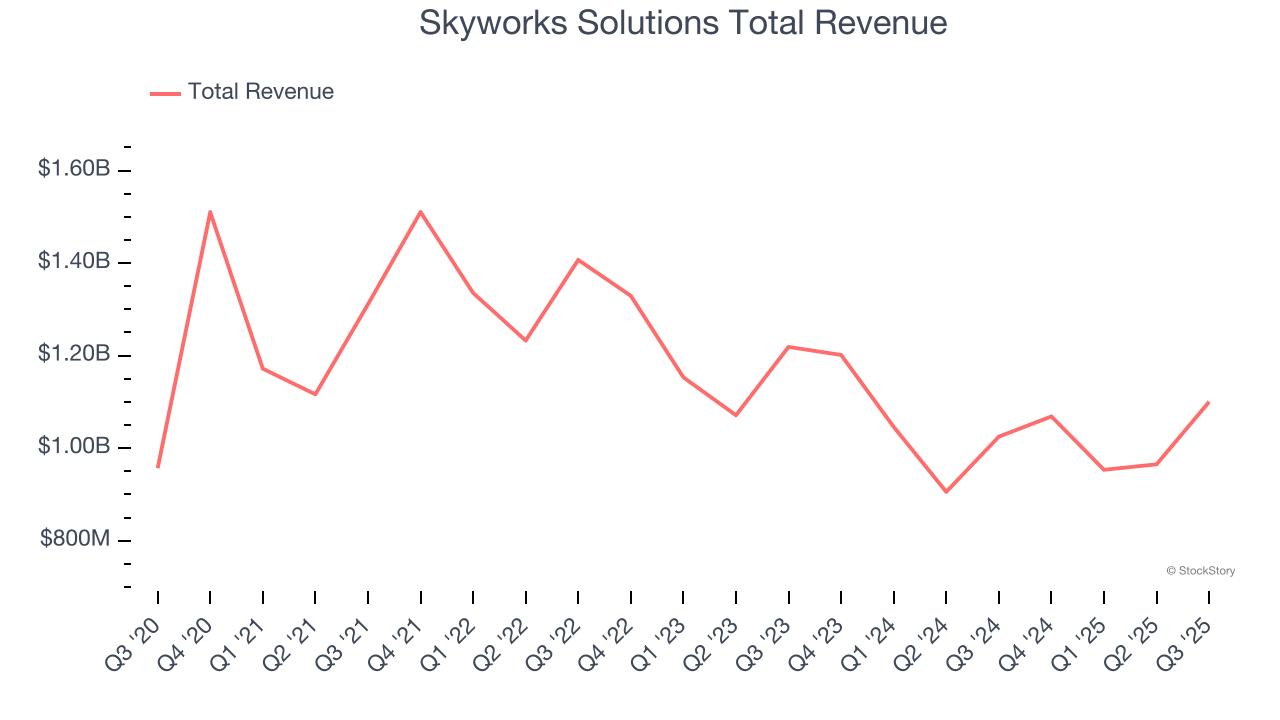

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.1 billion, up 7.3% year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.3% since reporting. It currently trades at $68.91.

Is now the time to buy Skyworks Solutions? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Universal Display (NASDAQ: OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $139.6 million, down 13.6% year on year, falling short of analysts’ expectations by 15.9%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Universal Display delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.2% since the results and currently trades at $121.71.

Read our full analysis of Universal Display’s results here.

Monolithic Power Systems (NASDAQ: MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $737.2 million, up 18.9% year on year. This result surpassed analysts’ expectations by 2%. Overall, it was a strong quarter as it also logged a significant improvement in its inventory levels and revenue guidance for next quarter topping analysts’ expectations.

The stock is down 12.1% since reporting and currently trades at $956.03.

Texas Instruments (NASDAQ: TXN)

Headquartered in Dallas, Texas since the 1950s, Texas Instruments (NASDAQ: TXN) is the world’s largest producer of analog semiconductors.

Texas Instruments reported revenues of $4.74 billion, up 14.2% year on year. This print topped analysts’ expectations by 1.9%. Aside from that, it was a mixed quarter as it also produced a solid beat of analysts’ adjusted operating income estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

The stock is flat since reporting and currently trades at $179.70.

Read our full, actionable report on Texas Instruments here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.